Brazil Stock Market SHUT DOWN! Trading Halted! Market CRASHED 10%

Stock markets are extremely vulnerable to fluctuations. There have been countless times throughout recent history when stock, commodities, and other markets have had their trading halted due to either a glitch or the beginning of a crash.

Just prevent people from getting their money out of the stocks and you can prevent the panic selling.

Check out this article:

Brazil Stock Market Halted After Plunging 10%: What Happens Next

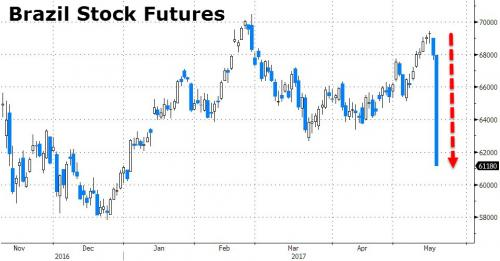

With Brazilian Bovespa futures already halted for trading earlier after crashing 10% at the open...

... the circuit breakers has moved to the cash market, where moments ago the Bovespa was similarly halted after crashing 10% at the open.

For those asking, here are the Brazilian circuit breaker mechanics:

Cash:

Rule 1: IBOV down 10% (60,786) triggers 30 minutes pause

Rule 2: IBOV down 15% (57,409) triggers 1 hour pause

Rule 3: IBOV down 20% (54,032) will be subject to Stock Exchange evaluation, likely it shuts down for the day

And this is how Brazil just erased all of the year's gains in an instant (and per the EWZ which is down -15%, more pain is coming once the circuit breaker unlocks).

Just before the circuit breaker was triggered, state controlled companies Cemig, Banco do Brasil and Petrobras fell 42%, 25% and 19%, respectively according to BBG. Banks Itau and Bradesco fell 18% and 19%, respectively, and JBS fell 15% as the Brazilian Bdloobath continued..

And even more dramatic chart is the 3x Levered Brazil ETF, BRZU, which was down 50% moments ago:

At the same time Brazil's default risk is soaring, as shown by the country's CDS>

So what now?

According to the Citi EM Strategy team there will be a quick enough resolution of this issue to take the other side of those large moves in the short term and would stay on the sidelines for now.

We expect joint intervention by the National Treasury in the form of bond buybacks and BCB through FX swaps, similar to actions taken during the peak of the political crisis in September 2015. However, they will not be enough to stop the sell-off, in our view.

And some additional thoughts from Citi FX:

EM FX is closely watching BRL, with the FX open ahead at 08:00 EDT / 13:00 BST. This is no surprise after we explained What happened to BRL here. Since that update, there’s more headlines coming out with talk of impeachment calls, and Senator Neves being suspended. However nothing confirmed yet. A full blown political crisis may just be unfolding.

There are concerns about the circuit breaker. Note that the Brazil circuit breaker allows only trading on the exchange at the limit price for the day (6% on the day). It can trade lower than that but not higher, for the rest of the day.

In the meantime, Brazilian assets continue to suffer. Check out the chart below from Bloomberg on Brazil’s EUR bonds. Meanwhile Brazil CDS is absolutely soaring even as we type, with the 10y spiking to 356, after staying around the 299 level earlier today.

And for the BRL market open, it’s hard to say. USDBRL closed at 3.1395 and we’re certainly in for a wild ride. Our trader notes that on the first future, 3.30/3.33 is being eyed. As a reminder of what our local trader said overnight: “I would expect a round of stops at the opening, can imagine little initial fading appetite from investors who still have ammo (mostly foreigners, I would guess) and a potential joint intervention by BCB and NT (in case price action is as bad as some people are saying).”

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://www.zerohedge.com/news/2017-05-18/brazil-stock-market-halted-after-plunging-10-what-happens-next

Is there a place to see all the stock markets all at once? I'm curious how other markets are faring. We know they are all connected.

It's starting to go down. Hope it doesn't get too bad until September. Hold on to your hat! 💥

Nice post. Didnt catch this. Upvoted.