The *REAL* Creature that Escaped from Jekyl Island

For those who are unfamiliar, Jekyll Island is a beautiful resort off the coast of Georgia. However, it is infamous as the birthplace for what would eventually seize control of the U.S. money supply and usher in a new economy dominated by credit and the bankers that issue it.

You see in 1910, under the guise of anonymity, six men met there; including bankers and one senator, they drafted what would eventually become the Federal Reserve, the central bank to the US.

The creature, is an allusion to G. Edward Griffin's book, the The Creature from Jeykll Island. The creature that escaped is Inflation, a subtle theft of your savings over time.

Not that you have to sit back and take it, earlier in the week GOLD had it's best day in 2 years on the back of higher than expected inflation numbers as measured by the CPI (consumer price index), or CP-Lie as some like to call it for it's propensity to under state the rising cost of living. (The CPI of course is understated to slowly rob old people and help fund the deficit.)

Even the Fed pays no serious heed to these numbers, preferring instead to use it's own inflation gauges. I should note that ALL of them point to Inflation being above the Fed target rate of 2%

Inflation already over 3%

The NY Fed's Underlying inflation gauge or UIG hit 3% in January, while the Cleveland Fed's "Sticky Inflation" measure rose 3.7%!

Here a quick rundown of the consequences of a rising inflationary environment:

Bonds crash as yields go up, making the cost financing your next car, house, etc. more expensive. Which in turn prevents more people from buying those things.

Stocks crash, as corporations, having to pay a higher cost of capital, have less money in free cash flow to distribute in dividends. Institutional money returns to the now higher "risk free" return of the 10yr treasury, pulling money out of traditionally riskier stocks. Not only that, but the popular tactic for corporations to "buy back" their own shares using cheap capital (read low interest rates) to push up share prices, will come to an abrupt halt. Less demand + more selling = lower prices for stocks. Which in turn lowers the balance of most American's primary source of savings: the 401k, which is more or less a proxy for the stock market.

Gold soars on inflationary fears. Not only is Gold viewed as an inflationary hedge, like everything else it is denominated in dollars. When one goes down, the other goes up. Fortunately for Gold the dollar has been going down for the last 108 years.

Recession

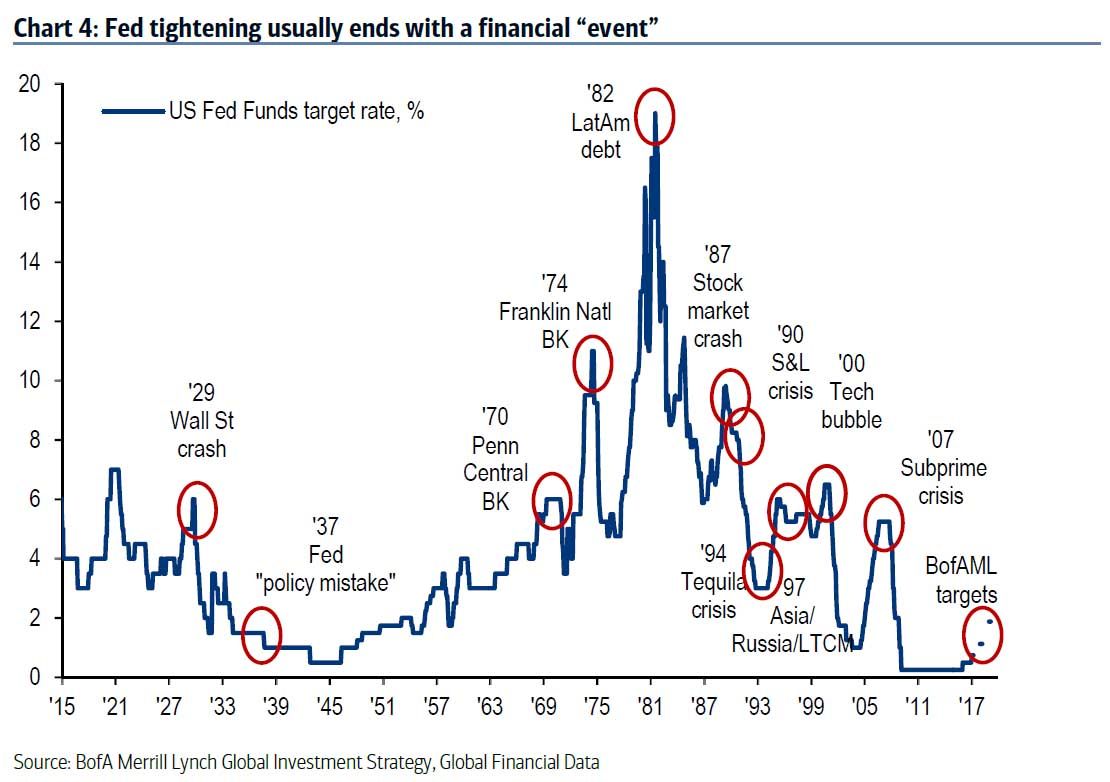

Overvalued global equities combined with tighter monetary policy is a recipe that comes out the same every cycle. According to David Rosenberg, since 1950 there have been 13 cycles where the Federal Reserve tightened interest rates… and 10 of them ended in recession. I don't imagine that this cycle will be any different.

Until Next Time

It's your move.

JESS

Thanks for reading, if you enjoyed this rant, you might also enjoy some of my Recent Articles:

Janet Yellen, the Truth Revealed

"I think they're all Worthless. I think they're the 21st century version of a Chain Letter"

It seems as if this economic cycle has finally entered the late stage. Time to be smart with your investments. Time for silver now, especially as the ratio is HIGHLY in favor of that metal.

Agreed, it seems half the analysts expect a blow off top for the next 2-5 yrs depending on who you ask, whereas the other have already started shorting.

My experience with timing the market has not been very good. I've had far more success getting out of overvalued assets early (stock market/ btc), and rotating into undervalued assets (such as silver).

I've literally never lost money this way.