Mukesh Ambani gives Anil Ambani Rs 23,000 crore relief On ,father's birthday

NEW DELHI: Anil Ambani's struggling telecom operations received a bail-out from elder brother Mukesh's Reliance Jio+ as the siblings announced a wide-ranging, but expected, deal for spectrum, towers and optic fibre assets on their father's birthday.

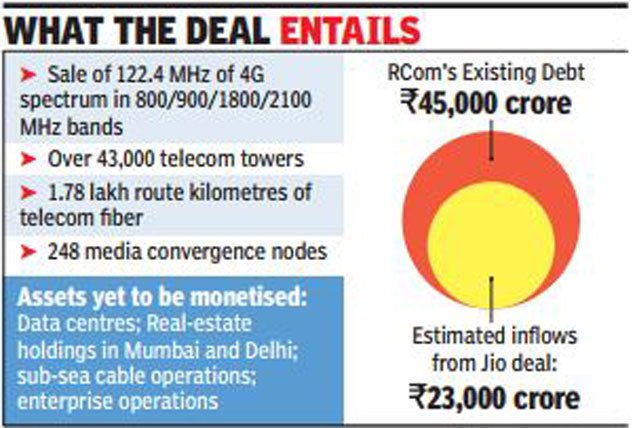

While the companies are yet to announce the deal size, it is estimated to be worth around Rs 23,000 crore, a massive relief for Anil's debt-ridden Reliance Communications (RCom) that is saddled with loans of nearly Rs 45,000 crore and was facing possible bankruptcy proceedings.

The deal, announced late on Thursday evening, marks the exit of Anil's RCom from the consumer telecom space, a business he received in 2005 as part of a bitterly-fought family settlement with Mukesh+ . He had already stopped the company's consumer 2G and 3G operations at the end of November, deciding to continue with only the enterprise business as well as sale of assets. The company's recent struggles to stay afloat are in sharp contrast to its heyday in 2010, when it was India's second largest mobile operator.

"RCom has signed definitive binding agreements with Jio for sale of wireless spectrum, tower, fibre and media convergence node (MCN) assets... Jio emerged as the highest bidder in a transparent process conducted under the supervision of a high-powered Bid Evaluation Committee, comprising experts from banking, telecom and law," the company said, adding that it expects the transactions to close in a "phased manner" between January and March 2018, subject to lenders' and other applicable approvals.

jio

The re-entry of Mukesh in the telecom business in September last year has driven massive consolidation among mobile service providers, as the cut-throat prices unleashed by his Jio disrupted the sector's financials.

While bigger players like Vodafone and Idea Cellular decided to merge, Anil's RCom merely veered towards a shutdown in the face of mounting losses.

RCom, which was under a strategic debt restructuring (SDR) and had been facing irate lenders (some of whom had dragged the company to the National Company Law Tribunal for recovery of dues), had been desperately working on deals to part-sell its business.

RCom said the deal with Jio comprises "primarily of cash payment" and also includes transfer of deferred spectrum instalments payable to the department of telecom (DoT). "The company will utilise the proceeds of the monetisation of this cash deal solely for pre-payment of debt to its lenders," it said.

After the heightened competition in the telecom sector following the entry of Jio, what had made matters worse for RCom was its failure to merge its business with Aircel. The collapse of the deal - which would have helped it cut its debt by Rs 14,000 crore - had resulted in another highly lucrative tower deal, with Canadian firm Brookfield that was getting in another Rs 11,000 crore, also breaking down.

Following the collapse of the two deals, RCom's business had seen a massive slide, especially with the business running into losses on a near-daily basis. This was conceded by Anil on Tuesday in a media conference in Mumbai where he also announced a revival plan that triggered a spurt in the company's scrip, which closed up 32% at Rs 21.3 on the Bombay Stock Exchange the day on Tuesday.

Jio said the deal would help the company expand its telecom business. "These assets are strategic in nature and are expected to contribute significantly to the large-scale roll-out of wireless and fiber-to-home (FTH) and enterprise services by Jio," the elder Ambani's company said.

While spelling out his revival plans on Tuesday, Anil had conceded that the telecom business was a money-guzzler and was running into constant losses. "This is a crisis of the wireless telecom sector and it has engulfed many, many people and many, many companies... It's a clear signal that this is something which is not for 10 players to enjoy. This is more for 2-3-4 players to enjoy and those who have either unlimited money or those who have the ability to raise unlimited amount of money," Ambani had said, though refusing to name any company.

Company officials said these would also be looked into actively as the group looks to improve its situation.

Anil had said on Tuesday that after the completion of the revival process, the 'new RCom' would have debt of just Rs 6,000 crore, down from Rs 45,000 crore in October. RCom will serve only the low-capex and high-margin enterprise space from here on, he had added.