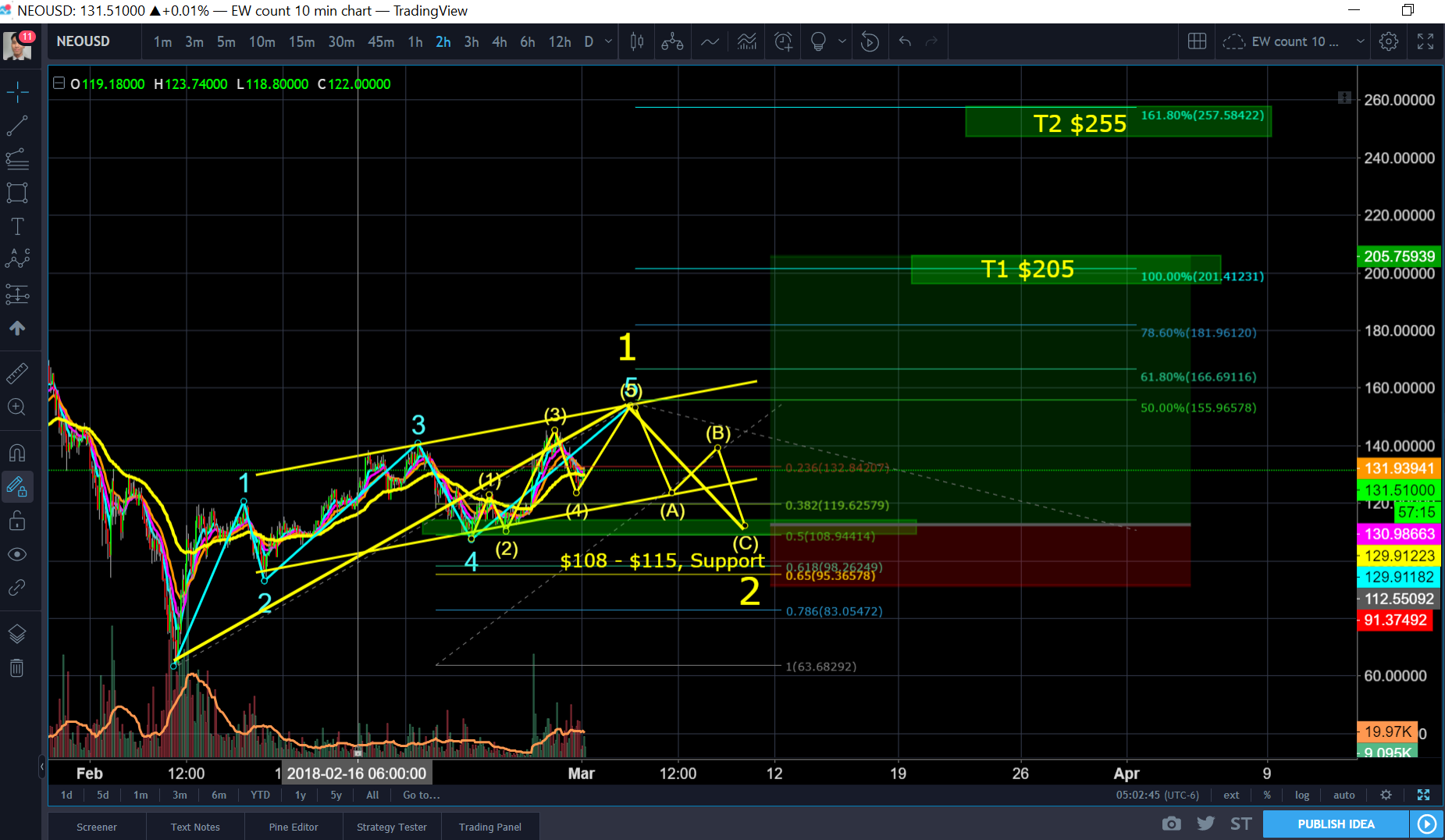

NEO March 1st Detailed Technical Analysis, Specific Setups. Target $205-$255 after correction phase

General Tone:

There is a high percentage risk setup to catch wave 4-5, though it is not

advised for inexperienced traders.

In a few weeks, there's a 4.4:1 risk to reward setups that is recommended

to consider with target $205-$255

Long Term Bias (6+ months) - Bullish

Medium Term Bias (Next Week) - Bearish

Short Term Bias (Today) - Neutral

This is the current wave count

NEO play of the month. When primary waves 1 and 2 complete, we can find support for wave 2 between $108-$115 regions, where the next target is $205 then $255.

My Comprehensive List of Tutorials

Please consider upvoting if it has helped you

Please consider purchasing me a 33 ft' yacht

if you have reached incredible success

Lesson 1 - Bitfinex Tutorial - How to Customize and Set Up Bitfinex

Lesson 2 - How to Analyze Candlesticks Charts with Strategy

Lesson 3 - Moving Averages

Lesson 4 - Relative Strength Index RSI with Advanced Strategy

Lesson 5 - MACD and Histogram

Lesson 6 - Margin Trading Long, Shorting, Leveraging

Lesson 7 - Basic Risk Management

Lesson 8 - Fibonacci Retracement Part 1

Lesson 9 - Fibonacci Extension Part 2

Lesson 10 - Laddering

Lesson 11 - How To Interpret Time Frames

Lesson 12 - Swing Trading Advanced 55 EMA Strategy

Lesson 13 - Introduction To Elliot Wave Theory

Lesson 14 - Using a Basic Excel Tracker for Risk Management

Lesson 15 - Automatic Stop Sell/Buy Executions

Lesson 16 - Advanced 55 EMA Strategy with Time Frames and MACD Part 2

Lesson 17 - 6 Hours Live Trade Scalping. Growing $2,000 Account into $3,500

Lesson 18 - Bitcoin BTC Feb 6 - BTC Update - Summary of ABCDE with live play.

Lesson 19 - Elliot Wave Theory, Fibonnaci Retracement & Extension (Combined with Feb 11 BTC TA)

Lesson 20 - Advanced Elliot Wave WXY With Feb 11 Technical Analysis

Lesson 21 - Using Elliot Wave, Fibonacci, And Extensions To Obtain Targets (Combined witFeb 11 BTC TA)

Lesson 22 - Risk Management, Channels, Fib Retracement, Fib Extension. Summarizing Feb 11 BTC

Lesson 23 - Fibonacci extension, Fibonacci Retracement, Elliot Wave, Shorting, Playing Downtrend - Summarizing Feb 21 BTC + ETH

Lesson 24 - Customize RSI Alerts & Multiple Charts, Pro Features of Trading View

Twitter - https://twitter.com/PhilakoneCrypto

Youtube - https://www.youtube.com/user/philakone1

If you think I've helped you tremendously, donate crypto to my dog's tequila / vodka problem.

BTC: 3FYAk7kMXP21S2hFvr7GrANAEDwxknCjCS

NEO: ANNmGUDAoFZs52dEkckQoL1vw34sxiV4Ey

EOS: 0x4236637ec78f4a9a4627d52829a68cdc6eb292a7

Ethereum: 0x4236637ec78f4a9a4627d52829a68cdc6eb292a7

LTC: LPHXW5WGSSES6RkZ9VXQe76YdLPCUWH1Ev

Bitcoin Cash: 1MaR7nSeVTbu894Xf8gLTNK6xvKZ2hNpbx

XRP Address: rLW9gnQo7BQhU6igk5keqYnH3TVrCxGRzm / Wallet: 2640750089

The ultimate goal is to help the crypto community because I think there's a lack of these type of videos. I want to share everything I've learned because knowledge is only power if passed on. These are educational videos intended to teach how to think through thought-out rationalization.

DISCLAIMER:

Legal stuff here. I'm not financial advisor. This is just my opinion that I'm sharing with the community. All information is for yours to process how you wish.

Really great stuff in this post. Thanks very much

Thanks man, you're molding this baby whale into a masterful trader in a mere 2 months, but i'm not done with mama yet ;)

(sounds weird, but i'm cool with it)

Me too - it's an exciting (& highly addictive) journey!

Wave 4 drops below wave 1 territory. Does that not invalidate this or does it just make it a "less than ideal" elliot wave?

I was wondering that too. That's why I come here for answers :)

Yeah, I'd like to know this too, since NEO is now at $118, breaking the wave 1 territory on every time frame chart.

Thank you! I will be keeping my eye on this one! :D

Me too my friend. I got the tickets !Just deciding now when/where. Man I appreciate you so much. You have no idea. It literally has made my year.

Fantastic! I'm sure you will pick somewhere nice where you can relax and enjoy yourself!

I can't tell you enough how much I appreciate you and everything you do as well! And that makes me so happy to hear, I also can't wait to hear where you ended up going :)

P.S. I get those every year so keep in touch... There will always be more, and I love sharing!

Please we still gunna get some live trading. Really insightful, really informative , on point ta.

Learn from the best @philakonecrypto

Hi Phil

Just have a simple question. Your bigger wave 4 is overlapping bigger wave 1. Now that's a breach of one of the fundamental rules. I didn't noticed any explanation in the video. Would you elaborate on this?

the ugliest possible leading first wave diagonal. :(

Or that we just started on bigger wave 3? Would you discount this count - just a close-up of the first 4 waves.png)

great that you analyze big coins! thanks

I seem to still have tunnel vision when looking at some of these charts it amazes me how well you think out side the box. I’m striving to get there. Thinks for your insight!

see it as a really complex puzzle that has no solutions, but multiple ways to see it as best we can:) It becomes quite fun later.

"responsible for you own decisions"

perfect sentence phil!

i am with you since you had a mere few hundreds subs on YT!

Most of the way through the video - yes, it's an interesting setup this one. I have all kinds of troubles with EWs - definitely more study required for me.