China Q3 Data: No surprise of growth softening

While yesterday’s 19th Party Congress report sent messages about the country’s long-term direction (attached in case), today’s data for Q3 and September provided a clearer picture about near term economic conditions.

Overall, China’s economy looks to be softening approaching the late Q3 as our China Coincident Indicator (CCI) suggested (Chart 1), and is expected to cool further in coming quarters, with momentum softening and base effects turning to be unfavourable.

Nonetheless, a more important question is probably how fast to slow. The latest data suggested not too concerned yet, as:

- Looking into GDP figures, slowdown was purely in industry sector, and breakdown from monthly IP data suggested it was mainly in mining, while manufacturing sector held up relatively well.

• This seems to be largely policy-driven, linked to anti-pollution campaign and previous property tightening.

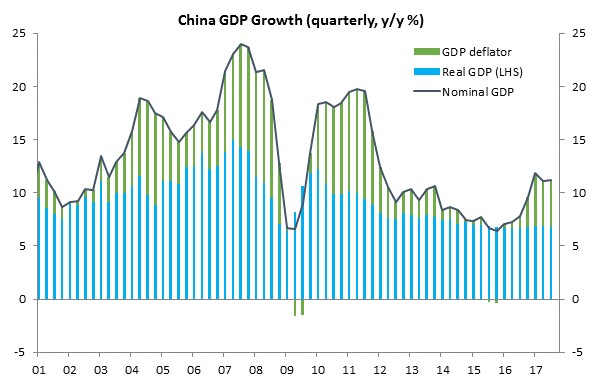

• In contrast, GDP growth in nominal terms held up stable at around 11% y/y, which demonstrated how supply side efforts to knock off real growth but to be offset by nominal terms.

• Nominal growth is also likely to cool ahead due to base effects in PPI, but is expected to stay close to 10% y/y in coming quarters. - Property: the momentum is softening, but downside looks limited with destocking.

- Exports: the latest data from the region looks still encouraging, even by considering holiday distortion.

- Consumers & services: holding up relatively well.

- Overall credit growth slowed but still in line with a path of moderately slowing.

- Capital flows: roughly balanced according to most of our indicators. HK’s RMB deposits seem to have bottomed out, as one of indicators for RMB expectations overseas.

Looking ahead, policy mistakes are the key risks to monitor – if they could manage this slowdown without too much disruption. - For now, it still looks convincing that policymakers are willing to achieve a smooth landing.

- The shift of top priority from Growth to Quality as suggested by Party Congress was for long-term direction, rather than any abrupt changes of short-term policy management