KINESIS: A New Dawn in the Evolution of Monetary Systems

Introduction and Problem Statement

However, all existing monetary systems from fiat to bullion and cryptocurrencies suffer severe drawbacks which make them highly unsuitable for economic exchange. These include;

Highly Volatile Cryptocurrencies

Furthermore, slow speeds of transactions and high processing fees highly limit the use of cryptocurrencies leading to a pathetic lack of real world application and uses.

Yieldless Bullion Assets

The monetary system rooted in bullion have also not fared any better with a fair share of its own problems and limitations. These precious metals like gold and silver and many other physical assets have no yield attached to them. They just are, thus possessing them assures no returns but even cost money to even hold securely.

However, an ingenious solution to the world's monetary problems is finally here! It is Kinesis. The Kinesis Monetary System is specifically designed to overcome these drawbacks through the development of a universally adopted, decentralized, asset-backed monetary system.

The Evolution of the Gold Standard: The Kinesis Monetary System.

Kinesis aims to deliver an evolutionary step that goes beyond all that we have as monetary systems in the world today ranging from fiat, cryptocurrencies to bullion. A system that will truly enhance money as a store of precious value and a means of exchange for the benefit of all and sundry as well as a means of stimulating economic activity and movement of money in a fair, honest and rewarding way.

Kinesis consists of three primary elements, these are;

1. Gold and Silver

From all of man's history, gold and silver have been the greatest stable and the most definable stores of value for use in man's commercial activities. All of Kinesis' primary currencies are backed 1:1 with allocated gold and silver which entails direct title to the bullion used to back the Gold currency (KAU) and silver currency (KAG).

2. Yield

Kinesis provides for return on investment which is perpetually recurring and occurs not from debt-based interest as obtainable in fiat but rather from economic activity. The Kinesis monetary system therefore attaches various degrees of yield to physical gold or silver based on the degree of participation. This is in form of;

- Minter Yield

- Kinesis Depositor Yield

- Holder Yield

- Recruiter Yield The recruiter yield is gained by those who are committed to the advancement of the cause of Kinesis by recruiting or referring new users or institutions to the Kinesis ecosystem.

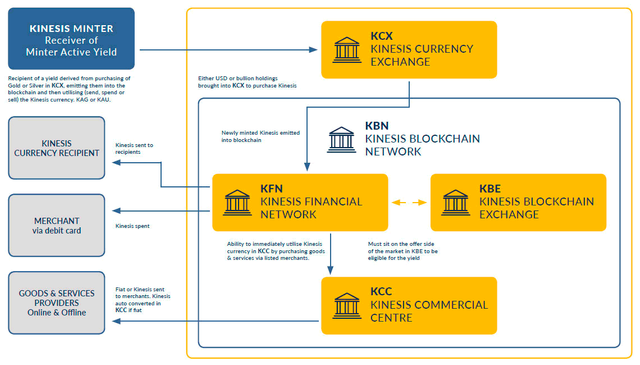

Minting is the process of converting physical bullion holdings into Gold Currency (KAU) or the Silver currency (KAG). Minters therefore receive a proportional 5% share of the transaction fees on the Kinesis coins they created and used.

Minting is the process of converting physical bullion holdings into Gold Currency (KAU) or the Silver currency (KAG). Minters therefore receive a proportional 5% share of the transaction fees on the Kinesis coins they created and used.

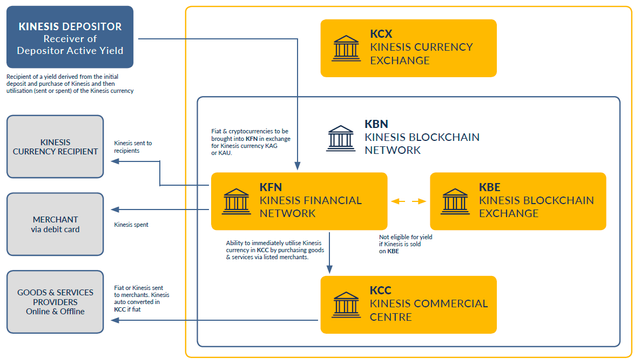

Kinesis Depositors will also gain a 5% share of the transaction fees on initial deposit and subsequent use of Kinesis pins from their Kinesis wallets.

Kinesis Depositors will also gain a 5% share of the transaction fees on initial deposit and subsequent use of Kinesis pins from their Kinesis wallets.

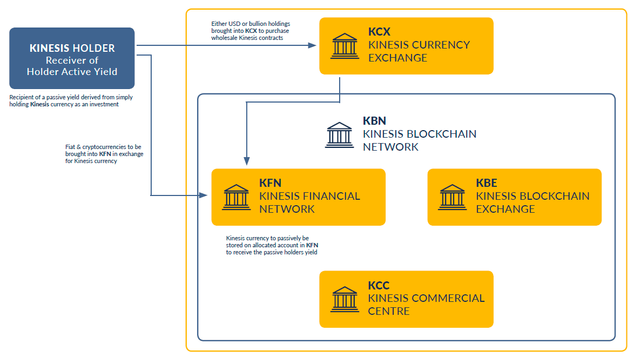

Kinesis holders will receive a 15% share of the transaction fees generated while holding the Kinesis currencies, such yield would be calculated on a daily basis and credited to their e-Wallets monthly.

Kinesis holders will receive a 15% share of the transaction fees generated while holding the Kinesis currencies, such yield would be calculated on a daily basis and credited to their e-Wallets monthly.

3. Blockchain and Cryptocurrency Technology

Kinesis utilizes both the blockchain and cryptocurrency technologies making use if their strengths to build a formidable monetary system while mitigating their weaknesses. The Kinesis team has therefore developed a proprietary blockchain network off the Stellar bblockchain for the Kinesis currency suite.The Kinesis Blockchain Network therefore, as opposed to other blockchains provides very high transaction speeds, coupled with a customisable, percentage-based transaction fees, which is for all intents and purposes best for the Kinesis currency hence high velocity which is core to the Kinesis model.

The Kinesis ecosystem can therefore be very much integrated into all that can be effectively stored, traded or standardized as money. A monetary system such ad Kinesis therefore has indispensable real world applications in both commercial and private transactions.

Kinesis will therefore attract capital from existing markets which are experiencing low yields in terms of the cryptocurrency markets, Gold and Silver markets, Fiat currency market and investment asset markets. Given Kinesis' stability therefore, participating in the Kinesis state much more less risky and provides for more returns.

Therefore, Kinesis is very much a monetary system that is focused and will well minimize risk, maximise returns, stimulate greater velocity and enable mass adoption by improving on the flaws of current inefficient monetary systems which will be addressed hereunder:

Kinesis to the Rescue 1.0: Addressing Crypto's Problems.

Cryptocurrencies are highly volatile as obtainable in the swings of the value and prices of even the largest cryptocurrencies obtainable in the market. This high volatility is very much crypto's Achilles' Heel which has been hindering mass adoption even by individuals, businesses and governments hence they are not viable reserve currencies that can facilitate global commerce. The Kinesis Monetary System is however a new and improved innovation which blots out the limitations of contemporary cryptocurrency solutions.

2.0. Addressing Bullion Market Problems.

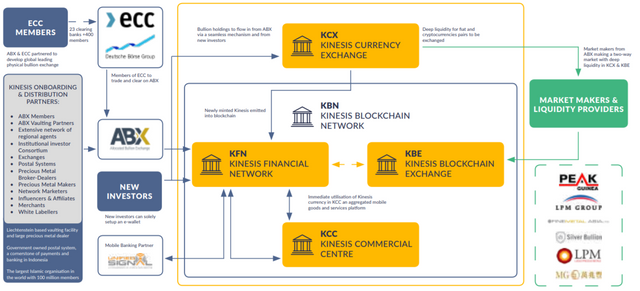

Inefficient and Archaic Markets: Bullion market participants currently trade over the counter. This have high negative effects on the bullion market as a whole hence the physical markets operated in are usually highly problematic hence they are manual, inefficient and costly. Phone dealing desks are costly and involve manually booking a trade, placing a physical order with a supplier, and hedging the trade.There is then a general consensus that a new innovative, digital, globally efficient method is needed which is all that Kinesis stands for. Kinesis via its institutional integration with ABX and its operationally segregated wholesale contracts, which offer serial number and bar hallmark, provides an ideal solution for bi-lateral wholesale trading through the blockchain thus a new dawn in bullion marketing.

Segregated and Inefficient Markets: Local markets currently trade in a manner that is very segregated or independently and so disconnected from one another. Kinesis will efficiently interface these markets and aggregate global physical liquidity.

Barriers to Entry: Bullion markets have high barriers to entry. Local market participants typically conduct business only within their home regions only with the exception of big bullion banck and international trading houses. Kinesis breaks down the barriers to entry to each physical market and directly interface these trading centres thereby bridging gaps and lowering entry barriers.

Limited Resources: Many stakeholders in the bullion industry currently do not have the resources to understand the global framework and establish global operations. However, the Kinesis Monetary System allows these stakeholder institutions in terms of local market participants to spread their tentacles internationally enabling them benefit from international liquidity and clients.

3.0.Addressing Fiat Currency Problems

Fiat currencies as history has shown time and over again are very much susceptible to devaluation collapses which always have very negative impacts and implications for such economies of those fiat currencies as well. In the same way, fiat currencies are also a very poor store of value if indeed they are any hence central banks print and devalue money just to keep commercial bank lending and consumer spending just to maintain economic growth in nominal terms. The centralized nature of any monetary system is therefore inherently problematic, an anomaly the decentralized Kinesis system would definitely solve.

4.0 Addressing Asset-Backed Currency Problems.

Kinesis defeats the "bad money drives out good" Gresham law of money that has continually plagued both traditional traditional cryptocurrencies and asset-backed currencies. This is achieved through incentivizing people to utilize a valuable currency through a multifaceted reward system based upon participation.

Another of the problems associated with asset-backed currencies is the fact that they have no yields attached to them and may even cost money to keep or hold. Therefore, investors have no choice than to turn to yielding assets like interest bearing bank deposits of stocks paying dividends.However, the Kinesis Monetary System gives yield to these precious metals by attaching multiple yields for varying degrees of passive or active participation.

Central to the problems of asset-backed monetary systems is also the age long problem of security.. Even historically too, a lot of cases abound involving fraud in the use of precious stones and other physical assets as payment systems. Asset-backed cryptocurrencies are also not even spared as evident in the Tether saga. However, Kinesis' major currencies are backed 1:1 to gold and silver, the most definite stores of value from ages past to the present and therefore assures security through its partnership with ABX (Allocated Bullion Exchange)

Strategic Partnership with Allocated Bullion Exchange (ABX)

Featured Components of the Kinesis Monetary System.

The Kinesis monetary systems consists of components which are truly necessary for the successful functionality of any monetary system. Kinesis therefore contains various business units which would perform different functions. These are;

(a)Kinesis Currency Exchange (KCX): The Kinesis Currency Exchange functions as the main wholesale market where the currency is minted. The Allocated Bullion Exchange would play a major role here hence this occurs in an institutional centrally cleared exchange with deep liquidity and connectivity with global wholesale trading organizations.

(b) Kinesis Blockchain Network (KBN): The blockchain is highly indispensable in the monetary system proposed by the Kinesis idea. This featured component therefore refers to the blockchain technology upon which the Kinesis Cryptocurrency suite is built. Hence such cyptocurencies can be traded, sent or saved through the instrumentality of the blockchain.

(c) Kinesis Blockchain Exchange (KBE):The KBE operates as a blockchain digital coin exchange where Kinesis currencies can be traded as well as other digital coins. The Blockchain Exchange would help in ensuring a deep liquidity for the Kinesis Currencies.

(d) Kinesis Financial Network (KFN): The KFN featured component of the Kinesis Monetary system serves as a mobile banking system where the Kinesis currencies can be user for everyday payments, savings and money movement. It all gets exciting here as this facility has a debit card which enables the use of Kinesis as a payment currency the world over and even allowing for withdrawals of fiat at Automated Teller Machines. The KFN also features a mobile payment account system and balance that is equivalent to a virtual savings account including the ability for customers to earn interest on all funds loaded into the user’s mobile payment account.

(e) Kinesis Commercial Center (KCC): The KCC is an online platform that serves as an aggregator of goods and service providers, enabling the Kinesis currency suite to be utilized without hassles as payment for participating merchants.

Use Cases

Case 1: Returns on Bullion Holdings

All Stars Inc. have from all times invested in bullion. However, with no returns or yield from their holdings rather than risks and and even hardships in entering the bullion market, it was not all rosy for All Stars Inc. However, All Stars Inc. is now truly all stars with their knowledge of and subsequent incorporation of Kinesis. By ensuring yield based on degree of participation, All Star Inc. is even more incentivized to actively use them and earn in the process.

Case 2: Crypto for Everyday Use

Holt and Sons Co. is a company who really believe in the crypto revolution and so had made several attempts to diversify into cryptocurrencies too even for use in their everyday transactions. However, with crypto's highly volatile nature that even allows for a 100% drop in value overnight, Holt and Sons Co. could understandably not live out their crypto dream. However, with Kinesis providing an asset-backed digital currency combining blockchain technology with two of the world's most stable assets and in terms of gold and silver, Holt and Sons Co can now key into a stable monetary economy.

The Kinesis Velocity Token (KVT)

The Kinesis Velocity Token is an ERC20 utility token that receives a portion of the transaction fees from the Kinesis Monetary System. It has an equivalent worth of $1000. The KVT holders also receive a 20% share of all transaction fees associated with all of the Kinesis Currencies. The KVT initial Token Offering (ITO) is scheduled for September 10th 2018.

Conclusion

The advent of Kinesis at this point in time is very much needed. Its establishment of a true monetary system backed by the definite value of Gold and Silver (1:1) ensures stability. The introduction of yield on bullion assets too comes as a great improvement while not forgetting its surmounting of the volatility factor of cryptocurrencies as currently experienced. Kinesis is therefore very much an effective store of value and efficient means of exchange, the hallmarks of good money.

The Team

The RoadMap

For more information check out this video:

For more information check out this video:

My tweet: https://twitter.com/Blezd_ben01/status/1036740714804269056

My tweet: https://twitter.com/Blezd_ben01/status/1036740714804269056

Kinesis2018

Kinesistwitter

Kinesis2018

Kinesistwitter

Excellent article. I learned a lot of new things. I signed up and voted. I will be glad to mutual subscription))))

This post has been submitted for the @OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!

Congratulations bro..

This is really cool

Thank you bro. We are learning.