Panama Papers Law Firm Mossack Fonseca On Its Death Bed

“The reputational deterioration, the media campaign, the financial siege and the irregular actions of some Panamanian authorities have caused irreparable damage, whose obligatory consequence is the total cessation of operations to the public at the end of the current month”

- Statement by Mossack Fonseca

Mossack Fonseca

This unprecedented leak revealed how the world's most powerful, wealthy and corrupt individuals and companies offshore substantial amounts of money in countries such as Panama where financial regulations are notoriously deficient. In 2016, publications by the ICIJ indicated that Mossack Fonseca enabled the world's rich and powerful to create shell corporations for the purposes of tax evasion.

Mossack Fonseca has vigorously denied that the firm is in any way involved in criminal activity:

“For 40 years Mossack Fonseca has operated beyond reproach in our home country and other jurisdictions where we have operations.”

“Our firm has never been accused or charged in connection with criminal wrongdoing.”

In a recent press release, the Panamanian law firm reveals that it will close its doors to the public by the end of March 2018. Citing extensive damage to Mossack Fonseca's reputation from the ICIJ investigation as a leading cause for the firm's dissolution.

[The full document is available on the ICIJ website - in Spanish]

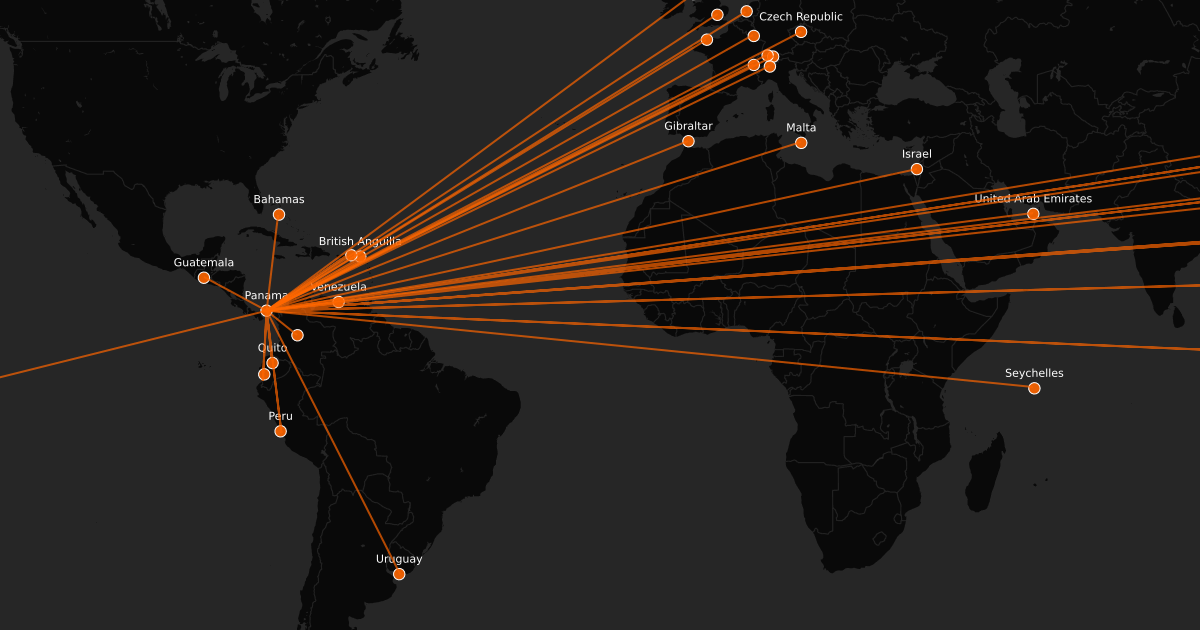

Established in 1977, Mossack Fonseca specialized in offshore accounts eventually expanded to 40 offices around the globe. By 2013, the firm employed over 600, acting on behalf of 300,000 companies and with an annual billing surpassing $42 million. German lawyer Jurgen Mossack founded the company which partnered with Panamanian lawyer Ramon Fonseca and eventually adding lesser know Swiss lawyer Christopher Zollinger in later years.

Shell Companies

So, just what exactly makes Panama a haven for tax evasion and money laundering? Fundamentally, there are several key ingredients that make the central American country a premier location for hiding wealth.

First, under Panamanian law any pair of individuals from any country in the world can create a company in Panama, even if neither individual resides in Panama.

Two or more adults of any nationality — even those who do not physically reside in Panama — can create a company in the country, according to Law 32 in the Panamanian legal code. They can choose to register the company as either a persona natural (“natural person”), which means the company is essentially a person, associated with their identity document; or as a persona juridica (“legal entity”), a corporation that is identified through its registration with Panama’s Taxpayer Registry (RUC by its Spanish acronym).

PDF Panamanian legal code (spanish) PDF

However, corporations in Panama will often opt to register as a sociedad anonima (“anonymous society”), or bearer share corporation. This protects the confidentiality of the company’s assets, the identity of its owner or owners, and all business and banking transactions under Law 32.

While the founders of a sociedad anonima are required to sign documents identifying themselves as such before a Panamanian notary, laws firms in the country offer a convenient loophole. For a fee, the sociedad anonima can hire lawyers to sign the required paperwork before a notary in their place. As part of the deal, lawyers retain the ability to renounce their obligations to the company if their clients are not in Panama. All of this further conceals the identities of the company’s owners.

As we can see, registering as an anonymous society allows the individuals behind the legal entity to remain anonymous while giving lawyers the ability to sign in their place. At the same time, the companies assets remain confidential and so do the banking transfers related to the company.

Operating as a 'anonymous society' has further benefits that are conducive to money laundering.

In addition, foreign companies that operate outside of Panama are not required to obtain a license for their foreign business activities. On top of that the average cost for registering a company in Panama is relatively cheap at just under $1,000 usd.

Minimal reporting is required - Corporations do not have to file tax returns

Tax exemptions - Corporations only need to pay a yearly franchise tax of $300 (no income tax, no capital gains tax, interest income tax or sales tax)

Confidentiality - Personal details of owners are not filed with Panamanian Public Registry and changes of ownership documents are also not required by the Public Registry.

As a result, only the sociedad anonima’s directors know the identities of the actual owners, since they maintain the sociedad anonima’s records and distribute the share certificates. However, under Panamanian corporate law, corporations do not need to keep records of any transactions. And even if the records exist, corporations are not required to disclose them to foreign governments and can keep the records outside of Panama.

The other main factor that makes Panama an attractive location for the world's rich and powerful is:

Panama’s limited regulation of bearer shares. These are equity securities that are exclusively owned by whoever physically possesses them. Bearer shares are also highly vulnerable to money laundering, as those who issue them don’t keep records of the buyers, and selling them is as easy as delivering a piece of paper to someone else.

No one keeps tracks of this buying and selling process, which makes it extremely difficult to determine who owns the share. Before Congress passed reforms earlier this year, Panamanian law made it even more difficult, as the original owner of the bearer share was not required under any circumstance to turn it over to an authorized custodian such as a bank or an attorney.

Unlike registered shares that are electronically logged along with the name(s) of the share owners, bearer shares are basically paper certificates that belong to whomever is in possession of them at the time.

The embattled law firm has decided to close it's doors by the end of this month, March 2018. However, a skeleton-crew will be left behind to comply with the Panamanian government's investigations and with other private and public entities.

Make no mistake, the closing of Mossack Fonseca is a small victory in the fight against international corruption, yet it's estimated that the law firm represents the 4th largest operation of its kind across the globe.

Rest assured One-Percenters, international money laundering will continue undeterred in countless other tax havens from the Caribbean to the Mediterranean.

Additional credits

cbc.ca

The Guardian

Is it a victory though?

I doubt it will make a shred of difference.

The operation will just move to a yet to be exposed criminal outfit or broken up amongst the 3 larger entities operating in the same sphere.

The hypocrisy coming out of those in power is biblical right now, they pontificate about criminals and terrorists using Bitcoin for money laundering and supporting crime etc whilst using the current system to do just that themselves!

One rule for them and one for us, that’s the problem.

I don’t judge anyone for stashing their wealth away from criminal, thieving governments however when it’s the criminal politicians and their cronies doing it I get pissed off.

Great work V

You're probably right, I honestly think it's doesn't amount to much in the grand scheme of things as there are literally hundreds of other locations to offshore wealth and avoid taxation. What I was trying to say was that exposing these crimes has pull backed the curtain on the activities of the elite proves they're hypocrites and no better than criminals. I see that as a small victory. But yeah, the closing of one law firm is not going to change the practice at all.

Also, I couldn't agree more about the attempts at conflating Bitcoin with money laundering while massive scale money laundering is currently occurring in the present system.

Thanks for your insight as always!

And thanks for yours dude, this is important work as many people are still totally unaware of the criminals they vote for.

Also, blockchain (potentially EOS) will make on-chain laundering practically impossible.

We should be promoting blockchains for this ability, not attacking them. Though, doesn't surprise me as it's the elites that need to launder money, no the common people.

Absolutely.

But people are gullible enough to belive them, which is even bigger problem.

https://steemit.com/fundraising/@jejes/steemit-help-fundraising-for-my-friend-s-father

Hi everyone! pls do help to upvote this post for my friend's father's heart. They need our support right now..

How about the Catholic oligarch, they are also involved on tax evasion and money laundering too. I don't know how they invest the money of their followers and I don't know why the Government didn't impose tax on churches especially in my country( Philippines) where 90% are Christian and all the money went to their pocket. That's one of the reason why Philippines remain poor. And religion is the best investment here in PH.

and they complain about bitcoin being used for laundering! looks like the people accusing are the worst offenders.. as always!

Indeed. They are the worst offenders. They can accuse of anything, they always try to pull people down with their shit acts.

"No, no, it's not us! We are not conducting any illegal activities, with our anonymity and secrecy, trust us! It is that decentralised ledger over there! Where every transaction is recorded on the blockchain, yes, yes! That is where the fraud and tax evasion is taking place, look over there, and not at us!"

nice your post. I complain about bitcoin being used for laundering looks like the people accusing are the worst offenders.

Well that is good riddance, now maybe the other guys, the ones who actually hid their ill gained money there are prosecuted in their respective countries, but I doubt this will happen.

Great research as usual. The cool thing about WikiLeaks is that once this information is dumped, it is kind of the gift that keeps on giving, and can be a source of research for years to come!

Yes, it's like going back to the well to draw water.

Great work as always @v4vapid I fear that these people know exactly how to play the game and are often in league with and tipped off by those that are investigating them. Like banking, and as a way of paying lip service they offer up a sacrificial lamb (either an individual or organisation) but prior to this those in the know (the ones that sit atop the organisations) have already moved their base of operations . I'm interested in hidden/connecting threads that run through certain organisations .. it is indeed a tangled web. In terms of a small victory I agree in that it has open the eyes of the public to these nefarious organisations .. what people do with the information is a diferent thing, but even if it's forgotten for now it will be remembered once a similar story rolls around again .. which it will. The fast pace of 24hr news has ensured the destruction of the publics long term memory, it's a good job some of us never forget and from that perspective you're doing a fantastic job at recording all this on the blockchain and rasing awareness .. keep it up for it's far more important than many of us may realise at this moment in time. Thanks again V

Bitcoin is fighting on a difficult war because it opposes and is not in line with the plans of the elite. As we know, the elite always displace everything that does not serve their interests. But I think it's hard to remove the bitcoin because it's built on a strong foundation

I think Panama is an attractive location for the world's rich and powerful corrupt leaders like the politicians from my country, because of the loophole in their judiciary system. Am not blaming them at all because its like that in most nation of the world. They create the law to suit their selfish interest. In Nigeria where i come from, you see lots of this corrupt politicians laundering public funds and when they are asked what they did with the money given to their ministry or state, they'll tell you this in quote:

This selfish and self centered politicians engage the youth in touting to promote their selfish political interest while their children are sent abroad...

When they see that the youth are making headway through steemits and other platforms like crypto trade they tell you things like

This so called centralized and currupt body i.e the banks, governments, corperations, who derive joy exploiting people, calls the decentralised systems fraud and all sort of names, they frowns seriously at bitcoin and other decentralised system because they know that they are gradually sent parking

The biggest criminal is the Federal Reserve ( a private bank)... printing money from thin air, then loaning to the government with interests. Since the creation of the FED... the USD has lost over 98% in value.... gold was $20 USD per ounce at one time (can trade $20 USD for gold in a bank). Now $1,300 plus per ounce (banks will laugh at you if you ask if they have gold).

Every 40 years or so the US defaults, the US coming off the gold standard in 1971 was one of the US great defaults and the US should have defaulted during the 2008 crisis, they didn't and now the crisis is going to be so much deeper.

This is why China, Russia and India are buying up huge reserves of gold, China is one of the largest miners but not sellers, they are keeping it all at home; they all know what's coming. The US economy needs to add several dollars of debt for every dollar of growth because they have exported their manufacturing base away, they have exported their money making ability and all this is at record low interest rates.

What's going to happen when interest rates rise? They can't balance the books at 0% how are they going to do it at 3% or 5%? I am going long Popcorn as this unfolds over the next few years, it's going to be fun to watch.

Appreciate your comments but I want to adjust something you wrote that I think get said too often and people start believing.

The Fed cannot just print money in whatever amounts it wants. Money policy is highly regulated and controlled by each country that uses a Fed system.

The amount of money in circulation is based on a series of factors and goes up and down. Countries cannot just continue to print money without consequences. There must be a balance or the country risks losing confidence and its interest payments go up considerably. We have seen what happens when they do, their financial systems collapse. Look at Zimbabwe and what is happening in Venezuela right now.

In terms of the US and other countries being off the gold standard, they were able to do this because they had been paying their bills for 150 years or more and never missed a payment. In other words, they built up credit worthiness. I am definitely not a fan at all and it sucks. But their position was that they gained this option to get “credit”. There was simply no need to keep stockpiling gold when they could just use credit instead. At the time the US was in a depression and needed more cash in the system so they made the jump. The consequences of this has not been good for all of us primarily because individuals and corporations now compete with countries for available credit and of course the skyrocketing debt (more on that later).

To be clear, yes printing money can and most often will cause inflation (although it didn’t these last 5 years strangely). But the biggest causes of inflation lately is supply and demand and tech advances. Both push up prices continuously.

In terms of why getting off the gold standard is really a problem is that it allows the US to borrow money too easily. The US has leveraged the future of young people for credit today. And like anyone who gets easy credit, they cannot stop. The debt will be $20 trillion dollars this year.

I am only offering these points because I too often see people making these statements and it only confuses things. The Fed is terrible but even if they were a completely public owned entity (which is the case with many Feds), they would still suck. We definitely need a better system. Thanks.

https://www.thebalance.com/causes-of-inflation-3-real-reasons-for-rising-prices-3306094