Intro to stock market "MySQUAR" in Myanmar gaming & telecom company

5 reasons to add Penny Stock MySQUAR #MYSQ to your Watchlist

MySQUAR (MYSQ)

Share Price: 4.25p

Market Capitalistion: £24.70m

Market: FTSE AIM

What Do MySQUAR Do?

MySQUAR is an established technology group focussed on becoming the social media, entertainment and gaming platform of choice in Myanmar, one of Asia’s fastest growing economies.

1. MONETISATIONMySQUAR’s reported revenue for the 6 months 31st December 2016 was only $340,716, somewhat disappointing as it wasn’t even half what they achieved for their previous full year.

HOWEVER

A lot of their revenue generating features seem to be kicking in this year. From their unaudited Interim Results Ending 31st December 2016 they stated that: Over the next 12 months, increasing the company’s revenue will largely rely on the following:

MyChat is a chat and messaging application. It will monetise through various channels.

In addition to advertising, they are adding premium content that users will have to pay to access, such as paid stickers (launched in April 2017), dating features, horoscope (launched in May-June 2017), gifting, and other features that will be added over time.

“The paid content will not only help generate revenue but we believe it will also increase stickiness (user engagement) to MyChat.”

Worth noting is the 8,390 reviews, MyChat has received in the Google Play Store. If you realise that only a fraction (some research suggests it’s usually below 1%) of the total users of any app write reviews, this figure is quite impressive.

MySQUAR state that they have the largest portfolio of games in Myannnmar.

They’ve already released some games, such as MyFish and Hawk Hero. They are continuing to expand their game portfolio by introducing new and different types of games to the market – such as the casual gaming platform released in late March, and in early April 2017 we released a new MMO (massively multiplayer online) game that is unique to the Myanmar market.

The gaming business is expected to substantially grow in the near term, due to not only the ongoing expansion of the game portfolio and user base, but also the integration with major carrier billing providers (such as Telenor) for streamlined payment options for users.

Fastsell is a marketplace app which allows people to buy and sell goods in their area, a bit like eBay but focused on Myanmar.

The advertising sales and premium accounts been available from April 2017 and marketing activities to promote the application are being carried out extensively.

“The full launch of the VoIP services (known as CallHome) was soft launched in December has been delayed longer than expected due to customization work conducted by our technology partner, however it got fully launched in the end of March 2017″.

The services target the Myanmar market and also South East Asian countries, such as Thailand, Malaysia, Singapore and the UAE where many Myanmar diaspora live.

The services offer users bundled packages with competitive pricing compared to other VoIP service providers in the market (such as Viber).In order to target users around the region and receive payment, the VoIP services will integrate the in-app purchase functionality of Google Play, which connects with most of the local mobile operators in the region, allowing users to pay for the VoIP services via their local carrier billing or via credit card.

- SUBSCRIBERS

Of course monetisation, using the methods above, is only effective if there’s enough people using their services. Fortunately this doesn’t seem to be a problem. MySQUAR has exceeded its targets on subscriber numbers.

On 12th January 2017, MySQUAR announced that the total number of registered users across all apps and games exceeded 7.5 million.

This is a 25% increase in users compared to it’s annoucement on 14th October 2016 when the company had approximately 6 million registered users.

If they continue to see this type of growth, they will exceed 10 million registered users by June 2017. This is nearly a quarter of all active SIM subscriptions or nearly a fifth of the entire population on Myanmar.

- THE SHARE PRICE

When you consider, MySQUAR floated at 10p on 1st July 2015 at around £18m market cap and that Beaufort Securites have a target price of 21p, then you could be forgiven for thinking they are now undervalued at 4.25p but what about their fundamentals?

Beaufort Securities reckon MySQUAR will achieve monthly breakeven by end of this June 2017 year end and be, potentially, profitable in the 2nd half of 2018.

Facebook’s, Linkedin and Twitter put their value per user at $86, meanwhile MySQUAR’s current value per user, based on 7 million users, is around 100th of that, at 86 cents per share.

It’s also worth noting, that there are a number of cash rich Japanese, Korean and US social media companies, who would value MySQUAR’s 7.5 million users highly, especially at such a low ARPU.

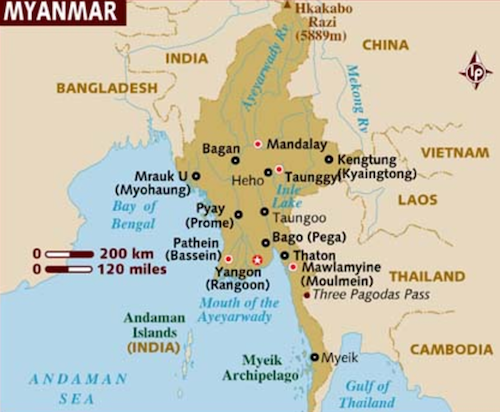

- LOCATION

Formerly known as Burma, the British invaded Myanmar after three Anglo-Burmese Wars in the 19th century and the country became a British colony. Myanmar became an independent nation in 1948, initially as a democratic nation and then, following a coup d’état in 1962, a military dictatorship.

In 2011, the military junta was officially dissolved following a 2010 general election, and a nominally civilian government was installed.

Economy

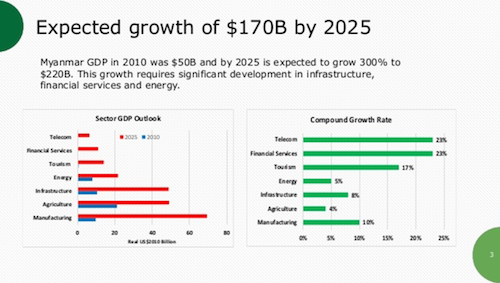

Myanmar has a population of approximately 54m and its economy is expected to grow by an average 7.1% every year, over the next three years.

Considered by many to be one of the last economic frontiers, Myanmar has seen inward foreign direct investment steadily increase since its reform. The country approved US$4.4 billion worth of investment projects between January and November 2014.

According to one report released on 30 May 2013, by the McKinsey Global Institute, Myanmar’s future looks bright, with its economy expected to quadruple by 2030 if it invests in more high-tech industries.

Telecoms Industry (Telenor)

Mayanmar has three mobile carriers: the government’s MPT and the two private carriers: Qatar’s Ooredoo and Norway’s Telenor.

The mobile phone penetration rate in Myanmar, which barely touched double digits in 2013, has now reached around 50% of its estimated 54 million population last year.

A report last year by the telecom equipment supplier Ericsson suggested that 6% of the world’s new mobile subscribers came from Myanmar, making it the fourth fastest-growing mobile market on earth.

In addition, smartphones are the first handsets owned by 80% of Myanmar’s mobile users, according to the two main operators, Telenor and Ooredoo.

Their neighbour, Vietnam, which is a country similar enough to Myanmar in order to compare growth, saw its mobile gaming market grow by 125% annually in 2012 and 2013. MySQUAR are targetting 30% of Myanmar’s entire population by 2019, which Beaufort Securities see as achievable.

On 21st March MySQUAR integrated and utilised the carrier billing service of Telenor Myanmar, a leading Norwegian telecommunications provider operating in Myanmar since 2014, for MySQUAR’s mobile applications and games. Telenor will earn a share of revenues as part of the integration.

Telenor is a major international telecommunications provider in Myanmar with a market share of about 37%. It has a strong subscription base with 18.2 million mobile customers as of the end of 2016 and has extended its LTE (4G) network to six new cities.

The integration will give MySQUAR access to Telenor’s large subscription base for enhanced distribution and marketing opportunities and in-app purchases will now be easier for MySQUAR users that are also Telenor subscribers. Revenue is anticipated to increase with this integration and this more convenient payment option.

- CONVERTIBLE LOAN NOTES

On 10th April, MySQUAR announced it was raising £2m via the issue of 235,294,120 shares 0.85p. The net proceeds of the placing will be used for general corporate purposes and to terminate the Convertible Loan Note facility in place with Sandabel Capital L.P.

These convertible loan notes were preferable, according to the company, to raising money via several smaller placings. However, the share price has tanked since the first annoucement of these convertible loan notes on 30th September 2016, when it was at 5p.

The termination of this agreement should now help the share price recover, as it removes a big seller that was Sandabel.

They also have cash from the placing to carry out their development, which includes ramping up their revenue generating features.

Their brokers Beaufort Securities state, “MySQUAR appears set to deliver an impressive 2017/18 result, with the opportunity to demonstrate success by achieving first monthly breakeven before the June 2017 year end”.

Judging by the growth in subscriber numbers MySQUAR are becoming the go to social media site for Myanmar, a country, whose economic and more importantly for the company, mobile phone growth is expanding at an impressive rate.

If MySQUAR’s focus on montisation this year, which is evident in the number of revenue streams they’re implementing, start to pay off as expected. This opportunity could be magnified, if they become the target of a larger social network looking to become a major player in Myanmar, seen as many one of the last economic frontiers.

I have been an investor since 1.3p and I have derisked along the way, this project is very exciting to me and I truly believe it is a great investment. It goes without saying if you ever decide to invest, please do so on your own research and never put more then you are willing to lose.