Stoic Investing : Learning to stay emotionless in the midst of market movements

What is Stoicism?

The Merriam Webster dictionary defines Stoicism as the indifference to pleasure and pain. Pleasure and pain come in many forms, for example there is certainly the obvious physical pain and pleasure, and there is also the pain and pleasure which lives more on a non-tangible emotional plane. According to Wikipedia (a fairly credible source) Stoicism was a school of Hellenistic that was taught and practiced by the Romans and the Greeks during the 3rd century AD.

The scholar, former trader, statistician, and risk analyst Nassim Nicholas Taleb has said in regards to stoicism:

"A Stoic is someone who transforms fear into prudence, pain into transformation, mistakes into initiation, and desire into undertaking."

Apply this to trading and you can draw a parallel to Warren Buffett's famous quote "Be greedy when others are fearful, and be fearful when others are greedy." But you may say, "Controlling emotions is difficult, how can we become stoics when there is so much fear, uncertainty, and doubt (fud) associated with the markets?!"

Become informed, observe your internal environment

Becoming a Stoic is about taking in the external world and observing the emotions you experience in the current moment and becoming indifferent towards them. By establishing a set of internal truths, by practicing observation and the gathering of information one is on their path to become a true Stoic. Zen meditation is all about observing the world and watching the rise and fall of emotions to learn the true nature of suffering and happiness.

The Hindu god Ganesh has large elephant ears and a large belly - the ears symbolize taking in all of the information one can from the external world, and the belly symbolizes filtering the negative out and storing the positive internally.

Applying Stoicism to life, cryptocurrency, and general investing

It is a well known fact that markets are irrational. The cryptocurrency markets today are clearly influenced by manipulation from fake news, governments, and whales (investors who hold a large quantity of coins). In such a volatile environment it can be easy to get caught up in a swirl of emotions.

For example, in the recent all around drops in cryptocurrency there was great pandamonium. Many who were newer and some older investors and traders in cryptocurrency who were emotionally attached to their money sold in great panic. There were those despite having knowledge of scams and pyramid schemes willingly lent their money on the Bitconnect platform, a platform whose premise was greed. Is it possible to not be greedy and participate in markets? Yes.

There is a common saying in investing that, "Bulls and bears make money, pigs get slaughtered." A true Stoic is devoid of greed, fear, and has an understanding of suffering as well as pleasure. What is a Stoic investing strategy then you may ask? If one becomes deeply informed of their internal and external environments gathers information on a timely basis, and is unaffected by swings in the market, knows when enough is enough for a specific position, and has a clear goal and set of values defined they are a true Stoic investor.

The world is filled with great variability, in your life you may meet many people with different outlooks. Sometimes you may not necessarily agree with what one says, but make no mistake, everyone has something to offer. Having true humility and being able to make the sensible decision without playing into emotions is tough - but we can certainly make an effort.

It is very easy to be impulsive, it is easy to do things on a whim. It is easy to fall prey into greed and other emotions, but in order to enhance our lives we need to make an effort to inculcate true focus. Focus and the qualities of stoicism aren't learned in a single day but may require a very long time in order to master.

Conclusion

I hope you enjoyed this piece in regards to Stoicism as well as how it can be applied to the markets. Of course, I'm not offering any sort of investment advice in this piece and as always one must make their own decisions, but I hope this gives you some clarity into your own personal strategy whether that is in investment or life in general. Thanks for the support!

"Apply this to trading and you can draw a parallel to Warren Buffett's famous quote 'Be greedy when others are fearful, and be fearful when others are greedy.'"

This is my favorite paragraph.

I remember your previous post advising us to 'hold' our cryptocurrencies(Bitcoin, sbd, steem,etc) when it crashed recently and to have faith because, it would rise again. It may have seemed unrealistic at that time, but I took your advice and shared it with my friends who laughed me to scorn. Who is laughing now😁?.

Thanks for this @nphacker

With❤️ from @adedoyinwealth

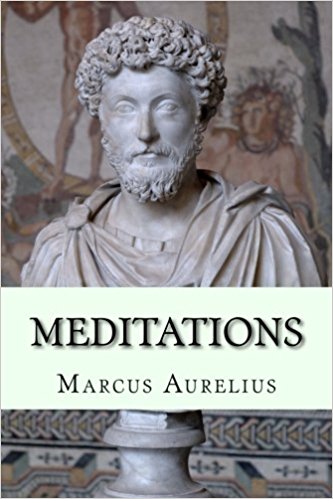

For anyone who wants to know more about Stoicism, you MUST read Meditations by Marcus Aurelius. One of the greatest insights into the mind of a historically great leader who embraced the mentality of stoicism.

Applies well to many facets of life.

Thanks for the comment! Definitely agree that this is a great resource :)