🔊 NEW! Neocash Radio Ep183: America’s Got Debt, Russia Loves Gold, Bitcoin Mempool Peaks, Trump Dumps TPP

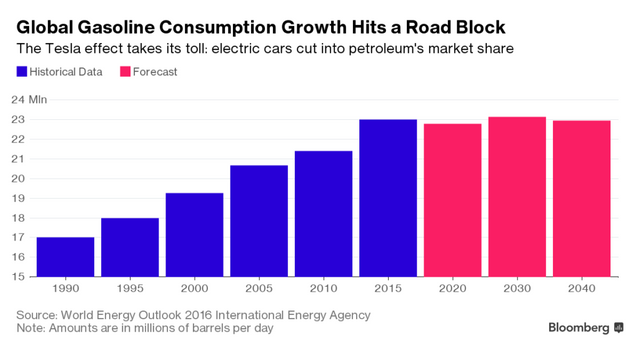

U.S. national debt spirals out of control. Trump will quit the TPP and have a hand in shaping the Federal Reserve’s Board of Governors. Trump being in NYC is allegedly costing $1 million a day just in NYPD costs! Russia is buying up gold in a major way. The IRS wants to go fishing through Coinbase accounts. The Bitcoin Mempool is peaking just in time for the holidays. ChangeTip to shut down despite being popular. Overstock is set to sell the first stock shares over a blockchain. Ethereum fork number 4 is a success! Global gasoline demand likely peaking as electric cars become more popular and affordable.

All this and more on Neocash Radio episode 183 - Wednesday November 23rd, 2016!

Stream this episode:

Tune in to Neocash Radio every Wednesday night and

RETWEET ALL THE THINGS @NeocashRadio!

on iTunes / Soundcloud / Stitcher / Google Play & iHeartRadio!

We’re also on Tunein, Player.FM, Overcast.FM, Podcast Addict, Blubrry, and more!

| Traditional Markets | Crypto Markets |

| Gold $1,188 | Bitcoin (BTC) $741 |

| Silver $16.34 | Litecoin (LTC) $3.89 |

| Oil $47.94 | Zcash (ZEC) $84.88 |

| Dow Jones 19,083 points | Ethereum (ETH) $9.67 |

| 30Y UST Yield 3.024% | DASH $8.40 |

| Euro (EUR) $1.06 | Monero (XMR) $7.75 |

| Chinese Yuan (CNY) $0.14 | Augur REP $4.43 |

| British Pound (GBP) $1.24 | 1 Doge = 1 Doge |

Record-shattering $2.4 TRILLION dollars could be added to U.S. National Debt this year

According to data released by the U.S. Treasury Department last week, the U.S. national debt has soared by a staggering $294 billion in the first 45 days of the 2017 fiscal year, an annualized increase of 13%. At this rate, the national debt could increase by $2.4 trillion this fiscal year, surpassing $21 trillion by September 2017. (Fiscal year 2016 saw the U.S. national debt grow by more than $1.3 trillion.)Debt is enslavement of future generations, and the United States empire has grown the debt by more than $100 million an hour, every hour, every day since Obama entered office.

The average rate of interest paid on U.S. government debt has been around 6%, though the Federal Reserve has artificially kept those rates much lower—between 0.25-0.50%—since the 2008 financial crisis. Fed chair Janet Yellen told the Joint Market Committee that a rate hike would be coming “relatively soon,” and according to the trading of federal funds futures contracts, 100% of traders believe that a push to 0.50-0.75% will come in December. (About 66% are betting that the rate will be 0.75-1.50% by September 2017.)

If the Federal Reserve interest rate ever returned to even 5% once the national debt reached $21 trillion, U.S. taxpayers would be paying MORE THAN A TRILLION DOLLARS IN INTEREST ALONE. As our main article points out:

“It is really, really hard to spend a trillion dollars. For example, if you were alive when Jesus was [allegedly] born and you had spent a million dollars every single day since that time, you still would not have spent a trillion dollars by now.”Yellen also noted that the national debt is around 77% of the United States gross domestic product (GDP): “The long-run deficit probably needs to be kept in mind. There’s not a lot of fiscal space should a shock to the economy occur.”

Trump vows to exit Trans-Pacific Partnership, pledges $1 Trillion infrastructure plan; could have huge impact on Federal Reserve board

In the midst of U.S. President-elect Donald Trump filling his cabinet with war-hungry Islamophobes, he also released a video vowing to withdraw from the controversial Trans-Pacific Partnership trade agreement on his first day of office. He called the TPP a “potential disaster” for the United States, and said he would “negotiate fair bilateral trade deals that bring jobs and industry back” to the U.S.

Trump has also held strong on his plan to spend $1 trillion on upgrading infrastructure—roads, bridges, tunnels, airports, etc.—though it still isn’t clear where this funding will magically come from.

Federal Reserve chief Janet Yellen indirectly expressed concern with the proposed spending, noting that continued massive government spending would drive up inflation, with employers offering higher wages to attract a limited pool of workers.

Trump is no fan of the Federal Reserve or Yellen, calling her “very political” and saying she “should be ashamed of herself” back in September. As soon as Trump is inaugurated, he is able to submit nominations for two vacant Fed governor seats and for the vice chair of supervision, a powerful position that oversees the nation’s biggest banks. And Yellen’s term as chair will end in February 2018, quickly followed by the end of Stanley Fischer’s vice chairmanship in June 2018, leaving Trump responsible for filling four of the seven Federal Reserve governor chairs during his four-year term.

Protecting Donald Trump costing NYC over $1 million a day

Protecting Donald Trump costing NYC over $1 million a day

The NYPD and Secret Service protecting President-elect Donald Trump and his family is costing New York City more than $1 million a day. Trump, along with his wife, children, and grandchildren are receiving security detail in the most densely populated part of America’s biggest city, which NYC mayor Bill de Blasio cites for the high cost: "This is a very substantial undertaking. It will take substantial resources. We will begin the conversation with the federal government shortly on reimbursement for the NYPD for some of the costs that we are incurring."

In the fiscal year ending June 30, city records show that NYC received $26 million—around $500,000 per week—in reimbursements “from the federal government” (aka U.S. taxpayers) for protecting world leaders.

NYPD has set up barricades around Trump Tower at 56th Street and 5th Avenue, essentially choking off traffic. Police are closing streets as Trump moves through the city, even shutting down the Lincoln Tunnel on Friday afternoon during rush hour as Trump traveled to New Jersey.

During October, a record 1.3 million ounces (40.4 tons) of gold were added to the Central Bank of the Russian Federation’s reserves. This is more than 250% of the gold added in September, though this is in part due to the central bank changing its reserve rules so that gold held in unallocated bullion accounts at banks could be reflected in reserves figures.

Russia—the second highest gold producer in 2015, mining 290 metric tons—now claims an official 50.9 million ounces (1583.167 metric tons) in total gold reserves, more than triple the amount they held a decade ago. Russia is using state rubles and selling off its holdings of US Treasury debt to fund their gold purchases.

This is reflective of a larger trend we’re seeing that has central banks buying up gold since 2010. In 2015, central banks collectively added 588 metric tons to their reserves—the second largest annual total since the end of the gold standard in 1971. Out of those 588 metric tons purchased by the world’s central banks, 208 of them (roughly 35.3%) went to Russia.

Russia now has the sixth highest amount of gold reserves in the world, and it is quite clear that they are aggressively buying up more. (Only the U.S., Germany, Italy, France, and China hold larger gold reserves.)

The IRS Goes Fishing For Coinbase Customer Records

The Department of Justice on behalf of the Internal Revenue Service has filed paperwork in Federal Court requesting the identities of Coinbase customers. The blanket “John Doe” summons amounts to more of a fishing expedition rather than any sort of targeted investigation. In a blog post Coinbase has said, “we are extremely concerned with the indiscriminate breadth of the government's request.” And that they, “In its current form, we will oppose the government’s petition in court.”

The Bitcoin Mempool Size Peaks

We at Neocash Radio have been watching the Bitcoin Mempool for a while as an indicator of the health of the network. The Bitcoin Mempool is made up of unconfirmed transactions awaiting a home in a mined block. An excessive number will both delay blockchain integration and also cause a rise in fees as bitcoiners pay more for faster confirmation. As of this afternoon there are well over 60,000 unconfirmed transactions with the total mempool more than 40 MB in size. The average block time is about 9.3 minutes and it would take more than 40 blocks -- more than 6 hours to clear just the backlog of unconfirmed transactions already.

This is not a new phenomenon with the last such peak in mempool size occurring in July of this year. For a period of about two weeks the mempool fluctuated wildly. This latest uptick started on November 20th which may be due in part to holiday shopping. Consumers are buying more and more online rather than braving the in-store madness of Black Friday.

Prior to this recent peak in mempool size, the 7 day average moved between 3 and 4 MB in unconfirmed transactions -- with fees already high for fast confirmations. The low transaction fee is part of what makes bitcoin so valuable and efficient. Without larger blocks allowing a higher throughput the Bitcoin network may just relegate itself to being useful only by a few true believers while other more innovative blockchain protocols solve the throughput issue and add layers of value on top of that. The alternative is Bitcoin Core’s plan to ‘soft-fork’ the protocol by rewriting the blockchain while arguing that max block size is not broken so don’t fix it.

With the release of Seg-Wit the clock is ticking on the Hong Kong Hard Fork for Bitcoin Core. Chinese miners agreed to support only Bitcoin Core code pending a plan for a hard fork with an increase in blocksize. That agreement is set to last until Seg-Wit’s release plus three months. Bitcoin Core has 10 weeks or so left to propose a hard fork solution.

Related listening: We’ve also got a special bonus interview with Roger Ver that we recently posted! Listen in as Bitcoin Angel Investor and Bitcoin.com CEO Roger Ver talks with us about how the current Bitcoin block size limit is throttling the Bitcoin network, and how Bitcoin Unlimited could be poised to increase the block size and allow the Bitcoin network to scale.

Bitcoin tipping service ChangeTip to shut down

Bitcoin tipping service ChangeTip to shut down

ChangeTip founder Nick Sullivan took to Reddit to announce that the popular “Bitcoin tipping” service would be shutting down at the end of this month, though the site would remain in withdrawal-only mode “for a couple months” so that users could collect their funds or donate them to charity.

ChangeTip began as a way to send micropayments through social media. By mentioning @changetip and a desired tip amount on Twitter, Reddit, YouTube, Tumblr, GitHub, Slack, and others, users could transform the idea of a “like” into a method of financial appreciation with Bitcoin.

Despite raising $5 million in funding since its launch in 2014, ChangeTip struggled to find a buyer as it struggled to find continued funding. The ChangeTip engineering team was acqui-hired by Airbnb in April for $1.25 million, but the company has still been unable to find a buyer for its codebase and other assets. In his post, Sullivan concedes that “unfortunately the only remaining option is to shut it down.”

Sullivan closed with this statement:

“We want to extend a very special thanks to our entire community. We are truly humbled by your generosity and your philanthropic spirit. It was a great adventure, and we’re proud of what we built - we sincerely hope you enjoyed using ChangeTip. Please continue to spread the mission of generosity, gratitude, and appreciation all over the web.”

Overstock Could Raise $30 Million With Blockchain Stock Offering

Last week, Overstock quietly launched a website for “Keystone Capital Corporation - powered by tØ,” where Overstock plans to issue 2 million shares of their Series A preferred stock using tØ's blockchain technology. Overstock unveiled tØ (pronounced "tee zero") last year in an effort to cut out middlemen in the financial industry by shifting the post-trade processes to an immutable, distributed ledger.

The maximum price of these Overstock shares will be $15.68, resulting in proceeds for Overstock of $14.43 per share after subtracting a broker-trader fee of $1.25 from each. Extrapolating out for all 2 million shares, the maximum funds raised will be $31.36 million, with $28.86 million in proceeds for Overstock. The subscription period ends on December 6th, and trading is expected to begin on December 15th. (As always, we are not speculating on prices, nor are we advising the purchase or sale of any stock, cryptocurrency, fiat currency, or any other type of financial instrument or asset.)

Ethereum Fork Number 4—"Spurious Dragon"—is a Success

Spurious Dragon has taken place and the Ethereum network is on to its fourth fork. If you have a node or wallet, be sure to update your software. The fork is clearing out millions of empty accounts that have been used in the DDoS attacks of the last few months. The Ethereum Foundation is recommending miners set the gas limit or floor to 3.3 million to help with the state clearing process.

For a protocol working their fourth fork, there is a lot of testing to be done and the current testnet Morden is getting replaced with a fresh start: introducing Ropsten, a new Ethereum testnet that will have a much smaller blockchain given that the genesis block was recently made.

In other fun news, Ethereum founder Vitalik Buterin has been spotted on the Ethereum Classic subreddit giving advice for the betterment of the ETC chain.

Global gasoline demand has “all but peaked” thanks to electric vehicles

Global gasoline demand has “all but peaked” thanks to electric vehicles

The International Energy Agency forecasts that global gasoline consumption has nearly peaked, pointing to the growing number of fuel-efficient cars and electric vehicles on the road. Electric vehicles are growing in popularity; less than 1 million of them were on the road in 2015 but that is projected to grow to over 150 million by 2040.

Simon Henry, CFO of Royal Dutch Shell Plc—the world’s second-biggest energy company by market value—surprised investors this month when he said that he believed overall oil demand could peak in as little as five years. Though the International Energy Agency believes that gasoline demand is peaking, they project that overall oil demand will continue growing for several decades due to increased consumption of diesel, fuel oil, and jet fuel by the shipping, trucking, aviation and petrochemical industries. Refiners will likely be hit hardest by this shift, as many of them have spent billions of dollars to maximize gasoline output at the expense of other fuels over the past 20 years, and may now have to retool their operations.

Hi! I am a content-detection robot. I found similar content that readers might be interested in:

http://neocashradio.com/blog/ep183-us-national-debt-russian-gold-reserves-bitcoin-mempool-trump-tpp/

That is my content @cheetah, reposting here as I do each week. :)

I’m happy to have discovered your podcast, @randyclemens! I just downloaded the latest episode on iTunes and followed you here on SteemIt. I look forward to new episodes in the near future. Keep up your great work! :)

Thanks @oleg326756. Just posted this week's episode here: https://steemit.com/podcast/@randyclemens/new-neocash-radio-ep184-at-and-t-kills-net-neutrality-trump-s-global-conflicts-of-interest-the-dangers-of-venezuelan-bitcoin Cheers and thanks for the follow!

Awesome! I look forward to listening to it on my way to work today. :) Thank you for making it, @randyclemens! Upvoted!