The Token Economy

Network effects are one of the most powerful phenomenons in business. A network effect occurs when a new user of a service increases the utility of the service for existing users. Robert Metcalfe first popularized the concept in 1980 when he presented Metcalfe’s Law, which states that that the value of a telecommunications network is proportional to the square of the number of connected users. The concept was initially presented in the context of telephones and fax machines and later demonstrated itself in Internet-enabled products like email, Facebook and Twitter, whose existing users all get more utility out of the networks when new users join.

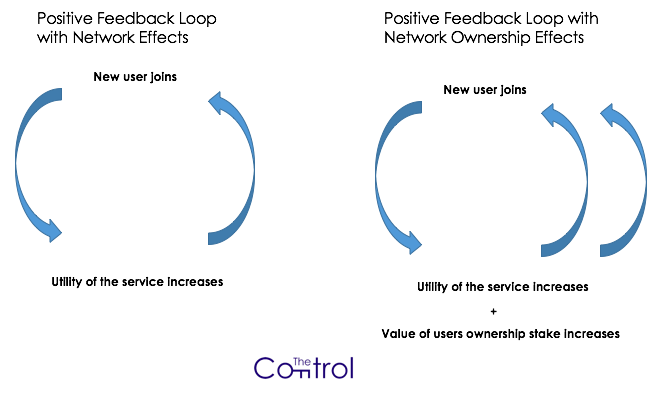

In 2009, Satoshi released Bitcoin into the world. In doing so, Satoshi unleashed the strongest network effect the world has ever seen, which I call the network ownership effect. A network ownership effect describes when the utility of the service and the value of ownership of the service increases for existing users when new users join. The combination of a useful product (in the case of Bitcoin, that service is an immutable public database) and a token that users can own (in the case of Bitcoin, that token is BTC) created a powerful positive feedback loop that has propelled Bitcoin to unimaginable heights since it was launched 8+ years ago.

Understanding the power of network ownership effects

Embedding economic incentives into a product makes people fanatical about the product. Case in point:

To understand the fanaticism of Bitcoin users, visit the Bitcoin Subreddit, which has 220K subscribers (more subs than r/google, r/amazon and r/facebook combined) and check out the daily chatter. Search “bitcoin” on Twitter to see the thousands of engaged Twitter users each day that love to talk about Bitcoin.

The passion of Bitcoin users stems from the fact that they don’t just use the product but they also have an ownership stake in the product and directly benefit financially from its success. Utility + ownership fosters a user base who also become passionate engineers, marketers and salespeople. A decentralized global ledger is useful, but we wouldn’t be talking about Bitcoin if it was just a decentralized global ledger. A decentralized global ledger combined with a token that’s required to use the ledger aligns incentives and creates more intense product engagement than ever seen before. The product becomes more useful as more users join and demand for the token increases as a result which increases the value of the ownership stake for users.

Token models don’t work without a great product and sound economics

Tokens can enhance the growth of great products by driving a positive feedback loop via network ownership effects, but the feedback loop will not get started without a great product. In Bitcoin, the token model would not work if the product wasn’t great and the economics weren’t transparent. If Bitcoin wasn’t a resilient, decentralized protocol for storing and transferring value with a clear and sound token distribution policy, we wouldn’t be talking about it today. Token models are primarily about enhancing the product experience by creating strong network ownership effects, not raising money or creating a product

In 2016, $160M+ was raised by entrepreneurs issuing tokens without a live product. As a result of the hype and media attention those token issuances garnered, some think of token sales as a funding mechanism first. While there may be long-term benefits to crowdfunding from public blockchains (inclusion), it’s important that we think of tokens as a product feature first. There are huge risks associated with tokens being used as a fundraising mechanism (both legal and execution) and the best blockchain projects will incorporate tokens with sound economics into useful products to foster powerful network ownership effects.

Token models beyond Bitcoin

In the long-run it’s likely that all assets are digitized on blockchains, from event tickets to home deeds to international equities. But the most successful projects in the near-term will be the projects with useful protocols and products that incorporate tokens distributed directly to users to foster powerful network effects. The economics, governance and legal implications of the emerging token economy are the big open questions that are still being figured out by the entrepreneurs and investors that are at the forefront of the nascent token economy today. In addition to Bitcoin, projects like Ethereum, Augur, Sia and Numerai are building products that distribute tokens to users to align incentives and foster strong network effects. The token distribution approach (fixed vs. continuous), the decision making rights of users and developers in the network, and appropriate legal structures are all being experimented with as we speak.

It’s important to remember that all of these projects are experiments in new economic, governance and legal models that have never been attempted before. But history is likely to favor those who embrace network ownership effects, so it will be useful to observe and learn about the emerging token economy rather than resisting it.

NOTE: THIS WAS ORIGINALLY PUBLISHED ON MEDIUM

About me: I run The Control and am an investor at Runa Capital, an early stage venture fund. Previously, I worked on business development and marketing at Coinbase. Follow me on Twitter, signup for our newsletter, and show support by upvoting on Steeem

Nice !