What is Rugpull in Cryptocurrency? 8 Ways to Avoid Rugpull in Altcoins!

If you haven't lost all your money on an altcoin before, you still have a chance. 8 details you need to know before you lose all your money!

https://unsplash.com/photos/Skf7HxARcoc

Anyone who's had it before knows exactly what rugpull is. However, if you haven't reset all your money in a single investment, you may not have experience in this regard. We hope you will not have such a bad experience, but there are important details that you need to pay attention to in order to stay away from it. Let 's take a look at 6 ways to stay safe from rugpull risk.

🟥What is Rugpull in Cryptocurrency?

Rugpull is a type of cryptocurrency scam that occurs when a team pumps their project's token and leaves their investors a worthless asset before disappearing with the funds . They rugpull when malicious developers create a new crypto token , raise its price, and then get as much value from them as possible before abandoning them when their price drops to zero. Imagine you have a startup and you sell the whole company and disappear, rugpull looks exactly like that.

Rugpull is an exploit specific to DeFi platforms. DeFi is preferred because it is risky to make such malicious sales in centralized exchanges and to take the money out.

🟥What are the Rugpull Types?

There are 3 main types of rugpull in cryptocurrencies . These; stealing, limiting sell orders and dumping. Rugpull comes in two forms: hard and soft. Stealing malicious code and liquidity are tough transactions, while rugpulls mean draining an asset. Tough contention ensues when project developers encode malicious backdoors into their tokens. Malicious backdoors are hidden exploits coded into the project's smart contract by the developers. The intent to commit fraud is clear from the very beginning. Liquidity theft is also considered a hard pull.

🟥Liquidity Theft

Liquidity theft occurs when token developers withdraw all tokens from the liquidity pool. Doing so removes all value injected into the currency by investors, bringing its price to zero. These “liquidity shots” often happen in DeFi environments.

🟥Limiting Sell Orders

Limiting sell orders is a subtle way for a malicious developer to scam investors. In this case, the developer codes the tokens so that they are the only party that can sell them. Developers then expect individual investors to purchase their new crypto using paired currencies. Paired currencies are two currencies paired for investment, one against the other. When there is enough positive price action, they abandon their position and leave a worthless token behind. The Squid Token scam is an example of such rugpull.

🟥Dumping

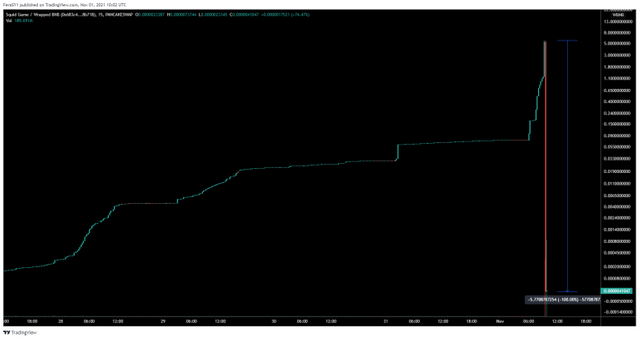

Dumping happens when developers quickly sell their own large supply of tokens. Doing so lowers the price of the coin and causes the remaining investors to hold the worthless tokens. “Dumping” usually occurs after heavy publicity on social media platforms. The resulting increase and sales are known as the Pump and Dump.

The dump is more of an ethical gray area than other DeFi rugpull scams. In general, it is not unethical for crypto developers to buy and sell their own currencies. When it comes to DeFi withdrawals, “ dumping ” is a question of how much and how fast a coin sells.

🟥Is Rugpull Illegal?

This will vary depending on the type. Rugpull is definitely unethical, but in some cases it may not be illegal either. Hard rugpull is illegal. Soft rugpull operations are unethical, but they are not always illegal either. For example, if a crypto project promises to donate funds but chooses to keep the money instead, it is unethical, but not illegal either. Either way, like most scams in the crypto industry, both types can be difficult to track down and prosecute.

🟥8 Ways to Avoid Rugpull

First of all, you should be able to examine the detailed data related to the project you will invest in. You can access liquidity pool, wallet distribution and many more details through blockchain browsers.

Unlocked liquidity is a serious risk. Such “new” projects should be approached with caution. One of the easiest ways to distinguish a fraudulent cryptocurrency from a legitimate cryptocurrency is to check if the currency is liquidity locked. When there is no lock in liquidity in the token supply, nothing can stop the project creators from escaping all liquidity. Liquidity is secured by time-bound smart contracts, which ideally last three to five years from the token's initial offering.

Lacking any external audit, blockchain-focused cybersecurity startups like Certik do the job.

Malicious code blocks found in smart contract codes, BAYC NFT collection has a code block that can increase the maximum supply. You won't be able to detect it with zero code knowledge, so examine code chunks used in similar exploits or wait for audit firms like Certik to approve the project.

Projects of unknown or anonymous entrepreneurs are extremely risky. Investors should consider the credibility of the people behind new crypto projects. Are the developers and supporters known in the crypto community? What is their track record?

The overall legitimacy of the project, the anonymous project developers can be red alert. While it is true that the world's original and largest cryptocurrency was developed by Satoshi Nakamoto , who has remained anonymous to this day , times are changing.

Limits on sell orders: A bad player can encode a token to restrict the selling ability of certain traders and not others. These sales restrictions are hallmarks of a fraudulent scheme. Because sales restrictions are embedded in the code, it can be difficult to determine if there is fraudulent activity. One way to test this is to buy a small amount of new tokens and then try to sell them immediately. If there are problems with unloading what has just been purchased, the project is likely to be a scam.

Price skyrocketing with limited token holders: For a new cryptocurrency, large fluctuations in price should be watched carefully. This is unfortunately true if the token has no locked liquidity. Significant price spikes in new DeFi cryptocurrencies are often signs of the "pump" before the "dump". Investors who are skeptical of a coin's price action can use a block explorer (e.g. etherscan if it's an Eth-based project) to check the number of cryptocurrency holders. Few holders make the token susceptible to price manipulation. Signs of a small group of token holders could also mean that a few whales may leave their positions, causing serious and immediate damage to the coin's value.

Suspicious high yield: If something sounds too good to be true, it's probably false. If the yield on a new coin looks suspiciously high, but it doesn't turn out to be a rugpull, it's likely a ponzi scheme. While not necessarily an indication of fraud when tokens offer triple-digit percent annual returns ( APY ), these high returns often mean equally high risk.