This is a good piece by Dean Baker on the savings rate.

https://cepr.net/issues-with-the-saving-rate-the-falloff-may-be-over-rated/

Since GDP and GDI have such an uncharacteristically large gap in recent years, we probably should be less confident in things like the reported savings rate, which relies on their accuracy.

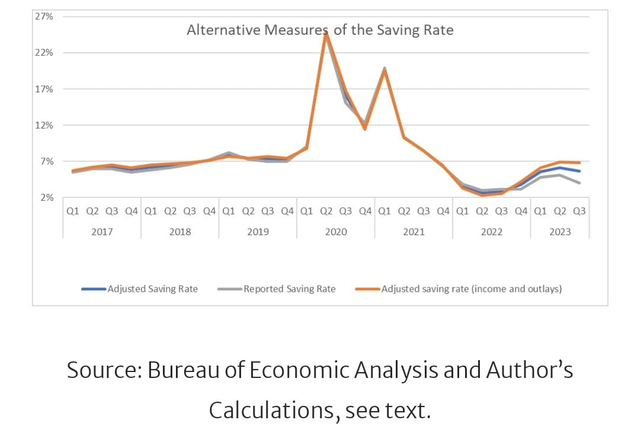

Here he calculated an adjusted savings rate that is based on the average between GDP and GDI (two adjustments- one just if the income side is adjusted and the other if both sides are adjusted). Since final values for both aren't available for several years, economists will average the two to get a potentially more accurate estimate.

Doing so, largely eliminates the recent drop in the savings rate. Of course, this whole endeavor is just a guess at the true values. But it is a useful thought exercise on how an out of the ordinary change in an economic metric may just be out of the ordinary measurement error. And thus just a statistical illusion.

It reminds me of how consumer sentiment has not be tracking the actual major economic indicators very well since 2020. It has been overly pessimistic compared to actual consumer behavior. This has made consumer sentiment not very good as a leading indicator of future consumer behavior. That in turn has made many people jump the gun forecasting a recession that has never come.

Or for another example, we have two employment metrics, the payroll survey and the household survey. They generally are pretty close to each other. But again in recent years they've had large differences. Economists prefer the payroll survey as the more accurate picture of job growth as it is much more comprehensive and robust. But laypeople don't understand the differences between the two, and think there is some conspiracy afoot to fake job growth.