Short line selection method that has to be studied

Short term investment refers to the investment behavior in two or three trading days or one or two weeks. Once the stock price falls below the buying price of the investor, the stock is shipped, and then other stocks are purchased. In short term operation, the short-term fluctuation and rising space of stock price are most concerned about short-term investment, while the fundamentals of earnings and performance are not very important.

Although the short-term operation of a quick profit, but the short-term operation requirements for higher level of investment, investors need to be responsive, and pay attention to the time to read the tape, tape method. If we do not have certain operational skills and experience, it is difficult to gain good profit by short line operation.

The difference between the short line, the middle line and the long line

The short line, the middle line and the long line are only a relative concept, and there is no specific criterion.

(1) short line

Generally speaking, two or three trading days or one or two weeks are the time intervals for short-term investor operation. Most short listed investors choose hot stocks and subject shares. When intervening, opportunities are adjusted according to the trend of large market and the activity of stocks. The short-term demand for returns is not high, usually when the profit is 3% to 5%, they will be shipped. In short term trading to investors, stock selection, technical analysis, operation skills and higher wagner.

(2) middle line

Middle line investors usually hold more than one month to half a year, and generally choose cyclical industries such as steel, non-ferrous metals and chemical stocks. The timing of intervention will generally choose the early stage of a cyclical industry recovery, while the profit is more than 30%. Middle line investment mainly examines the ability of investors to judge the direction of the medium term development of a certain industry or company.

(3) long line

Long term investment holdings are generally more than a year, many with benign or growth firms's stock, such as stocks of small plates, while the intervention points are in relatively low market, due to long-term investors is the pursuit of long-term gains, and do not care about the stock of short-term price, so the requirements of higher income. Long line investment tests the ability of investors to judge the future prospects of the listed companies.

Skill case

Short line technology is a very strong attack, high stability short line hype, as long as the appearance of standard specifications of the graphics. A profit of 10 - 30% in 2 to 5 days. And more use of the market, the success rate up to more than 90%, is the best choice for roasted. But be sure to master the skills.

Short line buy signal:

1, heavy volume pulled after shrinking Xipan, when representatives Xipan almost, low opened, small line signal.

After 2, a small low pulled sideways, to cross a few days, the main test of patience Xipan, common means, after sun massive, is an excellent opportunity for you to buy (sideways 5 days).

3, pulled sideways, then suddenly pulled up, tiaokongdikai, but to pull on the line, you can buy, the reliability is high; there are wonderful and different approaches but equally satisfactory results in Figure 1, tiaokongdikai pull line; the main ship never tiaokongdikai, unless you are out of your mind.

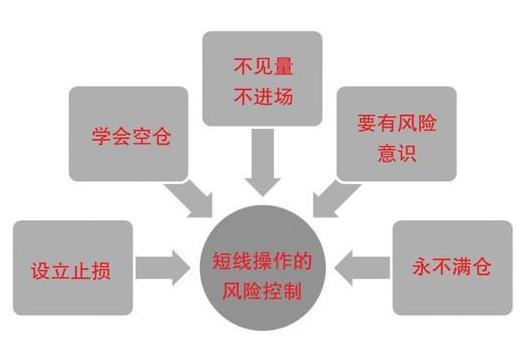

Risk control of short line operation

In general, the stock market is a process of avoiding risk, avoiding the risk at least not losing the loss, and it is the first step to succeed. Therefore, the short-term investors should be prepared to prevent the risk before entering the operation. Short line investors can operate on the following points in control of risk, as shown in Figure 1-5.

First, risk awareness should always be the first. Firstly, the short-term operation, as long as the stock price reached only profit is secured, not greedy, otherwise the instant profit will come to nothing. Secondly, investors should rationally decide the amount of investment according to their own financial resources. They must not be able to enter the stock market with gambling mentality. Let alone financing or illegal means to raise funds into the market, there are huge legal risks in these ways.

Second, a stop loss is set up. For short-term investors, it is necessary to learn to stop the loss and to set up a stop before buying the operation. Once it breaks, it should be broken out. The following describes several methods: first stop is the biggest loss, this is the easiest way to stop, when buying stocks floating loss rate reached a certain percentage when you stop, the percentage once laid down, can not easily change, to act decisively. This percentage point is based on its own risk preference, trading strategy and operation cycle. The second is the exit soon after buying sideways, the price in a certain range of sideways time to stop, stop this method is particularly suitable for buying stocks in the finishing sideways after use. Again is the unconditional exit, namely regardless of cost, or even to flesh out the stop. When the fundamental turning point of the stock has taken place, the short line investors should sell locally in order to preserve the fruits that have been preserved because of the deterioration of the fundamentals.

Congratulations @qc1995713! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Congratulations @qc1995713! You received a personal award!

Click here to view your Board