Stablecoins lose ground

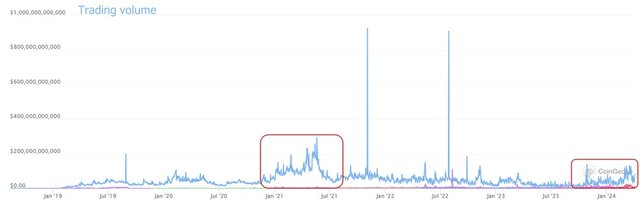

Stablecoins' share of the cryptocurrency market continues to shrink, hitting 5.8% in March. This is the lowest value since November 2021. They are also significantly lagging behind the previous bull run in terms of volume, gathering $1 trillion in February.

Image source: coingecko.com

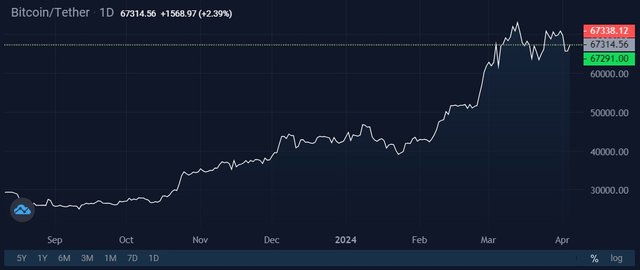

The first reason for the sector losing ground is the launch of spot Bitcoin ETFs in the United States. Traders from popular platforms received access to Bitcoin's volatility while bypassing the crypto exchanges.

Image source: StormGain Cryptocurrency Exchange

The base currency for settling transactions on crypto exchanges is generally stablecoins. For licensed brokers, it's usually fiat currency. In March, the volume of ETFs set a new record at $111 billion.

Image source: twitter.com/EricBalchunas

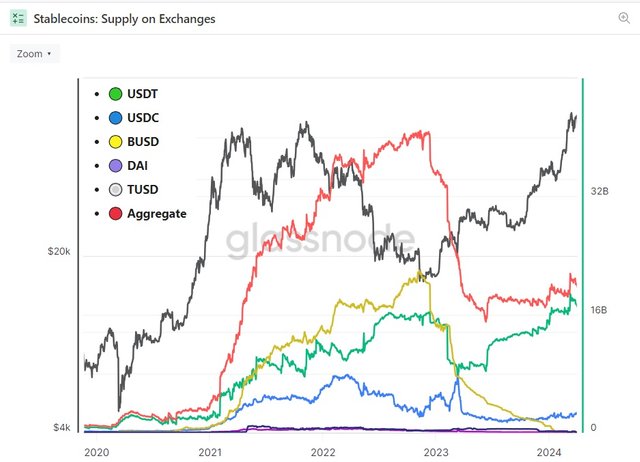

The second reason is the drop in trust in stablecoin issuers. In May 2022, the Terra project's UST, the third-largest stablecoin by capitalisation, collapsed. In February 2023, after receiving a pre-trial enforcement action, the issuer of BUSD decided not to mint any more of the token. The following month, USDC from Circle was on the verge of folding as a result of the collapse of the bank holdings its reserves in the United States.

The impact of these events on investor sentiment is clearly reflected by the volume of stablecoin supply on crypto exchanges (data on the Ethereum blockchain):

Image source: glassnode.com

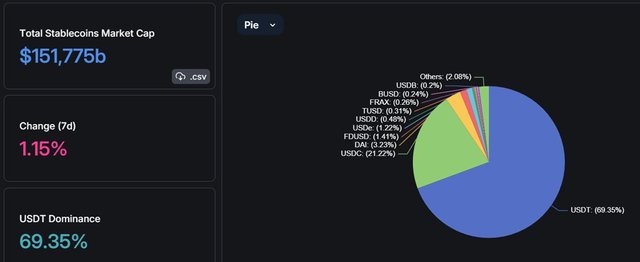

At the same time, USDT's share increased to 70%, and its capitalisation rose to $105 billion.

Image source: defillama.com

This significantly increases systemic risks since the community doesn't have reliable information about the banks they use or the quality of reserves. Tether's (non-audited) financial statements continue to list "other investments" and "collateralised loans" totalling $8.5 billion.

The company's balance sheets are so opaque that the Seychelles-headquartered crypto exchange OKX refused to work with USDT in the EU due to potential claims from regulators. As a result of the adoption of the MiCA law, other operators in Europe are likely to follow this example.

Some market participants call stablecoins an oxymoron because they aren't stable. Thanks to the appearance of investment products such as spot Bitcoin ETFs and the lack of strict regulatory control, the sector's share will likely continue to shrink.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)