How to break the viscous circle of Steem price development

One of the greatest blockchains...

If I look at Steem, I see a great blockchain, which offers potential for so many great things:

- Steem is one of the fastest blockchains out there.

- Transactions are free for the user (or at least appear to be free).

- Steem is very flexible, giving you the opportunity to do all different type of projects on it. I have built @nextcolony together with @oliverschmid, @bronkong, @jarunik, @holger80 and @platuro and I must say that it is really an incredible space to start your project, also because...

- ...Steem comes with a built in community, which allows you to grow your project quickly.

- Steem now even allows for ICOs and smart contracts to be run on sidechains.

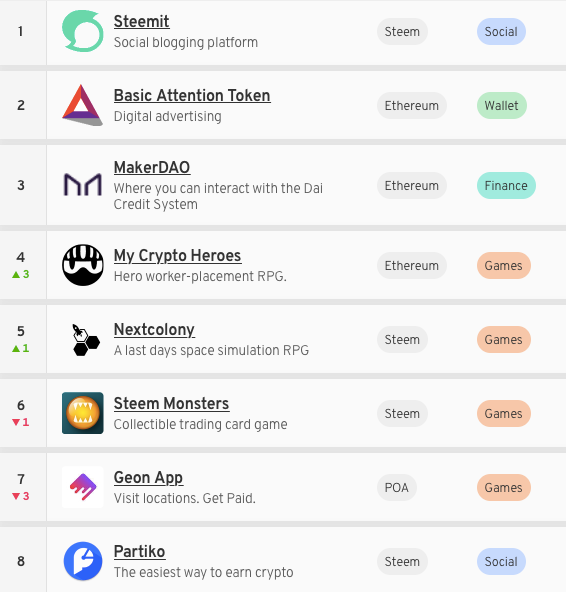

No wonder that half of the top 8 DApps out there are based on Steem and that Steem is a blockchain with one of the most - if not the most - daily transactions per day.

...but this is not reflected in the market cap of Steem

If you look at all this, one would expect the market cap of Steem to rank in the top 10 crypto-currencies out there - instead, we have continued to lose ground and now rank only 63rd in the list of the most valuable crypto-currencies. The price in bitcoin is currently near its all time low and even projects with highly questionable use-cases and value propositions rank much higher. How can that be?

The crypto currency Steem is not the same the same as the Steem blockchain

Whatever asset you value - being it a house, a luxury watch or a digital asset such as a crypto currency - the value always comes down to just two relevant factors: Supply and Demand. The price is where Supply and Demand balance.

We struggle to generate new demand for Steem...

On the demand side, you have investors. Investors will buy Steem because they think that it is profitable to hold it - either because they consider it likely that they can sell it for a higher price later on, or because they can get some other return by holding it. The problem is that it is difficult to value crypto currencies and the investors which are into Steem for a longer period already are mostly depressed given that the price continues to go down relative to bitcoin. The alternative - buying Steem for the income you can generate from it - is most likely attracting some other investors. However, with the Steem price going down, this does not improve the economics of these guys as they will earn their returns (through curation, vote selling or self voting) in Steem - and lose money on their initial investment. So this type of investors is unlikely to be attracted as the price goes down - and the investor who have already invested for this reason lose money and might thus revise their investment decision.

Secondly, demand for Steem might come from users if there is a utility in owning Steem. In the case of Steem the main utility you get from owning Steem Power is resource credits, which are needed to do transactions on the blockchain. However, given that transactions are so cheap on the Steem blockchain, you do not need many resource credits. Most users will tend to have them in excess as they do regenerate over time. Another utility is the possibility to do upvotes. But this is a weak argument as investing money to help others benefit is not what most people do - unfortunately. If you do this to earn money however, then we are back to the investor case which I covered above already.

The third alternative would be if ICOs on the Steem blockchain became an increasing issue. If that would happen, investor who intend to buy a specific token would need to invest in Steem or SBD first in order to being able to participate in the ICO. This additional demand was one of the main reasons behind the strong ETH price increase during 2017. While there is an opportunity now to do ICOs on Steem thanks to steem-engine, this is still in its infancy and it is uncertain if it will ever become a big issue.

In any case, in order for the price to increase at a given supply we would need an increasing demand - but that is not visible where that should come from.

...but have constant flow of supply

So let's take a look at the supply side.

For most crypto currencies, supply is coming mainly from the investors, which have bought during the ICO, miners and the originators of the coin. In the case of Steem we have several sources of supply:

Steemit Inc., which is the largest stake holder in Steem, continues to sell down its stake as they need to cover their costs. This is somewhat different to other crypto currencies as many of the Etherium based coin initiators own ETH from their ICO and - due to better liquidity - they tend to sell these down first. The problem with a seller like Steemit Inc. is that they are very price insensitive. Actually, rather the opposite is the case as they incur costs mainly in USD, which means that with a falling price they need to sell more Steem in order to cover their costs. This leads to a viscous circle which is hard to break.

Additionally, a lot of Steem's inflation is given away to very weak hands, which sell their newly acquired STEEM immediately. This includes the vote sellers which try to mitigate their price risk by selling to USD immediately. But also a lot of the smaller content producers, which write on Steem to generate income, sell down immediately. These guys are also price insensitive and sell whatever they earn.

Unfortunately, Steem has one of the highest inflation rates of all crytocurrencies - at the moment it is as high as 8.2% p.a. - which means that the steady supply from this source is quite high.

Overall, this leads to the situation that Steem remains in a viscous circle, which is hard to break. Of course, you can do marketing, develop great products on the blockchain, but to be realistic, even if you start your own business on Steem you will not need to own any Steem to start.

How to break the vicious circle?

So in my view there are only two things you can do which would have a significant impact on the price of Steem:

Steemit Inc. would have to further reduce its costs and / or develop alternative income sources in order to reduce the amount they need to sell regularly. This is already on the way but clearly has limits.

Reduce the inflation - it helps nobody. Printing money does not add any value - not in Fiat currencies and for sure not for crypto currencies.

Here is my proposal:

Reduce the inflation by 4 percentage points to 4.2% - this would almost half the additional supply from inflation. I am sure that we would see a significant increase in the Steem price - my best guess would be that the price could double. This means that the additional value of Steem, which is printed in USD terms, would not even change - this is important to keep the witnesses profitable as they ensure the functionality of the blockchain.

Additionally, I would reduce the share of value which goes to the content producers and allocate this to the curators. My proposal would be to change the share between content producers and curators from currently 75-25 to at least 50-50. Counterintuitively, I think that this would actually increase the amount content producers would be able to earn:

Currently, Steem Power holders can earn the biggest return on their investment if they sell their votes. If a vote is sold, however, in most cases you will lose a large share of your curation reward. Given that this amount is relatively small, people do not care too much about this component however.

If we would increase the curation share to at least 50%, people would in my view stop ignoring this portion of their potential income - and in most cases it would become more profitable to curate than to sell your vote.

If that would happen, the share of votes which are sold, which are currently lost for the content producers as they have to pay for them, would decrease. Like this the share of earnings that belongs to the content producers might actually increase. In any case, it would be positive for the quality of the trending page, which might potentially lead also to an inflow of new users.

What do you think?

All the best and if you are a NextColony player - stayed tuned for the battles which will start tonight at 20:00 UCT.

Tim

stinc already cut 80% of their monthly costs...

Inflation is not a problem. We just don't have ANY new big investors who are willing to hodl for a few years. We can only try to analyze and minimize the reasons why that is.

I want steem to hit rock bottom at 10-5 cents so I can buy a ton, but I am quite sure this is never going to happen.

Another source of inflation is how Steem Dollars (SBD) are implemented and pegged to the value of 1 USD, which leads to additional STEEM printed (inflation) especially in a bear market, another vicious circle which we should need to break, by lowering the SBD print rate, convert to STEEM and the 10% market cap rule for example.

You are right, I did that a lot myself when SBD was trading well below 1 USD. At the moment it is not much of a deal, but if the price goes down again it could again become one. Lower print rate would on the other hand increase the printing of Steem, if inflation is not adjusted, right?

Lowering or stopping SBD creation, would immediately create the equivalent amount of STEEM (SP) which would result in the mentioned 8.x% yearly decreasing inflation, whereas SBD is more like debt, it initially lowers the STEEM inflation, but when SBD and STEEM enters a bear market, "convert to STEEM" could get out of control. SBD is good for bull markets but catastrophic for bear markets, and adds a lot of complexity to Steem/Steemit.

Great analysis. You break it down in a simple way and also offer good suggestions of how to solve the problems. I think Steem’s dependency on Steemit.inc has and is one of the biggest short falls. Broken promises and really bad communication, and now selling off a lot of their stake and lowering the price.

Hopefully soon Steem’s price is going to be dependent on many other new good platforms and projects and that is what will offer it stability. It might not be a social platform but something complete different - only time will tell! But we should not forget, steem usually lags, but when Steem gets momentum upwards it can go really fast.

At the moment I do not see the social media platform as the main use for Steem and the chain is capable of doing many more things. But it is a very cool feature because it helps to build a community.

You’re right that is definitely a good thing!

If curation becomes more effective a larger portion goes to self votes. Self-votes are prevalent. Many accounts have 20% and more self-votes.

--> more uninteresting content, fewer users. Nobody cares about a "wale" upvoting a picture of his own face twice a day.

As emittent of a dApp like NextColony wouldn't you say that the customer and his experience is everything that matters for the success of a App? I mean a App is defined by the customer experience.

Why should we have more self-votes then? Self votes are already today the most profitable way to earn with your own votes - but still people sell to upvote-bots which are less profitable.

not quantitative more self votes but a higher relative distribution of the reward pool to self-votes.

My concern would be: effective (self-)votes mean more income inequality since the initial wealth distribution is already a power-law or some extreme distribution and after n-rounds of voting it would be even more extreme. Selling votes is even more extreme right, but isn't there any way to overhaul the whole distribution dynamics?

Definitely difficult. But I am convinced that lower inflation would in any case be good for everybody...

We were relatively close to these levels in late 2018. I have bought quite a bit back then and it has been a great investment so far - however, I also bought some more bitcoin and that has been the better investment.

I think it is too easy to just wait for the big investors to show up - we should do something to actively attract those.

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

Thank you so much for participating in the Partiko Delegation Plan Round 1! We really appreciate your support! As part of the delegation benefits, we just gave you a 3.00% upvote! Together, let’s change the world!

Congratulations @rondras! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!