Bitcoin

What is Bitcoin?

What is Bitcoin? Well Bitcoin is a the currency of the new age. Bitcoin is a cryptocurrency and worldwide payment system. It is the first decentralized digital currency, as the system works without a central bank or single administrator. The network of bitcoin is fully transparent and its transactions take place between users directly, without an intermediary.

Bitcoins are created as a reward for a process known as mining. They can be exchanged for other currencies, products, and services and etc. It is the currency of the new age.

Bitcoin’s History

source

On 18 August 2008, the domain name "bitcoin.org" was register. Nakamoto implemented the bitcoin software as open source code and released it in January 2009 on SourceForge. The identity of Nakamoto still remains unknown. In January 2009, the bitcoin network came into existence after Satoshi Nakamoto mined the first ever block on the chain, known as the genesis block.

Hal Finney, who created the first reusable proof-of-work system in 2004 was the receiver of the first Bitcoin transaction. Finney downloaded the bitcoin software the day it was released. The other first supporters were Wei Dai, the creator of bitcoin predecessor b-money, and Nick Szabo, the creator of bitcoin predecessor bit gold. In the early days, Nakamoto is estimated to have mined about 1 million bitcoins.

In 2010, Nakamoto handed the network alert key and control of the Bitcoin Core code repository over to Gavin Andresen, who is now the lead developer at the Bitcoin Foundation. Nakamoto partially disappeared from any involvement in bitcoin.

How Bitcoin Works!

source

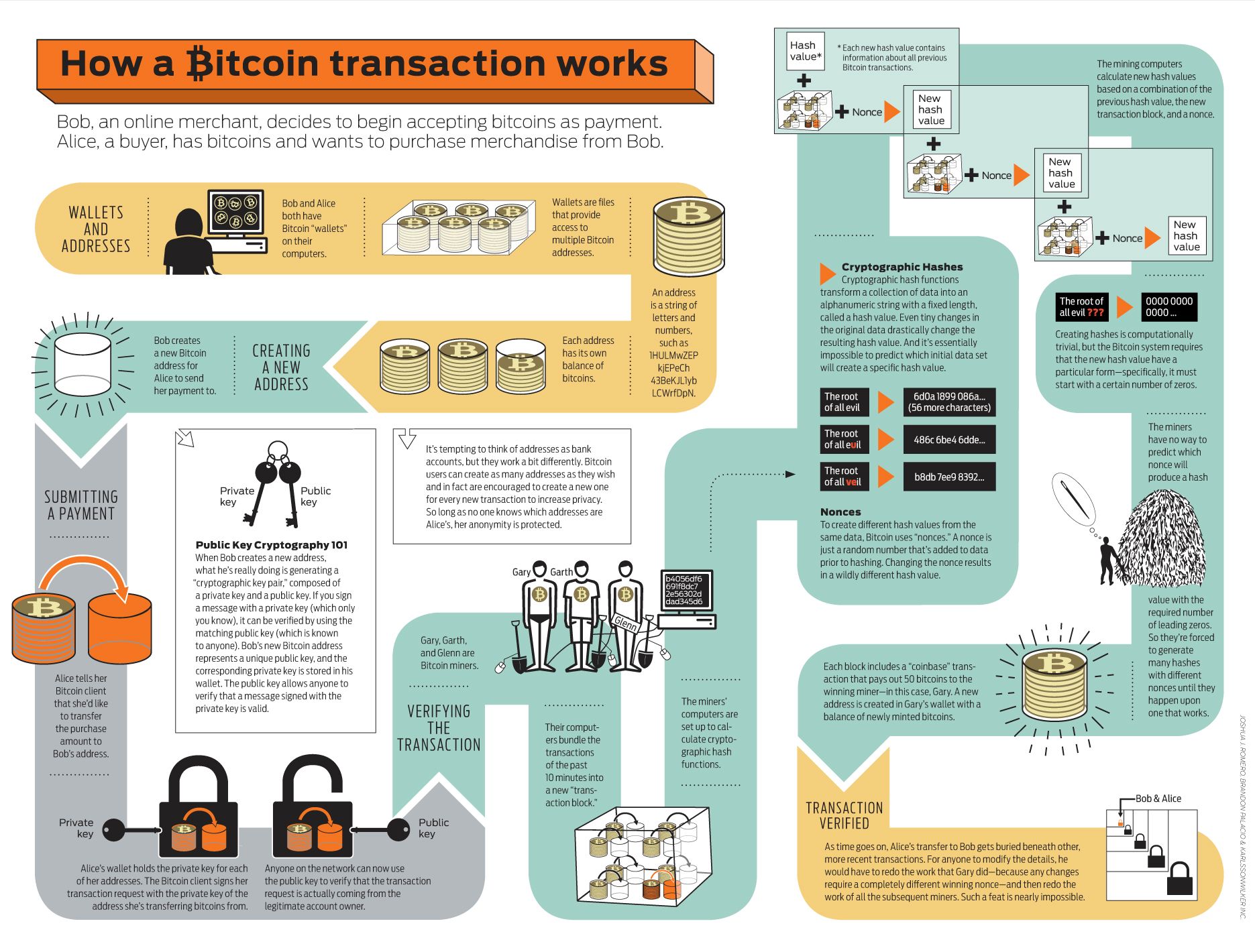

Bitcoin record its transaction through a public ledger which is known as “Blockchain”. The blockchain is a distributed database – to achieve independent verification of the chain of ownership of any and every bitcoin amount, each network node stores its own copy of the blockchain.

Transactions are defined using a Forth-like scripting language. Transactions consist of one or more inputs and one or more outputs. When a user sends bitcoins, the user designates each address and the amount of bitcoin being sent to that address in an output. As bitcoin transactions can have multiple outputs, users can send bitcoins to multiple recipients in their each transaction.

Paying a transaction fee is optional. Miners can choose which transactions to process, and they are incentivised to prioritize those that pay higher fees. Miners choose transactions based on the fee that is paid on their storage size, not the absolute amount of money paid as a fee. The size of transactions is dependent on the number of inputs used to create the transaction, and the number of outputs.

source

In the blockchain, bitcoins are registered to bitcoin addresses. Creating a bitcoin address is really simple, it is nothing more than picking a random valid private key and computing the comparable bitcoin address. The vast number of valid private keys makes it unfeasible that brute force could be used for that. To be able to spend the bitcoins, the owner must know the private key and should digitally sign the specific transaction. If the private key is lost, the bitcoin network will not recognize any other evidence of ownership, the coins are then unusable, and effectively lost.

Bitcoin's inventor Nakamoto set a monetary policy that there would always be only 21 million bitcoins in total. Their numbers are being released roughly every ten minutes and the rate at which they are generated would drop by half every four years until all were in circulation.

Bitcoin is artificial, meaning that funds are not tied to real-world entities but rather bitcoin addresses. Owners of bitcoin addresses are not explicitly identified, but all transactions on the blockchain are public.

Bitcoin’s Economy

source

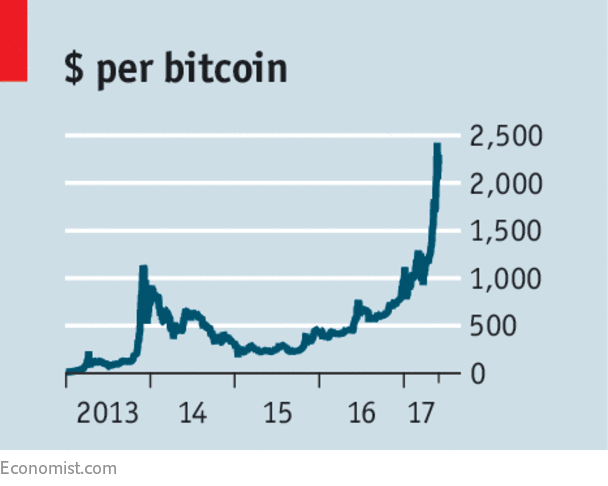

Hard to earn, limited in supply & easy to verify are the three useful qualities of Bitcoins as a currency. According to research produced by Cambridge University, there were between 2.9 million and 5.8 million unique users using a cryptocurrency wallet, as of 2017, most of them using bitcoin.User numbers of Bitcoin has grown surprisingly since 2013, when there were 300,000 users whereas now it has 1.3 million users. In 2015, the number of merchants accepting bitcoin exceeded 100,000. Firms that accepted payments in bitcoin as of December 2014 included PayPal, Microsoft, Dell, and Newegg.

Merchants who accept Bitcoin usually use the services of bitcoin payment service providers(Such as Bitpay/Coinbase). When a customer pays in bitcoin, the payment service provider accepts the bitcoin on behalf of the merchant, converts it to the local currency of the merchant's place, and then sends the obtained amount to merchant's bank account after charging a fee for the service.

source

During the 2012–2013 Cypriot financial crisis, bitcoin purchases in Cyprus rose due to fears that savings accounts would be confiscated or taxed.

The Winklevoss twins have invested into bitcoins. The Washington Post claimed that they owned about 1% of all the bitcoins in existence at the time of 2013.

Other methods of investment are bitcoin funds. The first regulated bitcoin fund was established in Jersey in July 2014 and approved by the Jersey Financial Services Commission. Forbes in favor of investing in Bitcoin started publishing arguments on December of 2015.Forbes named bitcoin as the best investment of 2013. In 2015, bitcoin topped Bloomberg's currency tables.

Bitcoin’s Legal Status & Regulations

source

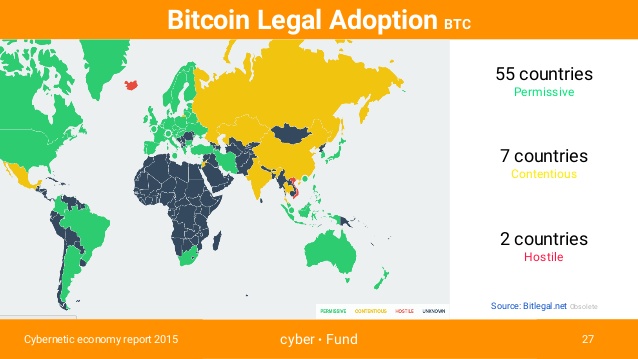

Because of Bitcoin's decentralized nature, nation or states cannot shut down the network nor can it alter its technical rules. However, the use of bitcoin can be criminalized, and be shuttingg down its exchanges and the peer-to-peer economy in a given country would constitute a "de facto ban". The legal status of bitcoin may vary from country to country and is still undefined or being changed in many of them. While some countries have absolutely allowed its use and trade, some others have banned or restricted it. Regulations and bans that apply to bitcoin probably extends to similar cryptocurrency systems.

Electricity Consumption of Bitcoin

source

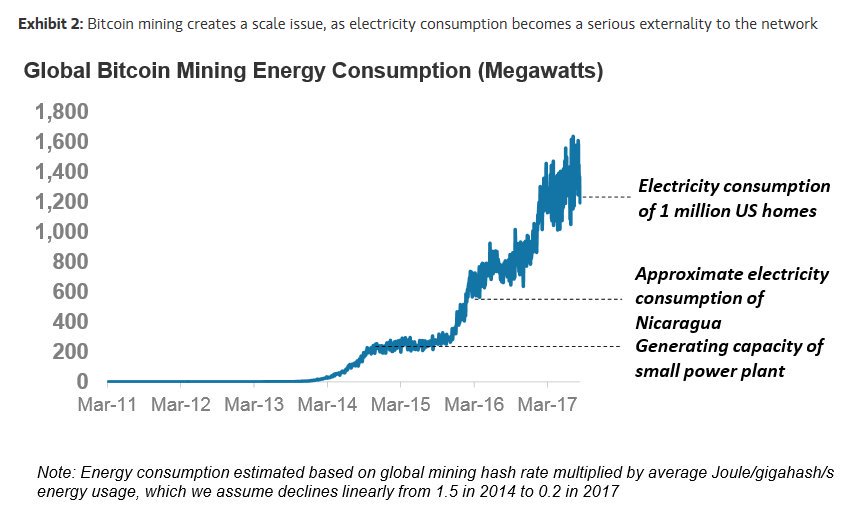

Bitcoin has been criticized a lot of times for the amounts of electricity consumed by mining. As of 2015, The Economist estimated that even if all miners used modern facilities, the combined electricity consumption would be 166.7 megawatts (1.46 terawatt-hours per year). It was estimated that the Bitcoin mining consume between 1-4 gigawatts of electricity globally at the end of 2017. Politico noted that the banking sector today consumes about 6% of total global power, and even if bitcoin's consumption levels increased 100 fold from today's levels, bitcoin's consumption would still only amount to about 2% of global power consumption. To lower the costs, bitcoin miners have set up in places like Iceland where geothermal energy is cheap and cooling Arctic air is free. It is known that Bitcoin miner uses hydroelectric power in Quebec, Tibet, Austria & Washington(state), in order to reduce its electricity costs. Miners are attracted to suppliers such as Hydro Quebec that have energy surpluses. It has been confirmed by a study of the University of Cambridge, that maximum of bitcoin mining is done in China, as electricity is subsidized by the government in China.

Added to my follow list. Keep up the good work and what do you think of the current market?

Thank you for your comment. I will try to. And I will write a post about the current market. So, stay connected.

Congratulations @marahim! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

To support your work, I also upvoted your post!

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPHello, crypto community! In my pursuit of finding a reliable platform for trading Bitcoin, I stumbled upon https://bitcoindecode.com/. They boast an array of features, including AI-powered trading tools. However, I'm someone who values firsthand experiences. Has anyone here dabbled in this platform? I'm curious to know if it lives up to its promises. Your opinions matter!