STEP 5 OF 10: BUILDING YOUR CREDIT RATING

Good afternoon fellow steemians and friends;

In today's installment we will be covering why keeping a balance on your cards can actually help your credit rating. Lets get started below shall we...

Yes, you heard me right, in some instances it is actually a good thing to keep a small balance on your credit cards. This is called "Utilization", and it's a good thing. In the world of credit your creditors do not mind you borrowing from them. In fact, they encourage it, and they encourage you to do so often. It is afterall, how they make their money. If you use your card, but do not always pay it off in full every month(especially if you bought something special that you normally wouldn't buy), don't panic. Creditors know this, in fact, they count on it...again, it is how they make their money. The main thing is that you always..and i mean always, make your monthly payment on time. that is the most important thing about credit, they may not care that you don't pay the whole balance every month, but they do expect some payment every month that you hold a balance.

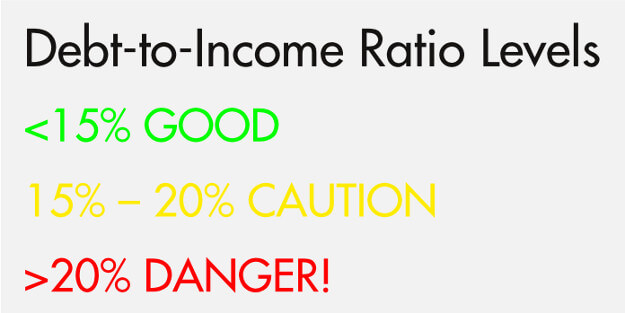

So how do you manage keeping a running balance without damaging your credit rating? Well here is an example: credit card limit 10000.00 you would want to keep your running balance for that card under 1000.00, and would be better if you kept it under 700.00. I know, you might even be capable of paying it off and that's a good thing too... ,but remember, we're trying to grow your credit worthiness. Creditors and rating houses like to see that you can manage your debt, and that you can do so while you use it regularly. even if you only make minimal small purchases each month, you don't want to pay the balance off completely. You will grow your credit rating faster if you carry between a 2-7% of total available credit from month to month. You never want to carry more than 15%, higher than that can actually hurt your score. Always remember that that is between 2-7% across ALL of your available credit. Say you have 5 credit cards, and between them your total available credit limits are 30,000. You would want to keep your revolving debt at 650.00-2300.00 a month roughly... slightly below 7% and around 2% on the low side..

Simply knowing how to manipulate your credit to debt ratio will greatly help you in growing your credit score. If you can manage to utilize all of these ten tools for growing your credit you will always have great credit. Hardships aside, there really isn't an excuse not to have a great credit rating.

As always, if you like the content, give it an upvote. I welcome your questions, as we all can find the path to a better mousetrap together, if you like, you are also welcome to follow me.

DISCLAIMER: I DO NOT OWN THE IMAGES SHOWN, THEY ARE TAKEN FROM PUBLIC STOCK AROUND THE WEB

.jpg)

.png)