STEP 7 OF 10 : BUILDING YOUR CREDIT SCORE

Good morning fellow steemians and friends. in todays installment of the building your credit score we shall cover managing your credit/debt ratio. lets get started below shall we.

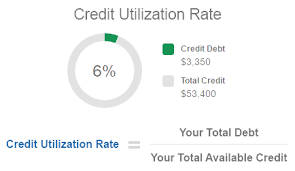

What is a credit to debt ratio, and why is it important to manage it? Well, a credit to debt ratio is simply the amount of debt you carry on a line of credit extended to you. Managing the level of debt is important because it shows a lender your ability to utilize credit effectively. The credit to debt ratio is an effective tool you can use to grow your credit. Credit reporting agencies use the credit to debt ratio to determine as a factor of your creditworthiness. Having too high of a debt to credit impacts your score negatively. While having zero debt to credit can also affect your credit negatively as well. So you should always have some amount of debt for the purpose of growing your credit score.

The prefferred credit to debt ratio for growing your credit score is between 2-15%. I personally preffer to keep mine between 5-7%. An example would be, say if i had $10k in available credit my debt would never be more than $500-700. which for me would be between the 5-7%. I have learned over the years that between 5-9% is the "sweet spot" in which lenders view as optimal utilization of credit and i have recieved the largest score increases when my credit to debt ratio falls between those lines.

Remember, when dealing with your credit, you should always try and look at it from a lenders perspective. By that i mean you should look at your finances and credit balances like a lender would. The reason for that is because it will help you think of your overall credit picture. Would you, as a lender based solely on your credit picture take a chance on extending you more credit?? That is how you should always look at your credit score... does my credit score reflect to a lender that i am a safe credit risk? If you view your credit score in this manner it will help you grow your credit score, and will make you more credit worthy in the process.

That is all for this installment, more to come soon. Thank you for taking the time to read this. If you like the content, and think others will enjoy it, or find it useful, feel free to upvote it. If you like my content feel free to follow... thank you, and have a great day!!

.png)

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by misterd21 from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, and someguy123. The goal is to help Steemit grow by supporting Minnows and creating a social network. Please find us in the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you like what we're doing please upvote this comment so we can continue to build the community account that's supporting all members.