Economy:Basic concepts and Monetary Policy.

ECONOMY:Economy literally means household (eXo) and manage (no my). It is a Greek term.

Economy means careful management of available resources. Basically there are three types of economic funds in the WORLD.

1.Capitalist economy: In which modes of production are in the hands of private sector eg:USA

2: Socialist economy: In which modes of production are controlled by the government for example China

Mixed economy:In which both public and private sector coexist.

Few technical terms :

Deflation :Decrease or fall in the prices and therefore fall in employment.

.jpg)

.jpg)

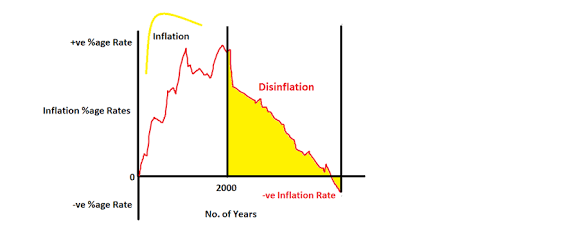

Disinflation: Fall in prices but without causing unemployment. .png)

Stagflation: Prices and wage rise but people cannot find jobs and companies cannot find new customers. RBI does not want stagflation to occur. .jpg)

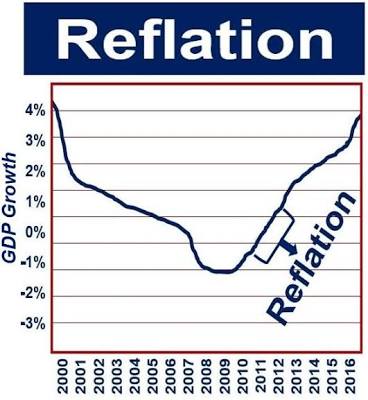

Reflation: Policy to stop the fall in price levels but without causing rise in price levels ie: inflation .jpg)

Inflation: increase in prices and wages. .jpg)

.jpg)

MONETARY POLICY

Monetary policy is made by the central bank of the country (RBI in case of India) to control money supply in the economy( LIQUIDITY) and thereby to fight both inflation and DEFLATION. RBI implements monetary policy using certain TOOLS, these tools are of two types 1. Quantitative tools

- Qualitative Tools

Quantitative tools control the money supply.

Money supply is called liquidity.

RBI controls demand, RBI reduces demand in inflation,

RBI decrease the demand but decreasing the money supply.

CPI = consumer price index

WPI= wholesale price index

inflation is equal to CP plus minus 2%

Policy ratio is equal to 4%

INFLATION is equal to 2% to 6%

NOTE:

MARKET works on the concept of supply and DEMAND, any mismatch between these two will result in inflation and deflation. Inflation is increase in PRICES, because supply is less and demand is MORE. To control inflation either we can increase supply or can reduce demand by decreasing liquidity.

Supply side is controlled by government while demand side is controlled by RBI ie: The Central Bank.

To control inflation RBI reduces money supply in the system this is called as tight money policy or dear money policy.

To control deflation) decrease in prices) RBI increases money supply in the system this is known as easy money policy or cheap money policy. To perform all these things RBI uses monetary policy INSTRUMENTS.

QUANTITATIVE TOOLS

This includes :

Reserve ratio) CRR and SLR)

Open market operations (OMO)

RATES)(repo rate) (reverse repo RATE) (bank RATE) (MSF) (LAF= liquidity adjustment facility)

RR + RRR =LAF

QUALITATIVE TOOLS

It includes:

Mariginal requirement /loan to value ratio

Consumer credit control

Rationing

Moral SUASION

Direct Action

MSF =Marginal standing Facility

Quantitative tools are also known as General or indirect tools because these tools impact the money supply in the modern whole system.

Qualitative tools are also known as selective or direct tools, because they are used to control inflation and deflation in the specific sectors.

They do not impact the whole system.

Definitions

Reserve Ratio

CRR: Cash Reserve Ratio :4%- all banks have to keep this much cash in reserve with RBI, they cannot use it for giving loans, they do not earn any profit from CRR.

SLR :20%- Statutory Liquidity Reserve: All banks have to keep this much In cash in gold, government securities, RBI approved securities with them.

There is some profit earned by bank banks on SLR.

CRR and SLR are counted on NDTL (net demand and time LIABILITIES)

Demand liabilities includes current ACCOUNT, savings ACCOUNT, demand Drafts etc.

The total demand liabilities of all banks is rupees 11800 billion. Yime liabilities of a bank includes fixed deposits, current deposits, cash certificates, staff security deposits etc. The total time liabilities of all banks is approximately Rs 92000 billion.

NOTE

Market works on the concept of supply and demand, any mismatch between these two results in inflation and deflation.!

Thanks

.jpg)

.jpg)

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by dr qaisar from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.