Is It Time To Buy??? - Part 16

Over the weekend, COVID-19 cases rose in major centers around the world but at a slower pace than in recent weeks. In New York, which has over 130,000 cases, Governor Cuomo said that cases were starting to plateau. The news was enough to send all the US indices higher by more than 7%. This is the news the Markets were waiting for, when will things start getting better, so they can start forecasting into the future company revenues and profits the next several quarters into 2022.

But I think the pain is just getting started as mid-April kicks off earnings season. What we are going to witness is many, many, many companies cutting dividends, halt their buyback programs, announcing downward and dismal guidance and/or even pulling their forecast of the table all together.

The other day I wrote a post about Bank of America and their Chief Executive Officer Brian Moynihan felt it was a health crisis, more so than an economic crisis. But I think Dan Niles, a founding partner of Alpha One Capital Partners, an investment management firm serving institutional and high net-worth investors, puts it best that the Markets can fall another 30%.

“If you go back and look at history, there are nine times that the market has sold off about 30% or so since the 1920s, so it’s pretty normal,” he said. “You get one of these every 10 years or so and if you look at every one of them, you always get these bear market rallies.”

Pointing to the most salient example in the Great Depression, Niles highlights the average gain over those so-called bear market rallies totaled 24%, compared to the drops that averaged 33% on what ended up being an eventual 86% top-to-bottom collapse.

“So these rallies kept sucking investors back in, you know, in the sense that you thought it was over and then you got worked over,” he said.

OK, OK, lets take the statistics out the equation and lets get straight technical. 3 out of 4 major US indices have broken their there monthly uptrend line data back to the Great Recession. The Dow Jones Industrial Average,

Standard and Poor’s 500

and the Russell 2000

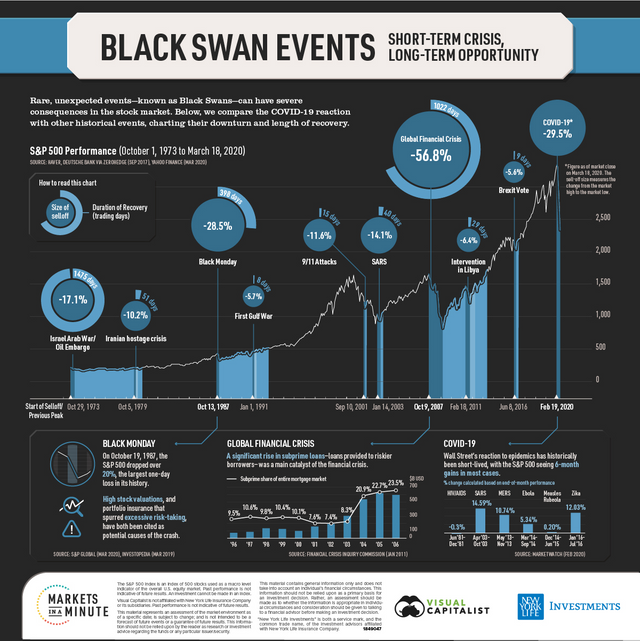

have all breached their monthly uptrend line. So is it just a matter of time before we see the Nasdaq do the same? Well based on Black Swan Events, it's just a matter of time as recessions and depressions don't last a couple of months.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advice. Do your own research before making investment decisions.

Hi! Did you know that steemit.com is now censoring users and posts based on their opinions?

All the posts of these users are gone!

https://github.com/steemit/condenser/commit/3394af78127bdd8d037c2d49983b7b9491397296

Here's a list of some banned users:

'roelandp', 'blocktrades', 'anyx', 'ausbitbank', 'gtg', 'themarkymark', 'lukestokes.mhth', 'netuoso', 'innerhive'See anyone you recognize? There could be more, they also have a remote IP ban list.

Will you be censored next?