My Top Investment - Naspers (NPSNY)

My Top Investment - Naspers (NPSNY)

I'm not going to beat around to bush. If you don't own a stake in Naspers, it's probably because you never heard of it.

This is the layman's summary overview:

Naspers is Africa's largest company piggybacking on China's largest company - Tencent. Yes, Tencent, the super internet app company (WeChat) and world's largest gaming company. Naspers was an original investor, and today still continues to own 31% of Tencent. That's key.

Even today, Naspers effectively acts as a proxy investment into Tencent itself and trades accordingly.

But ironically, Tencent has grown so large that the 31% stake of Tencent that Naspers owns is now worth more than Naspers itself.

The beautiful problem that every CEO would kill for.

So what gives?

What happened is that Naspers has outgrown its domestic market. Institutional owners (read fund managers) are restricted in terms of how much of a single company they can own in order to meet diversification criteria. As such, they are constantly forced to liquidate portions of their holdings in Naspers as it continues to grow because the rest of the South African market simply isn't growing fast enough. In other words, funds have capped out in terms of how much Naspers they can own.

Likewise, retail investors have often never even heard of this company. Because most mom and pop investors have turned into fund-holding sheep (who also only tend to invest domestically), retail investors simply cant provide enough demand to keep up with the company's underlying value growth. All of this forces Naspers to trade well below its true value - an outrage considering its technically one of the largest companies in the world.

The cherry on top.

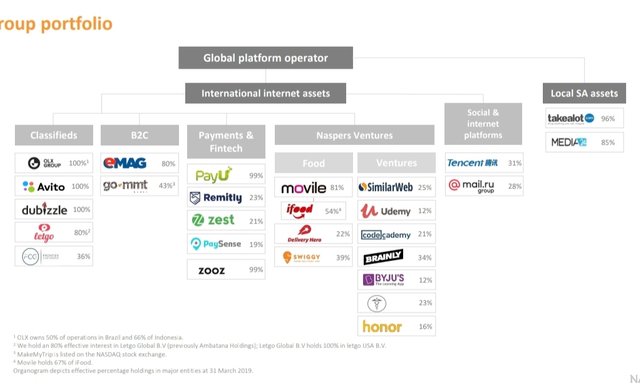

If Naspers was solely a holding company just for Tencent, this would be justification alone for owning it. Yet it's actually far more. Using its wealth, the former media company has transformed into a venture capital holding company with a portfolio spanning across the developing world in search of an encore

of its largest success.

Naspers now owns an ever-growing portfolio of rapidly developing companies poised to take significant market share in promising industries and geographies.

The company is globally one of the largest in online classifieds and food delivery as well as in investment into the budding market of India.

The catalyst

It would suck if the story ended here, where the shares just continue to stay suppressed.

But this is a problem with a very addressable solution.

After many years of debate, management has decided to spin off most of its assets into the European markets. Come this September, owners of Naspers should receive a spinoff dividend of a new company which when listed will become the largest in Europe.

So keep an eye out for Naspers.

- This is one of the world's largest companies.

- It continues to expand a diversifying growth portfolio.

- It has a lot of cash on hand.

- It trades at a significant discount to its underlying market value.

Personally, I will continue to be buying this company until it spins off its holdings.

Posted using Partiko Android