Bitcoin Is Not Money, It Is A Technology Hence Subject To the S Curve

The mistake people make when looking at Bitcoin is to think it is money. It is not. Bitcoin is a technology and, as such, it is subject to a different set of criteria for growth than the usual metrics people use.

Financial analysts all seem to use the same barometers when valuing something. When I watch the investment programs, I laugh at those who try to use their traditional valuation analysis for major tech stock. It simply does not work. I recall watching one guy blast Tesla or some other company for being over valued and in a bubble when the guy admits he missed NFLX and thought AMZN was a over priced at $400. Using a P/E of 15 as the level for these companies simply does not work.

Getting back to Bitcoin, the fact that it is a technology puts it under the laws of IT. This puts it on the technological S Curve that all technologies (that succeed) follow. By applying this idea, we see that Bitcoin is not in a bubble. To the contrary, it my placement is correct, we are just at the beginning stages of a huge boom.

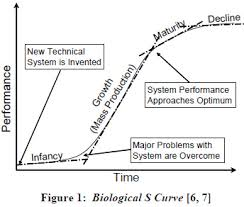

Here is a basic outline of the S Curve....other labels can be applied on the chart but the basic idea is there.

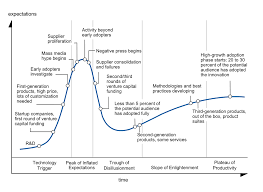

And another.

And one more.

I think you get the point. If you view Bitcoin as a technology or, at worst, a technological product, then you see where it is on the S Curve. This technology is at the very early stages. I wonder if people who think this is in a bubble thought the same about VCRs circa 1984. At that time, the video rental market was just starting to emerge. I believe the same is true for Bitcoin.

Are there technological challenges to overcome? Of course. However, isnt that what one of the charts shows. My point is that it is to be expected. We live in a world that is changing with technology at the core of that change. It is time people start to look at things from a different perspective to understand what is going on.

Let us look at Bitcoin if it were a technological product. Here is a chart of the S Curve as it pertains to that.

Please bear in mind this chart, nor any of them, are to scale. They denote the general outline of the cycle.

So where is Bitcoin at this point. In my mind, it is starting to get near the bottom of the downhill curve. The Mt Gox situation a few years back really brought out the negative publicity and was one event that could have sunk the entire concept. Fortunately it did not. Over the next couple of years, we will see that number of people owning BTC growing as the instutions start to get involved in it. Still, I would say we are a long way from the 5% total that is shows on this chart.

People like to put absurd targets on Bitcoin. Yet are they really so absurd? When you understand the technological curve and the laws it operates under, you realize none of this is outrageous. Technology does not experience linear growth but, rather, exponential. It is this type of growth in processing performance which allowed computing to advance from primitive 25 years ago to what we have now. The same is true for smartphones. As the technology improves (SegWit, lightening, smart contracts, atomic swaps), the implementation rates also improve. This is how technology works.

So does that mean Bitcoin is off to the moon? Perhaps...perhaps not. We are still dealing with a market that is subject to the same greed and fear motives of every other market. That said, in the long term, I believe the technology will explode. Cyrptocurrencies are here to stay no matter what you read about in the MSM. And, just like the Internet, the regulators are not going to be able to control this medium (the Internet ended up being taken over by the Silos-FB, Google, Amazon).

The best way to think about technology is to think like water. Technology, if desired and useful, will find a way around the governmental system. While one country might be able to stop the progress, technology simply finds a way around that dam. Outlaw it in China and it moves to Hong Kong or Korea. This is something we saw repeated many times throughout history.

Thank you for reading this. I am bullish on BTC along with some others. That said, do you own research and drawn conclusions. This article is for informational purposes.

Images by google.

@taskmaster4450 Steemit is gonna change lots of lifes, it has changed mine and many others but that is just the beginning. Followed

How has it changed your life? That would be interesting to read about.

Thanks for the comment.

Sounds like a pretty good argument.

I consider bitcoin, and other crypto-currencies, to be digital commodities: there are many parallels between physical commodities, like gold, silver, tungsten, etcetera, and digital ones.

I would agree with you....there appears to be many parallels with the commodities. I do agree with BTC as the digital store of value.

Thank you for the comment.

Exellent explanation.

I don't think anyone would argue against there being an adoption curve for a new technology and therefore you can plot performance or number of users on a Y axis. You could have done the same with TCP/IP or other protocol technologies that are similar in idea to the btc blockchain. I think the question is will the btc blockchain be a long term winner, industry standard, etc, or will something better come out tomorrow. The current price could easily be a bubble. I'm not saying it is, but it could be and BTC may turn it to be more like the laser disk that the vcr.

great blog @taskmaster4450 - and I completely agree, this is the main factor being overlooked by all those dismissing Bitcoin (and cryptocurrencies in general)

I have written a blog on Ethereum this week which is much to the same effect - Ethereum technology promises so much more than just a currency, but needs to start delivering!

Alex