The Budget Challenge | My B.U.D.G.E.T. Principle (A Witty Way towards Financial Freedom)

As early as 9, I was already earning and saving. I used to sell candies, sandwiches and even my own services (not that kind of services you're thinking! hahaha). I basically just earn, spend and save. Yeah that kind of sequence. hahaha I have always practiced saving after spending and to be honest that might be good sometimes but it actually isn't in the long run. I bet you know what I mean. Been there too, right? When I turned 15, I had already understood the effect of saving so I decided to make a change. Being the spanish bread winner of our family, I had to earn not just for myself but for my younger siblings as well. At a very young age, life has taught me how to not just adjust to short blankets but to look for another blankets. Now that I'm already 22, I am subconsciously confident with how I handle my finances. And I'm very glad that @smaeunabs initiated this challenge for I can share to you my fellow Steemian how I managed supporting my siblings' financial needs and my college fees by following my simple budget monitoring sheet.

.png)

Brace yourselves because I am about to share to you my B.U.D.G.E.T. Principle. Haven't heard of that? No? hahaha Maybe because I just made it up myself. Hahaha

Sounds familiar, right? Been there done that actually, but what I'm going to share with you isn't some sort of networking scheme. What I want to tell you is that, handling money until it works for you and not the other way around is one tough work. It surely will bring you down a couple of times and it will make you just quit on chasing your dreams. But worry no more! Those things are ought to happen. You ought to undergo those trials to be able to learn. And in order to surpass this kind of stage, just be open-minded.

Be open-minded about the experiences of others. Welcome the huge amount of trials coming your way. Positively accept the criticisms and insults. You have to maintain a calm mind to be able to think of strategies for financial independence. Just endure whatever battle you're in right now; I'm telling you it'll all paid off soon.

There are a lot of ways to encourage oneself. You could remind yourself every 5am in the morning how wonderful God and all His blessings are. You can read some good articles, too.

No one understands you better than you do.

Understanding oneself would imply knowing your needs and wants. List them down on your journal, planner, whiteboard, notes on your cellphones and pcs's and even your diary if you like. You have to internalize what you have written their because that will initially lead you to better decision making.

I personally have not mastered this one until I reached 20. Until such a time 2 years ago (Yeah, doing the math I'm already 22 y/o) while I was walking in the middle of one of the grocery store's aisle, I came to a thought -- Niks! Do not buy something just because its cute. Buy something you will surely need! I was pretty young and broke back then when I realized how to stick to my B.U.D.G.E.T. principle. Now, I'm in the process of bettering myself when it comes to finances.

F.E.E.S. stands for Funds, Expenses , Excess and Savings. Determining these important aspects in your budget plan is very essential.

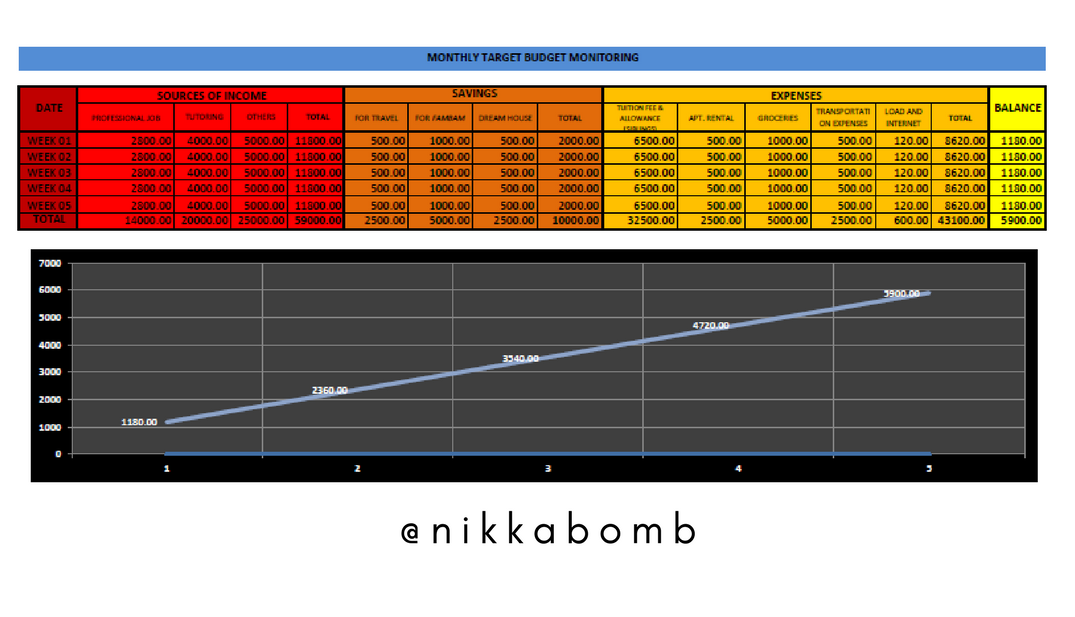

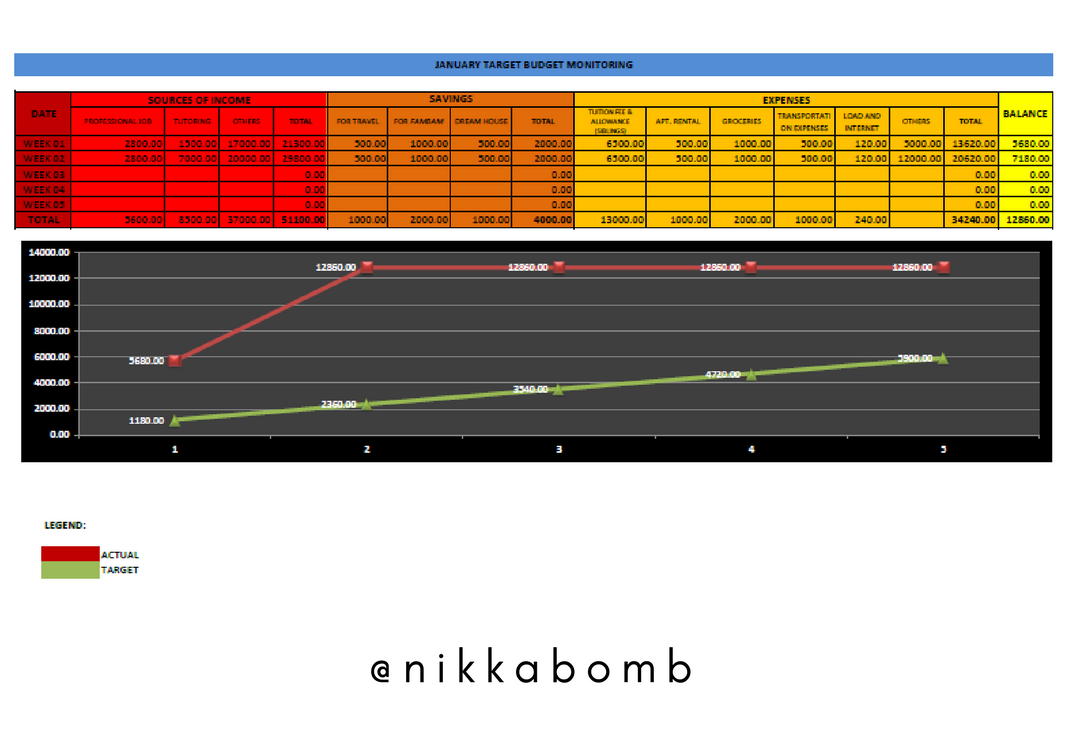

The picture above is only an example I made from my personal budget plan. Engineers do tend to create basis and references in order to validate losing and gaining changes. And this happens to be my target monthly monitoring. Of course, here's a sample of my actual monthly monitoring:

This has taught me how to manage my excess funds after paying my recurring bills (apartment rental, electric and water bill, my siblings' tuition fees, and Pag-ibig/SSS/PhilHealth contributions), allocating some of it for my savings and other necessary expenses. And to be honest, this really helped me last Christmas 2017 because of this I was able to compute my gifts-allocation to all of my nephews, nieces, siblings, parents and friends, give them their gifts and pay my bills.

Every end of the month, you'll see how your actual budget plan went then you can also compare it with your target budget plan. Having to do so, that will give you an idea on what to do and where to adjust next month. After arriving with numbers significant for your monitoring and analysis, you'll definitely have to work your arse out. Don't settle for a fixed plan. You should continually adjust your mindset, your sources of funds, and most especially your monitoring. Always strive to be the better version of your yesterday.

And if you think life is beating you up right now, you probably have to change something. Do not go over one single method especially if you have already observed how sick it was. Take risks! It's normal to be scared and vigilant. But sometimes, the answers we're looking for is already in front of us, we're just too scared to grab it. Admit it, we've all been through the lazy days of our lives, trying to figure things out while not doing anything. Did we actually get closer to our planned and ideal accomplishment by doing so? No, right? It's because we haven't done anything in exchange of the benefits we're wishing for. So we should definitely get our asses up to work.

This means I myself have to change my target monitoring, set it higher! Dream big! Aja!

After working your ass out, exploring on other means of financial sources wouldn't hurt your butt. Who knows, you might be the next highest paid author, doctor, engineer, artist, lawyer, or developer. All you have to do is TRY! In exploring other fields which interest you, do not forget to enjoy. Relax a bit and treat yourself a cup of coffee.

And most especially, Think and Thank!

Think of all the other necessary updates and improvements you'll have to make to improve your status in your journey towards Financial Freedom! You have to undergo redesigning stage wherein you alter some of your monitoring to be better and to not just settle to your income. As I've said, always strive to be the better version of your yesterday. Also, think of the people who helped you and the people you can offer your help to. Think of improving not just your life but the life of the people around you.

Thank them for helping, supporting and encouraging you. Thank God above all for blessing you and your loved ones. Thank yourself for staying sane, too. Hehehe! I actually do that once in a while, to be honest.

After all these steps, go back to step 1. And the cycle goes back, with more equipped and improved version of you, your financial intelligence and your resources. A friendly advice, every time you go back to step 1 have an analysis report of your own finances to keep track of your financial growth. Best of luck fellas!

Lovelots,

@nikkabomb

P.S.

This is an original work by yours truly, @nikkabomb which I have published based on my own principles and experiences. If you learned something from my post, comment it down below as I love to discuss a few more things with you. A little disclaimer though, I am not a financial adviser myself; I was able to learn these stuff the hard way. And last but surely not the least, thanks to @smaeunabs because this lady really brought out this witty side of me. LOL.

If you haven't joined yet, click here and be amazed how it'll truly challenge you. hehehe

I wish I was good at budgeting, but budgeting would take up 2/3's of my energy - got to find a good balance.

Good luck in your quest towards achieving your budget plan @money-dreamer! It's never too late to learn your perfect balance.

Grabe nikssss you are taking this challenge to a deeper level! Reading your budget principles greatly contributed to my finance vocabulary!

Thank you sooo much @nikkabomb for sharing these principles with us! With those effortful words and images, it feels like I am reading a finance magazine hahahahaha Nice one niks! You just added to the headache of choosing the winner!

By the way, I particularly like this statement

I always try to stick with a fixed plan without taking into account the variable expenditures that may greatly affect my budgeting style. I have to adopt in a more flexible plan rn. Thanks for reminding me :D

Cheers to Financial Freedom!

Being noticed by a Fil-Am Financial adviser is truly an honor! haha char. Thanks @smaeunabs for liking my budget principle. hahaha witty nuh? hahaha

Cheers to financial freedom!

happy to see your post .. i have upvote

Thanks :)

You are welcome

😊

🍻

You got a 5.26% upvote from @yourwhale courtesy of @nikkabomb!

Concrete BUDGET principle indeed @nikkabomb! Financial Freedom starts with being open minded! Wohoo! I salute you for being a responsible spanish breadwinner! So proud of you @nikkabomb! I know how it feels to be am elder sister! Aja! 💪

Salamat @namranna. hahaha! mugna2x rjd tawn ni nako. hahaha .

Great write up. Thank you for taking the time to share your experience with regards to budgeting.

Thanks and you're welcome @elysolano. I'm currently editing this one because I forgot to include the letter E. hahaha

Wow. It's very encouraging. But I can't remind myself every 5am in the morning. Still sleeping at that time, pwede 6am lng? Haha.

Anyway, that's an amazing and interesting principle miss @nikkabomb.

😂 It's up to you. Could be 8am. 😂 Thanks for appreciating this @jayg17.

Hello witty @nikkabomb, I love your post. We always learn from experience gyud, especially during times ting.bitay..haha..Actually, I was looking for the E then i realized it was included in the number 4 na diay.

hahahaha. I unintentionally skipped letter E. hahaha. Now, I have edited it. Go and check it again @raquelita. Thanks! :*

Hehehe..It's ok..at least, it is enjoying while budgeting..

Thanks @raquelita

This post has received gratitude of 0.53 % from @appreciator thanks to: @nikkabomb.

Very Nice and thank you for sharing @nikkabomb! You have a huge self control and determination! I salute you! :)

I have no choice but to really control myself from impulse buying. I have to allocate money for my family as well. Soon I'll be financially free, I won't be worried to buy the things I long to buy. hehehe

Wow that's very good @nikkabomb! I have this thing called "impulsive buying" haha. And it is my goal to achieve financial freedom from this year onwards. :) Good luck to us :)

Good luck in your journey towards financial freedom @appleskie. Aja! 😍😘😊 Good luck to us, indeed. ☺️