15 TIPS TO GET RICH IN CRYPTOCURRENCY MARKET! (AND TIPS FOR STOCK EXCHANGE AND YOUR LIFE AS A WHOLE)

Written by Blimblimboy (Felipe as real name) ---- An 19 years old brazilian guy and CryptoLover! (Sorry if wrote some grammar wrong haha)

1 - Diversify, but not in excess (as Warren Buffetth would say). The excess, of course, is determined by you, because a billionaire has enough money to buy 1000 different currencies and with a lot of money injected into each one, but if you have 300 dollars, more than 2 currencies (depending on the case) may be already excessive.

2 - Prioritize coins with good projects, white papper (recommended by a larger number of people (mainly from reliable sites, youtube channels - I like "Ivan on Tech" - an ERICSON Swiss programmer who explains the technology behind a certain currency, and the "Suppoman" channel), so they are more likely to value it - the more people talk about a specific currency, the more it should probably grow.

3 - In addition to good projects, watch out for currency updates, and / or partnering with big companies - news can detonate or bring a coin to the moon (beware of fake news and follow the currency twitter as well). It is not because a currency is good now, that it will always be good - a news of fraud, or serious flaw in the system can detonate even a ripple. Speaking of news, always stand back when "THE economics' guy" says that the currency "x" will fall or rise, even if this guy has a Phd in economics at Harvard, that does not make him a seer - math is an art of projecting results based on previous patterns, but as the future is uncertain (with wars, hackers, the riches forming groups just to pump a currency or make it fall, elections and technology always multiplying, etc.) math is not 100% sure - follow your own strategy, have a goal (in fact, this is not just for the coins, but for your life as a whole)

4 - Depending on your capital, prioritize cheaper coins (so you can get more coins), but within those that have good projects, and well recommended (as stated in item 2). In addition, only if, among 2 to choose (for example), the cheapest has the same quantity or less MarketCap as the other (use the site "coinmarketcap" to know it) - the marketcap defines how much it would cost if you buy all of the currency you're looking, historically, companies with high market capitalization tend to decrease their expansion, and companies with smaller marketcap tend to expand (analogy to the Stock Exchange: companies already expanded pay good dividends and often do not invest in new projects, but there are no dividends in the crypto-coins ... yet ...). Example: a coin can cost $ 0.5 but have a much higher marketcap than a $ 3 - the probability of $ 0.5 give a stagnant is high

5 - If you have time to manage and/or prioritize your physical and mental health, I would recommend holding 50% of the amount of money you own, and trade with the remaining 50%, so you protect part of your capital if your trades go wrong. I do not recommend using 100% at your own risk.

6 - If you do not have the time, and/or prioritize your physical and mental health, buy and hold (HOLD or HODL) the coins. PS: hold does not mean abandoning, always stay tuned to the news, but do not be crazy, know how to handle. If the currency falls, do not despair, as long as there has been no news of the type ("it was all a lie, this company does not even exist"), keep buying to lessen your loss.

7 - If you hold or not, have a spreadsheet with the buying and selling values of the currency you invested, so you'll know if it's in profit or not (I use google spreadsheets because your service is in the cloud).

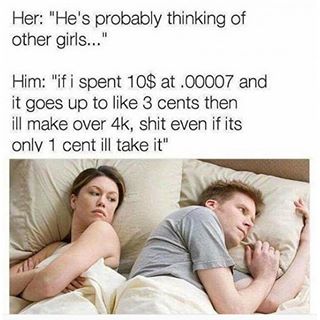

8 - Do not look at the quote every "x" minutes (if you do HOLD), otherwise the chance of you ending the year betrayed by your wife and/or with health problems is great (live your life).

9 - If you are going to trade (50% or 100% of your total capital), study Graphical Analysis (which works the same way as the Stock Exchange). I recommend using Ichimoku Clouds with Fibonacci. I learned all this on youtube, for free.

10 - Avoid high transfer rates: instead of paying 10$ in a bitcoin's/litecoin's transfer, convert them to an unknown currency, for example, paccoin, then transfer the purchased paccoins to your wallet at the other exchange, and that's it! Almost 100% cheaper and faster! The price and the time of the transfers go up due to the high demands - recently it was fine to transfer DOGECOIN, at the moment I already see slowness and an absurd of fee, I make transfer using paccoin or another coin of the type. For example, to transfer 5000 doge approximately, yobit charges 300 doge of fee, but if you use 5000 doge to buy paccoins, which, at the moment of writing, gave 618,000 paccoins, at the time of transfer, charged me only 0.1 paccoin, which is basically zero fee, and one more, the deposit completed in the other exchange (cryptopia) in less than 5 minutes (I got to wait hours to transfer doge before figuring it out)!

11 - There are many coins that value around 500% or more per day and although they do not have white papper and often no website, it costs nothing you buy only 10 dollars from them and observe: if it goes up a lot, you sell, if everything falls, you heve lost only 10 dollars.

12 - As our friend Isaac Newton said: "everything that goes up, goes down," so if you see a currency valuing too much in a short time, wait, it can drop, at worst, 20-30% of the value that has risen. Do not be like the mass of the population, who buys when the asset is rising, and sells (desperately) when the asset is falling (that is the time to (re) buy). The rich get richer because of this mass of the population that does not study and has no emotional preparation and does this kind of thing. The rich have power to sell millions of units of currency far below its current value, so that the mass becomes desperate and sells, and the price of it drops even more, so that this same rich or groups of wealthy people buy underneath (the reverse also occurs - that is, when the magnates buy the asset at a much higher price, as if it were bait for the uninformed population, which causes the asset to rise even more, desperate for profit, and makes the rich sell it to a higher value). If you are not rich, do not want to act like a rich, take the crumbs of them, surf in the wave they produce, and maybe in a few years (or less) it will be you who will produce the same waves.

13 - Do not be greedy, made 100% in x days / months? Take out 50% of the profits, at least. I say that for you to protect part of your earned capital. As the ancients would say: "whoever wants everything, loses everything".

14 - Invest your profits on the stock market (study the main stocks), cause this market is much more secure.

15 - Do not forget your friends, your family and try to exercise charity (do not be hard bread), because these things are the real virtues of the human being, because there is no point in being rich (or living trying to be one) and die knowing that you did not enjoyed your life with the people you love, or knowing that you rejected them when you got a better life (or while you spent all day looking for it). "Improving of life" is having material peace (comfort) and peace of mind; otherwise, your "money" can become a curse. BE HUMBLE! #PEACE TO ALL! AND I ACCEPT DONATIONS OF CRYPTOCURRENCY hahaha