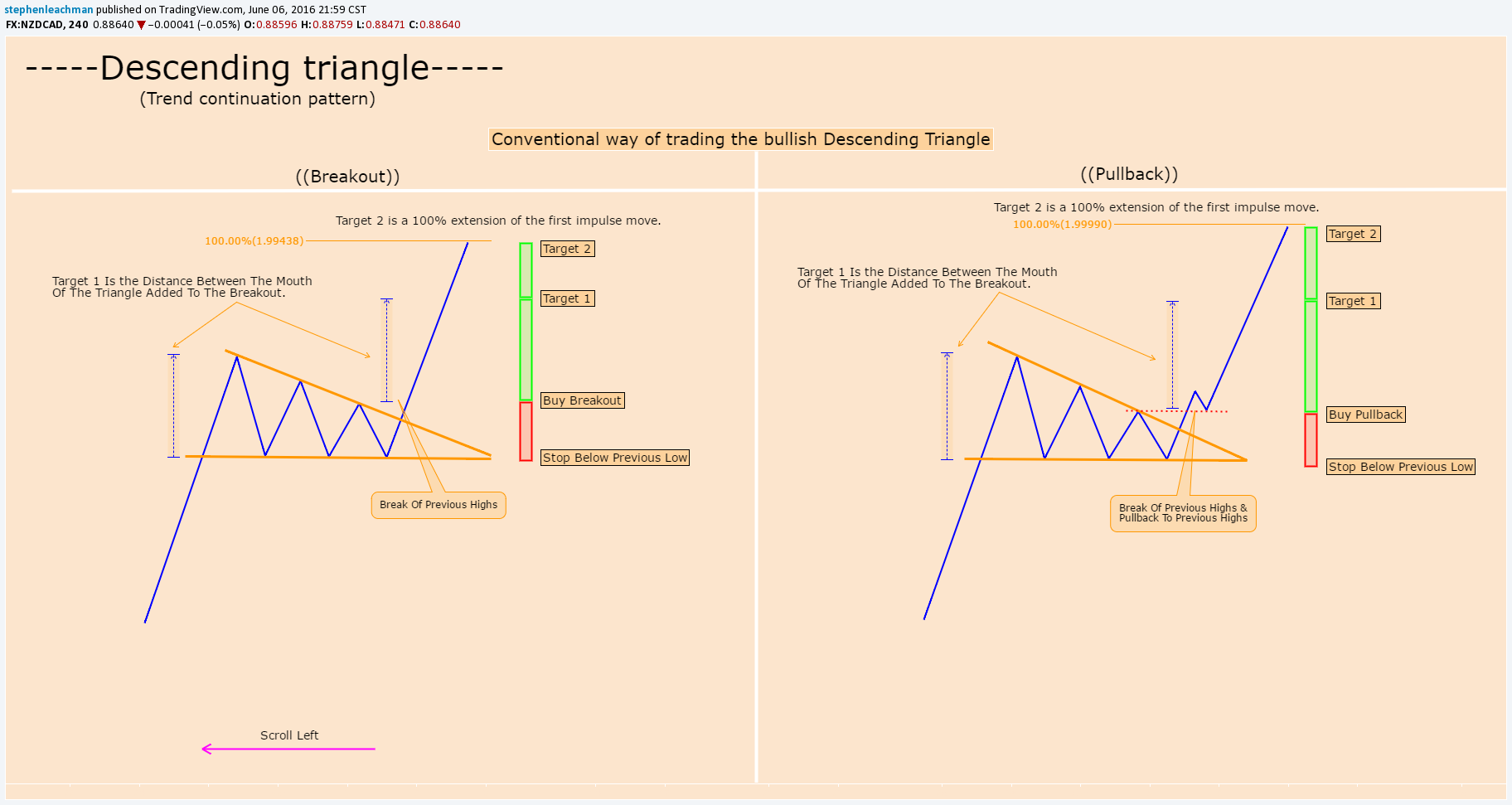

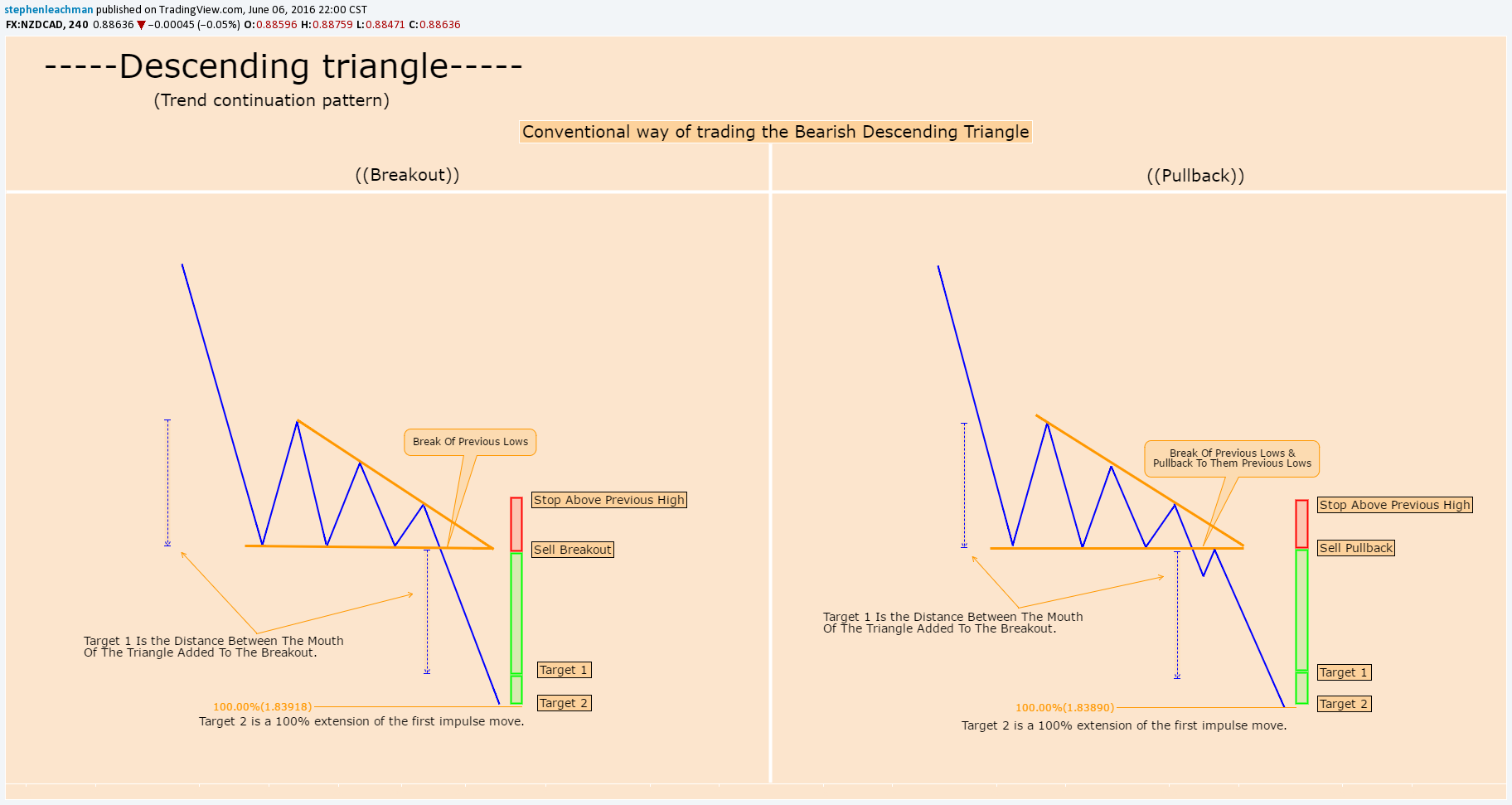

Conventional way to trade a bullish Descending Triangle pattern and bearish

Descending triangles are mainly considered continuation patterns but they

also can be used as reversals. This pattern starts with an initial impulse move

followed by a point of consolidation. As price consolidates it makes lower highs

and equal lows forming the descending triangle . the momentum builds up and

usually breaks out back into the direction of the trend. If price does break

back into the direction of the trend then look for a continuation and the target

is the Distance Between The Mouth Of The Triangle Added To The Breakout but

preferably I use a 100% extension of the first impulse move.

-----Breakout-----

(1) Wait for a clear Decending Triangle to form.

(2) Buy a break of the previous high.

(3) Stop below the previous Lows. (The Triangles Low)

(4) Target 1 Is the Distance Between The Mouth Of The Triangle Added To The Breakout.

(5) Target 2 is a 100% extension of the first impulse move.

-----PullBack-----

(1) Wait for a clear Desending Triangle to form.

(2) Wait for price to break and close above previous high.

(3) Buy pullback at prior high.

(4) Stop below the previous Lows. (The Triangles Low)

(5) Target 1 Is the Distance Between The Mouth Of The Triangle Added To The Breakout.

(6) Target 2 is a 100% extension of the first impulse move.

-----Breakout-----

(1) Wait for a clear Descending triangle to form.

(2) Sell when price breaks the triangle low.

(3) Stop Abouve the previous High.

(4) Target 1 Is the Distance Between The Mouth Of The Triangle Added To The Breakout.

(5) Target 2 is a 100% extension of the first impulse move.

-----PullBack-----

(1) Wait for a clear Descending triangle to form.

(2) Wait for price to break and close below triangles low.

(3) Sell pullback at the broken lows.

(4) Stop Abouve previous High.

(5) Target 1 Is the Distance Between The Mouth Of The Triangle Added To The Breakout.

(6) Target 2 is a 100% extension of the first impulse move.

Thank you for the good post https://9blz.com/descending-triangle-pattern/