How To Set A Stop Loss On Bittrex

Let’s face it. The market will always do what it wants to do, and move the way it wants to move. Every day is a new challenge, and almost anything from global politics, major economic events, central bank rumors and China FUD can turn currency prices one way or another faster than you can snap your fingers.

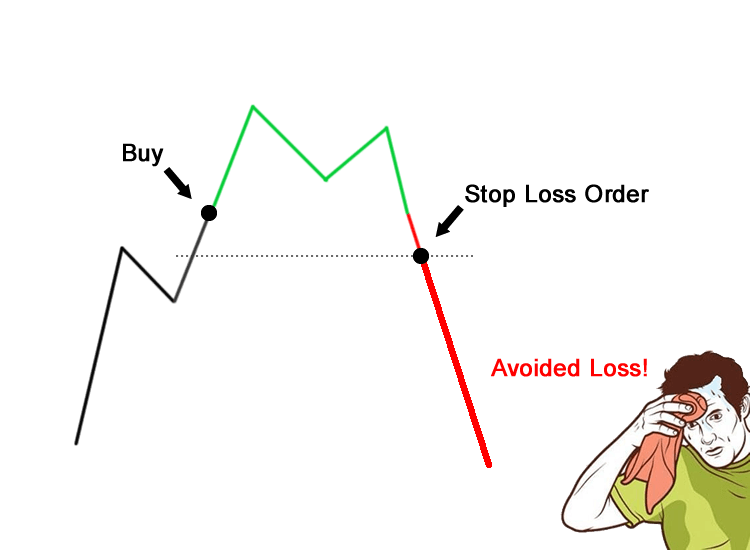

This means that each and every one of us will eventually take a position on the wrong side of a market move. Being in a losing position is inevitable, but we can control what we do when we’re caught in this situation. If you want to protect yourself from risk, you need to set a STOP LOSS order.

Taking a 5% loss would be preferred to losing 50% of your stack.

Stop Loss orders are a great way to mitigate risk and this is why they can be so useful.

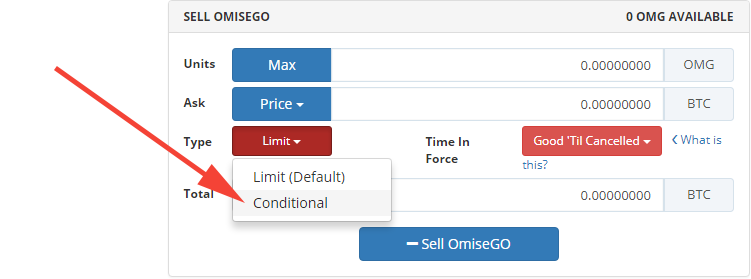

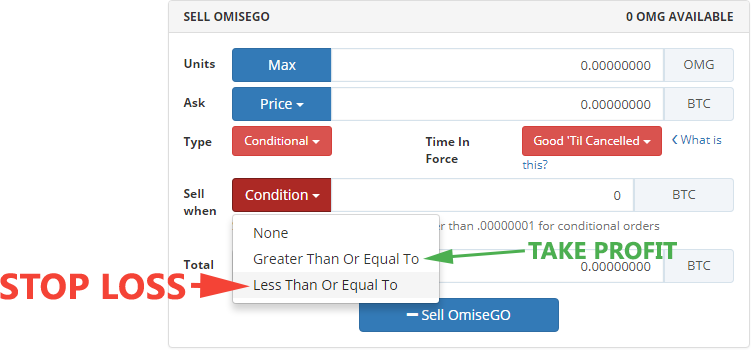

Conditional Orders are triggered only when the price reaches the value you defined. Your order is only added to the order book once the price reaches the value that you set. These types of orders cannot be detected as support/resistance by bots and other traders watching the book, therefore giving you a slight edge.

For STOP LOSS orders, use the condition "less than or equal to" and choose the minimum price you are comfortable with selling at.

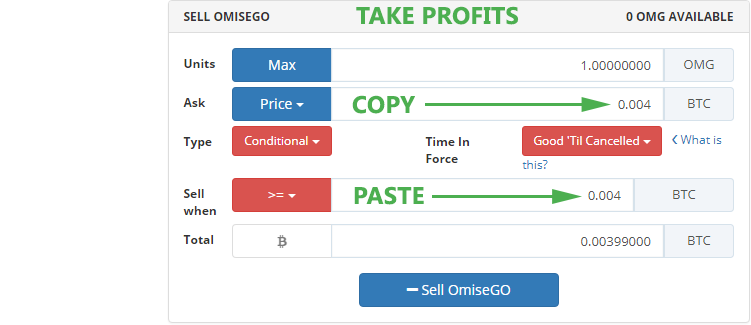

Setting a STOP LOSS order is easy. Simply enter the value you want to sell it at - I recommend 5% or more below purchase value - then copy and paste that same amount into the field below.

To TAKE PROFIT, use the condition "greater than or equal to" in order to sell your coin after the price reaches a certain value.

The saying, “Live to trade another day!” should be the motto of every trader because the longer you can survive, the more you can learn, gain experience, and increase your chances of success. To me, the measure of a successful trader is not how much they gain, but how much they don't lose.

This makes the trade management technique of “stop losses” a crucial skill and tool in a trader’s toolbox.

Having a predetermined point of exiting a losing trade not only provides the benefit of cutting losses so that you may move on to new opportunities, but it also eliminates the stress and anxiety caused by being in a losing trade without a plan.

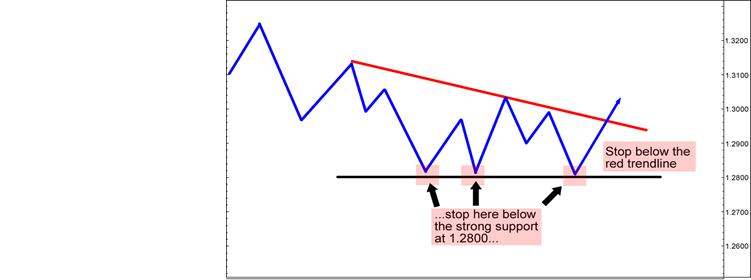

A sensible way to determine stops would be to base it on what the charts are saying. Let’s take a quick look at a way to set your stops based on support and resistance:

In this case, it makes the most sense to set your stops below the trend lines and support zones. If the market moves into these areas, that means the trend lines drew no support from buyers and now sellers are in control.

If you want daily cryptocurrency tips and news beamed to your inbox, sign up for our newsletter at CoinSheet.org. Happy trading!

Thanks for sharing, watched some videos on how to set the stop loss but this article made me understand it even better. Thanks bro

Thank you for sharing. Let's try it.

Shouldn't the "ask" price be lower than the "sell when" price to make sure that the stop loss order is actually matched? Otherwise it's possible that the price takes a step down and your attempt to sell just sits there forever at a price higher than anyone is willing to pay.

I've had that quite a few times and lost a lot of money because of it. Stop losses are very hard to get filled under a support because it will often go right through it. I'm gonna try 1% below from now on. I've had times 0.5% wasn't enough.

What you guys refer to is called slippage. You can look it up at Investopedia. Before setting stop loss you thus shouldn't look only to under which support you want to sell. Best thing is to try and get a view on what the strength is under the support so you can adjust accordingly.

The 1% is a general good idea but can vary greatly from stock/asset to another.

Should it happen that slippage causes you to be "stuck" in a trade there should be no need to worry. I try to trade with the tokens/coins I believe have a strong project/foundation. This makes sure I never panic sell, but be in the trade a bit longer than planned.

Great tutorial, Thank you!!!!

quite good

stop loss and risk management is key!

Lucas

Malabarize-se

Congratulations @jaggedsoft! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPThanks mate.

You know I was about to write an article about this, but with a slight different angle, that it is horrible that exchanges won't allow us to set an order that has a take profit AND stop loss in it.

Consequences are:

If you set the stop loss, you will have to monitor the market movement to be able to sell at a good price.

If you set a take profit, you will have to monitor the market movement to prevent from falling into huge losses.

Either way you have your eyes glued to the screen. This is extremely stupid.

Kraken had an order type like that but pulled it off. /facepalm.

I'll write a more detailed article on this soon.

I have a custom altcoin GUI trading bot needs testing. I created it because I wanted more options for buying and selling than what Bittrex currently offers. I wanted to be able to set both stop loss and take profit conditional orders at the same time. As of now you can only set one or the other. My bot will buy at desired price and set a stop loss and a take profit trigger at specified targets. Plus it has a trailing stop to get more profits when coins keep pumping. If anybody is interested in giving feedback and getting a copy message me.

Yes, I would love to have a copy of the code, can you share it on github?

I have just come across this and your bot is exactly what I am looking for. If you still need testers then I would be happy to test it for you.

Thanks a lot of this article ! Definitly something to share with my fellow noob-traders.

I am only new, but I am going to take your advice on board, cheers.