Trailing Crypto, scalping paradise

In the panorama of automatic operations, I personally identify two basic macro-systems. Bots, i.e. scripts or algorithms that allow you to perform certain strategies in total autonomy. And the semi-bots that operate automatically only under precise conditions and usually only once.

Trailing Crypto belongs to the second category. For those who are familiar with Technical Analysis this tool is really excellent, because it allows us to chain together a series of events trying to implement our prediction, but at the same time trying to ride any surplus both in and out.

First you need to register, there are also facilitated accesses via Google Account, then hook the API of your Exchange. The list is pretty well stocked, I would say above average.

The trading terminal looks more or less like that of a common Exchange, except that among the various items there is certainly a new one. That is OSO. You have probably heard of OCO (one cancel other) that is a specific action cancels the other, very useful when, for example, we want to enter at a certain price level, but if this goes the other way, cancel the order because in fact the technical analysis has to be redone.

In the case of OSO (one send other) or one order ignites another, it allows us to indicate the purchase order and when this is satisfied, activate the sales order.

Let's take for example the typical scenario, i.e. a LONG order. We have highlighted through our Technical Analysis a possible retracement area. We will then place an order where at the expected level we will activate the trailing buy, that is, once that price has been reached, the bot will try to follow a further lowering that the trading could have, with a progressive stop buy.

When this is activated, that is, we have bought, a second order is activated, this time relating to the take profit, where a possible price level for the sale is highlighted. Also in this case, as for the purchase, we will be able to activate trailing to try to maximize profit if the price were to rise well beyond our forecast. Taking care to also issue a Stop Loss to protect us in case the market comes against us.

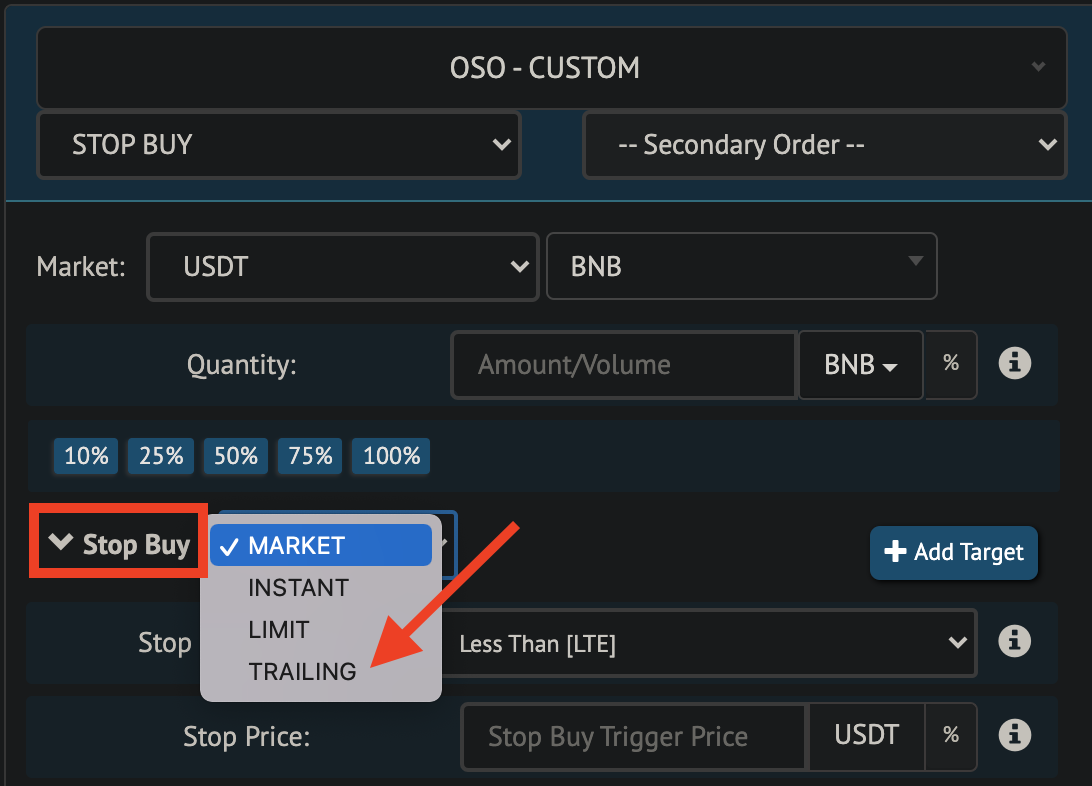

Let's see on the practical side how to proceed. First you need to select the OSO Custom item from the selector at the top left.

As you can see below two selectors appear, the primary and secondary order.

Primary order

Selecting Primary Order we will select the "Buy Stop" item and then we will select the pair in which we intend to trade, in the case of USDT vs BNB and the quantity. In the following items we can choose from the "Stop Buy" dropdown, under the quantity, the item "Trailing" as shown in the following image:

At this point a new field is activated, under the stop Price. So leaving unchanged the first item "Less tha (LTE)", we will put the price at which we intend to buy, and under a percentage of "engagement" under the item "Offset".

Basically this will happen: once the set price is reached, the bot will put a "dynamic" stop buy that will be activated when the price rises by 1% (or the percentage you have decided). If the price falls well beyond what you anticipated, you will have the advantage of having bought at a lower price.

Secondary Order

We can now press the "Next" button (blue button) which will take us to the secondary order creation setup. In this case we will choose an order type OCO, or OCO SELL. In the following screen we will set the quantity, while in the Stop Loss option we will choose the item "Instant" and then we will indicate our stop loss level.

In the item "Take profit" we will choose "Trailing". As in the purchase operations, we will indicate a price level for the sale and a percentage of "engagement". In this case the operation is inverse, that is, if the price should rise more than expected, we will be able to make a greater profit.

Conclusions

It would be nice if this type of tools provided them directly to the exchange, on the other hand also the type of OCO order is often not clear, not how much and how Trailing Crypto shows it. In this review I skipped a whole series of secondary aspects, for example it is possible to use signals (for a fee) or to be notified on telegram of the execution of orders.

Let's talk about prices. There are two levels, one free and one paid. In fact, for 10 consecutive open orders, for a maximum of 100 operations per month and a maximum duration of 15 days for execution of the order, it is free. To learn how to use this tool is more than enough I would say. If the only paid plan becomes profitable, it has a considerable annual discount, for just under 84 euros a year you get access to 250 simultaneous monthly orders, 10,000 operations and a year of orders before cancellation.

To say that licensing is honest and certainly cheaper than other products that I have been able to view. If you are looking for a smarter tool than the trading terminal, it is definitely worth checking out.

Trailing crypto website

note: the above link contains my referral link