Here Is The Leaked Trump Tax Plan, can it pass? Probably not... 5 Trillion in Cuts

Authored by Tyler Durden

Update 1: To our complete 'shock', Democrats have already taken to the media to bash Trump's tax proposal as a "windfall for the weathly" even though the plan explicitly contemplates a new top end personal tax bracket to "ensure that the reformed

tax code is at least as progressive as the existing tax code and does

not shift the tax burden from high-income to lower- and middle-income

taxpayers."

Meanwhile, Senator Wyden somehow concluded that a "lack of detail" necessarily confirms that the middle class is about to get screwed by the Trump administration...we're waiting to hear from Wyden on whether that lack of detail also confirms that Trump colluded with the Russians in 2016.

WYDEN: LACK OF DETAIL IN PLAN MEANS MIDDLE-CLASS WILL BE HIT

This afternoon, during a speech in Indianapolis, President Trump was expected to reveal, for the first time, the details of the long-anticipated Republican tax reform proposal that calls for substantial business and individual tax cuts. But in a political era where every little thing is leaked to the media, we no longer have to wait for presidential speeches to learn the details of key pieces of legislation.

As such, below is a 9-page summary of Trump's tax plan courtesy of the latest leaks.

Here are the highlights:

Today, we move one step closer to fixing our broken tax code so that it puts Americans first," Speaker Ryan said.

GOALS

Republicans have developed a unified framework to achieve pro-American, fiscally-responsible tax reform. This framework will deliver a 21st century tax code that is built for growth, supports middle-class families, defends our workers, protects our jobs, and puts America first. It will deliver fiscally responsible tax reform by broadening the tax base, closing loopholes and growing the economy. It includes:

- Tax relief for middle-class families.

- The simplicity of “postcard” tax filing for the vast majority of Americans.

- Tax relief for businesses, especially small businesses.

- Ending incentives to ship jobs, capital, and tax revenue overseas.

- Broadening the tax base and providing greater fairness for all Americans by closing special interest tax breaks and loopholes.

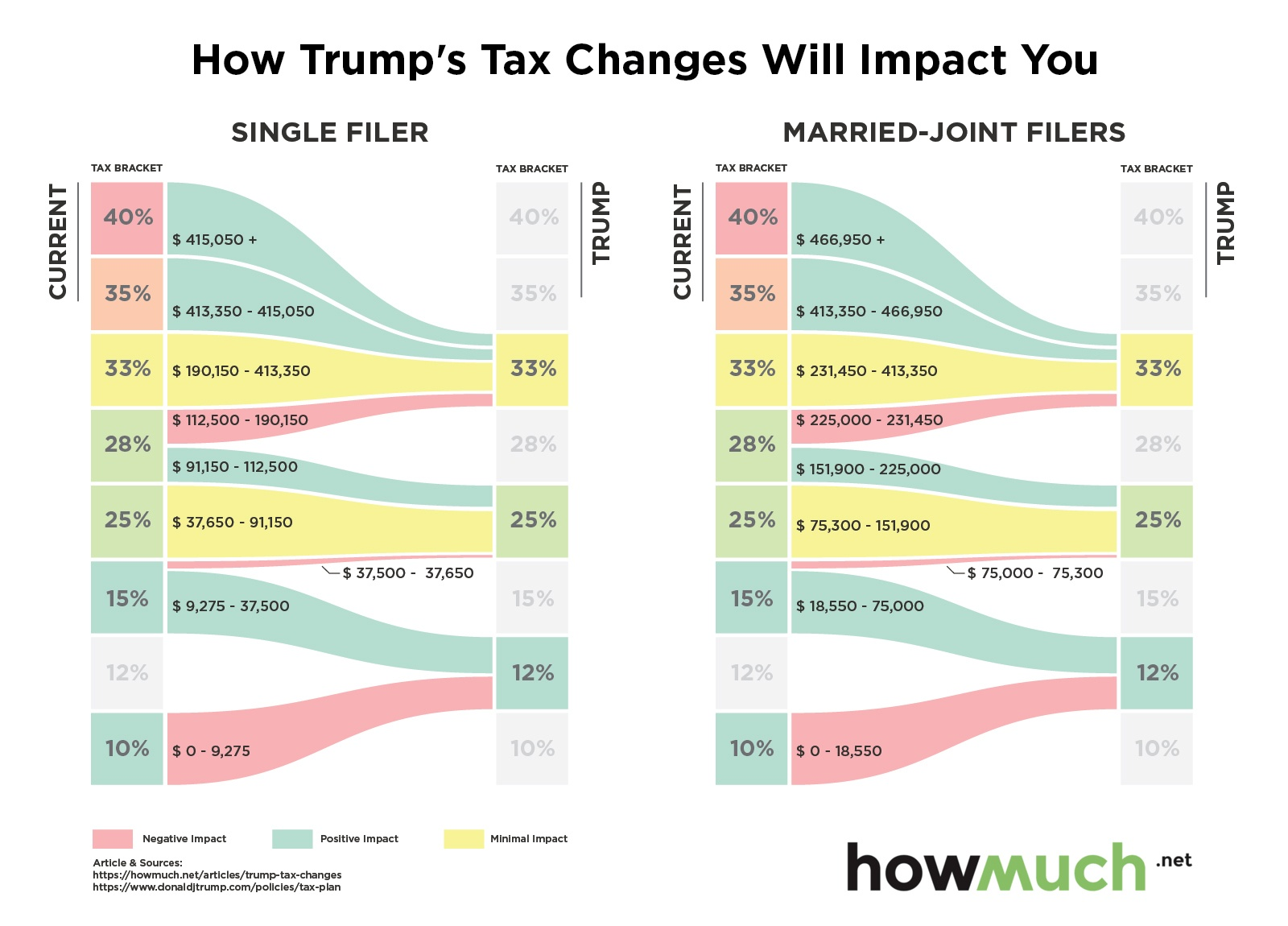

- Personal Tax Rates: As expected, Trump's plan includes a doubling of standard deductions with a consolidation of tax brackets and the suggestion that a new top end bracket may be created to "ensure that the reformed tax code is at least as progressive as the existing tax code and does not shift the tax burden from high-income to lower- and middle-income taxpayers."

The framework simplifies the tax code and provides tax relief by roughly doubling the standard deduction to:

$24,000 for married taxpayers filing jointly, and

$12,000 for single filers.

Under current law, taxable income is subject to seven tax brackets. The framework aims to consolidate the current seven tax brackets into three brackets of 12%, 25% and 35%.

Typical families in the existing 10% bracket are expected to be better off under the framework due to the larger standard deduction, larger child tax credit and additional tax relief that will be included during the committee process.

An additional top rate may apply to the highest-income taxpayers to ensure that the reformed tax code is at least as progressive as the existing tax code and does not shift the tax burden from high-income to lower- and middle-income taxpayers.

Small Business Tax Rates: Capped at 25%

The framework limits the maximum tax rate applied to the business income of small and family owned businesses conducted as sole proprietorships, partnerships and S corporations to 25%.

Corporate Tax Rates: Reduced to 20%

The framework reduces the corporate tax rate to 20% – which is below the 22.5% average of the industrialized world. In addition, it aims to eliminate the corporate AMT, as recommended by the non-partisan JCT. The committees also may consider methods to reduce the double taxation of corporate earnings.

Capital Investment Expensing: Immediate expensing.

The framework allows businesses to immediately write off (or “expense”) the cost of new investments in depreciable assets other than structures made after September 27, 2017, for at least five years.

C-Corp Interest Expense: Caps interest expense deduciton via some yet TBD formula.

The deduction for net interest expense incurred by C corporations will be partially limited. The committees will consider the appropriate treatment of interest paid by non-corporate taxpayers.

Repatriation: Enacts "100% exemption" for dividends from foreign subsidiaries

The framework transforms our existing “offshoring” model to an American model. It ends the perverse incentive to keep foreign profits offshore by exempting them when they are repatriated to the United States. It will replace the existing, outdated worldwide tax system with a 100% exemption for dividends from foreign subsidiaries (in which the U.S. parent owns at least a 10% stake).

To transition to this new system, the framework treats foreign earnings that have accumulated overseas under the old system as repatriated. Accumulated foreign earnings held in illiquid assets will be subject to a lower tax rate than foreign earnings held in cash or cash equivalents. Payment of the tax liability will be spread out over several years.

Noticeably absent in Trump's tax plan is any mention of the treatment of "carried interest"...a hot-button topic for hedge funds and private equity managers that reap the rewards of having the majority of their income treated at "capital gains" rather than "personal income."

Of course, the real question is whether the bill has even the slightest chance of passing both houses of Congress or if will soon meet the same fate as the failed Obamacare repeal bills.

And the initial market reaction seems to be disappointment...

Sources

http://www.zerohedge.com/news/2017-09-27/here-leaked-trump-tax-plan

https://assets.donaldjtrump.com/trump-tax-reform.pdf

Disclaimer:

I did not write this post. I love to read about the most important and reliable news stories every day. I try to share it with as many people as I can, so that you can also be informed.

How about I give the IRS 0% of my income and they can go fuck themselves.

We pay up to 55% income taxes in my country, you pretty well of when it comes to government stealing your money.

Yes but you at least get something for your buck. My income taxes are siphoned off by the 'defense' cartel, the pharmaceutical cartel, and the banking cartel . Are you also forced to prop up other people's businesses.