Automated Trading Success Tips According to Malcolm Morley

Do you rely on autotrading (automated trading) in generating profit in the Forex market? Still often experience loss or drawdown to touch the limit of loss tolerance due to automatic trading? Introducing Malcolm Morley, with trading experience from 1972 to the present, he has successfully developed an autotrading system to achieve consistent profit. Want to know what tips Malcolm Morley shares?

Soccer Malcolm Morley At Forex Market

Malcolm Morley started his career as an institutional forex trader at Bank of Nova Scotia, in London in 1972. Then he was transferred to Toronto, USA. From there he expanded his career as a project manager and banking system consultant to major banks such as Citibank and Credit Suisse.

The automated trading building skill starts from its position as an inventory administrator and treasury of the bank. Malcolm Morley is required to carefully monitor the input and output of any banking system operation in accordance with the procedure.

Interestingly, Malcolm Morley does not have a college degree certificate for personal reasons (where his parents live). So before he could get a higher position, he applied as a low-skilled employee in a private bank at a young age to pursue job opportunities.

For years believed to be the supervisor of the banking system cultivated a desire for him to start trading on his own behalf (private trading). Unfortunately at that time (in 80-90s), the Forex market is still dominated by the major banks in which the low spreads can only be enjoyed by institutional traders who are members of an elite circle of banks.

According to Malcolm Morley, retail traders still do not have the opportunity today because they have to deal with high spread spreads and the difficulty of having third party access to accommodate and process the flow of personal funds into the Forex market. It slowly began to change with the opening of internet access and the emergence of market maker brokers.

Initially, Malcolm Morley started retail trading activities on the stock market because at that time the equity market was more accessible. However, after finding a broker with a low spread bid, he moves to the Forex market again. According to him, the Forex market seemed like a search for his home page.

Malcolm Morley Auto Trading Tips On The Forex Market

According to Malcolm Marley, the most important factor of the high or low profitability of an autotrading system is directly proportional to the following aspects:

1. Spread

"No matter what pair of autotrading runs, you should make sure that the spreads are as low as possible," says Malcolm Morley. It is very important to prioritize because the autotrading system will open a (or more) position in a short period of time according to the rule set with or without your supervision.

Especially for automated trading system with scalping strategy on low timeframe (m5-m15). The low spread value is mandatory.

Therefore avoid installing autotrading in pairs with high spreads such as exotic pairs (eg USD / ZAR, USD / IDR) or during news releases because at that time the spread range could suddenly soar very high.

2. Analytical Method

According to Malcolm Morley, you must first understand that quantitative technical analysis techniques are the foundation of an autotrading system. In other words, you should be able to quantify the analysis process on the selected paired targets.

It can be said that automated trading will "negate" subjective analysis process such as fundamental analysis and some technical analysis which is very difficult to quantify, for example; chart patterns and Elliot Wave. However, you still have to be alert to important economic moments such as the central bank monetary policy (interest rate change) and high-impact news from G7 countries (United States, United Kingdom, Italy, Japan, Germany, Canada, and France).

For example the forex calendar shows that tomorrow will be held the announcement of changes in the interest rate of the central bank BoE. It is recommended that you do manual override or extinguish the operation of the autotrading system during news release announcements to avoid extreme volatility at the time.

3. Capital (Capital)

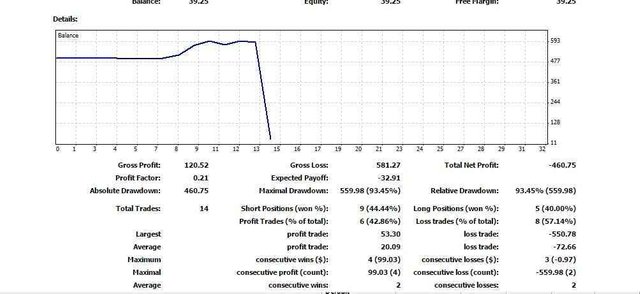

It should be noted that some automated trading systems require relatively large amounts of capital to get a decent profit. Malcolm Morley argues that drawdown and profitability calculations will generally vary from one model of the autotrading system to another model over a different time period.

For that, it's good you do the feasibility test of an automated trading model by injecting a small fund first and then monitor the development of equity. If the equity report is good, you might consider boosting capital on an account with the autotrading system.

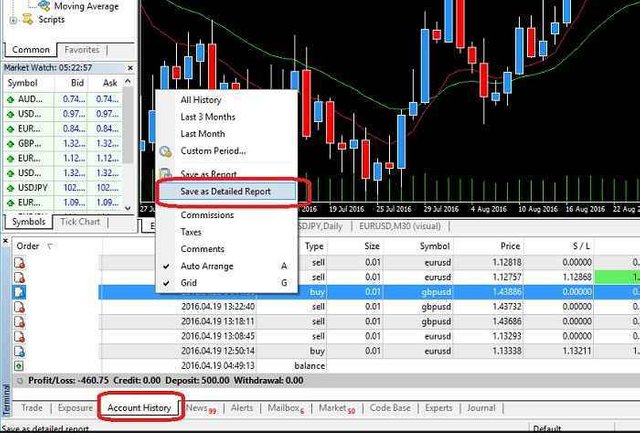

You can open your equity statement from MT4 by clicking the "account history" tab then selecting "save as detailed report"

4. Trading Facilities

Automatic trading in general requires a stable Internet connection to run optimally. Depending on the model, the autotrading system may use an external virtual private server (VPS) or use the default API (application program interface) from your own broker to "start" the trading robot model / script.

If you are unfamiliar with the facility, Malcolm Morley recommends that you consult with expert traders of other automated trading system users before deciding to purchase and use an autotrading system on a live account.

5. Risk Management

Even if you buy a model / automated trading robot from another developer (read also: how to choose a broker that matches your EA), you need to know what risk management is like. Depending on what strategy the system uses (scalping, martingale, or breakout, etc.), the risk of drawdown and loss will vary and require different calculations.

If you develop your own autotrading system, risk management monitoring will be more manageable by simulating the worst case scenario when developing a system model. Whether it's from the ratio of risk / reward or position sizing on every open position.

Conclusion

Building an automated trading system to get consistent profit is not an easy thing at all. Skills in formulating the analysis process to be the foundation of the autotrading system requires not only precision, but also depth in calculating all kinds of possibilities mathematically.

Malcolm Morley was one of the most highly skilled traders because he had been pursuing a career as an institutional trader from an early age. However, keep in mind that over the development of the Forex market has changed significantly.

You do not currently need to be an institutional trader to learn to use automated trading. Access forums and social trading open opportunities for beginner traders to share knowledge with other expert traders. Therefore, do not be discouraged! Pursue all trading opportunities for consistent profit!

Posted on Utopian.io - Rewarding Open Source Contributors

Thanks for sharing @muhajir169

Sama sama @ muhammad ikhsan21

Sma sma @muhammadikhsan21

@muhajir169, Like your contribution, upvote.

Thanks @steemitststs.

hopefully received my blog

Your contribution cannot be approved because it does not refer to or relate to an open-source repository. See here for a definition of "open-source."

Dear @muhajir169, your contribution is not an analysis and not related to an open source project.

You can contact us on Discord.

[utopian-moderator]