very personal and less special thought about the recent market plunge

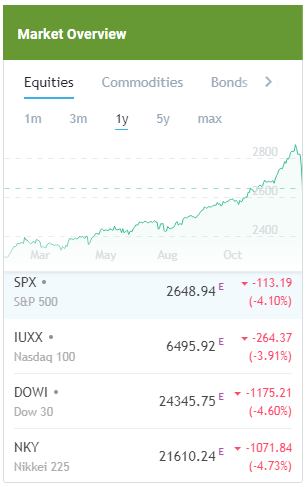

Surprisingly, even without any concrete Mr. Doom event, Market plunges.

Many people found out U.S. Labor indicator (i.e. unemployment rate, wage increase rate) was better than expected, and it triggered investors' fears and nerves as the signal can make Fed to increase its interest rate faster than expected as the indicator will end up increasing the inflation rate much higher. Well.. It sounds like pretty simple and logical idea, but is that enough explanation?

My very personal thought is here. (of course even I don't like nor trust my idea sometimes) The U.S. Labor signals was actually not that crucial thing at all. It was just like butterfly effect. I think the REAL trigger was "irrational fear". Yes, for sure, many of us thinks heyday for stock has been lasting for too long time, and maybe non of us thought this time is different and this market melt-up will last forever. But from the point of my view, this is too early for us to see the end of its up-ward market. This world has not seen enough economic triggers to convince itself to announce the end of its heyday yet. Labor rate was good and it ends up in crashing down stock market? It doesn't seem clear to me.

Maybe the year of 2017 was the real reason behind this market collapse. In retrospective view, it was, for sure, weird. Numbers say a lot. The recovery of U.S. economy has become one of the longest in U.S. history (more than 100 months old). Capital spending rose at an annualized rate of 6.2% through Q3 last year. The unemployment rate was 4.1%, which is nearly the lowest in the last 60 years. These good signals drastically melt up market so far, but I think many people start to think that this up-ward trend must top out someday and it seems they finally found good clue for exit strategy. good labor signals and rising interest rate provided them somewhat good background for execute the strategy. Well, again, my point of view is that these (kind of) negative signals for stock market is not strong enough. we need to find out more evidences to convince ourselves to recognize this market downturn will be wider and even wider. but for now, this is not the time to join sell-all-your-stock fever yet. I'd cherish figures representing our global economic and corporate profitability. It's not the best ever figures, but it's just pretty good one.

Of course nobody knows the future. (and I am the one who does not know anything) all we know by 100% chance is that some would have been made a better decision while others not. it's simple. Was this market plunge merely temporary correction? otherwise it was the awaited beginning of market crash? Let's wait and see together, then we will learn a lot. The most important thing in this volatile market is to see and learn it as much as possible as this time will provide us with various aspects of the market and things to think and discuss.

Personally the most interesting issue was about product for shorting volatility. Surprisingly, according to Bloomberg, The VelocityShares Daily Inverse VIX Short-Term ETN, known by its trading symbol XIV, dropped 14 percent during the session on Monday and its net asset value plunged more than 80 percent in late trading. It was even halted from trading Tuesday. As volatility index jumps up, more than 80% of loss occurred to exchanged traded note for shorting VIX in a day. Isn't it too tough to take, especially, for individual investor? Well, Market is always mysterious and difficult.