Bitcoin blocked by banks: The crack down on digital currency

Imagine being a bank, finding out that one of your customers is involved in a booming industry such as cryptocurrency - meaning they are soon likely to have money to invest with you - and instead of treating them as valued customers, you drop them like hot coals. Even if you did have to let them go, you would want to be very clear and polite about it, and preserve the potential for future business. However, many banks are deciding to take a less civil approach.

Many financial institutions are shutting down accounts, then being evasive or even hostile about the reasons for their decisions, making business difficult for crypto exchanges and users. Recent reports of this activity from financial institutions have come from Australia, Canada, the USA, South Korea, and Europe.

Australia

Small exchange problems

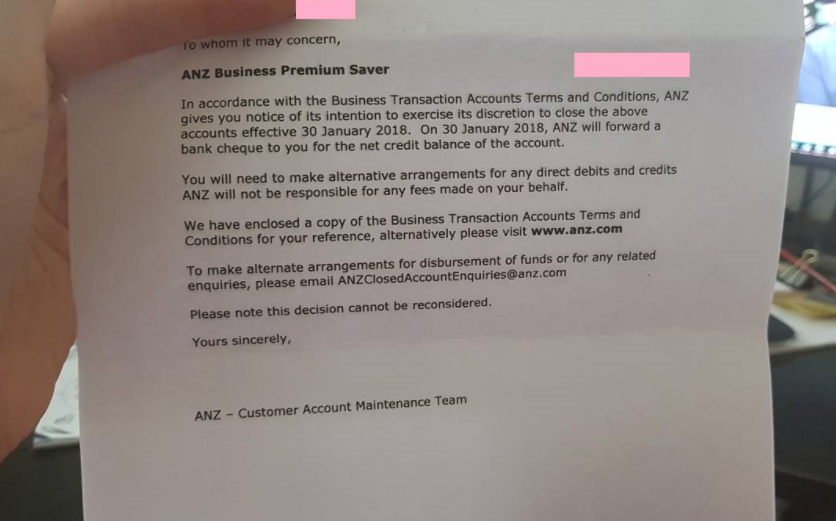

Bitcoin Babe, a personal crypto exchange service has reported that ANZ, one of the big four Aussie banks, has decided to close her account.

The related clause in the terms and conditions indicates:

ANZ may exercise its discretions to close an account due to unsatisfactory conduct or for any other reason it considers appropriate.

So, you might say the official reason they closed her account is because, well, they just felt like it.

Large exchange problems

The larger Australian crypto exchanges Coinspot and BTC Markets recently had problems with the traditional financial system, with banks unwilling to process transactions into their accounts with Polipay. The option to use bill payment service BPay is still available, but customers were frustrated as BPay can take a few business days to process, and Polipay is normally immediate.

In this case, it's possible that the banks were acting in the interests of their customers. Polipay is a relatively insecure service, as the user must provide Poli with her name and password. Banks such as the Commonwealth advise against using them, as any third party service like it voids their security guarantee .

Small banks make their move

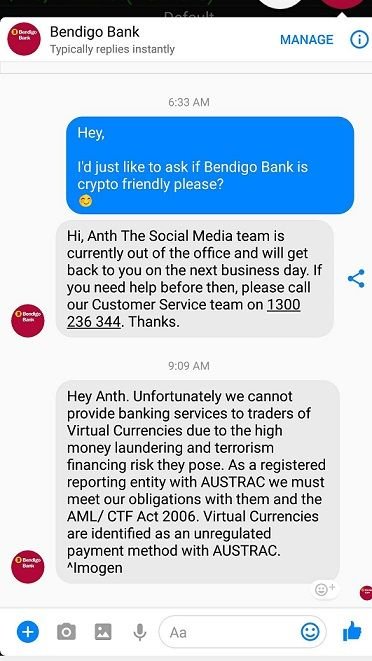

You might think that smaller financial institutions would be more willing to listen to what their customers want, but unfortunately that's not always the case. Bendigo Bank stated to one customer that it would not provide services to cryptocurrency traders.

Bendigo Bank later clarified that they were specifically talking about people who trade cryptos frequently as a business, and ordinary transfers made to exchanges would not be affected.

Canada

Bitcoin enthusiast Luke Westlake thought that Ontario credit union Libro, might be receptive, perhaps being more willing to work with a new customer. He discovered otherwise:

A few days ago I met with Libro Credit Union and they told me flat out if I did anything related to bitcoin that they'd cancel the transaction and terminate my account immediately if they 'caught' me buying into an exchange or similar service to buy bitcoin (like it was scary or naughty?). They would avoid banking a business related to bitcoin like a bitcoin ATM or exchange or coinsquare, or pretty much anything remotely related.

Aside from the commercial banks, in a quote some might find humorous, central bank governor Stephen S. Poloz stated that talk of cryptocurrencies is one thing "keeping me awake at night".

United States

Stateside, the Bank of America and Citigroup are considering their policies on allowing the purchase of digital currency with credit cards. Capital One Financial has recently started blocking these transactions, and Discover Financial has blocked them since 2015. Source: CNBC

South Korea

In the ROK, Woori Bank and the Industrial Bank are shutting down accounts for the 3 biggest exchanges: Bithumb, Korbit and Coinone, probably provoked by the South Korean government's recent decision to regulate digital currency.

However, in Korea we find an outlier, a rare creature - a bank willing to work with crypto. Shinhan Bank is working on cryptocurrency solutions, developing a platform where customers can deposit their bitcoins and enjoy the security of having someone else watch your money. For some, this seems antithetical to the crypto vision of the future, but for many it may offer a level of security, comfort and familiarity.

Europe

Visa toys with their future

On January 5th, 2018, CryptoPay, Bitwala, TenX and Wirex all had to suddenly announce that their Visa cards no longer worked. Visa had decided to end their agreement with WaveCrest, which provided Visa cards for these other companies, likely causing inconvenience for tens of thousands of customers throughout Europe.

This is a particularly egregious case, because the cards were cancelled with no warning. Visa Europe stated that the agreement was ended due to "continued non-compliance with our operating rules", so one can argue that the problems were the fault of WaveCrest, but regardless of where the responsibility ultimately lies, the message is clear for now: you cannot rely on Visa to build a bridge to the future.

Santander repents for their sins

Portuguese bank Santander decided to block crypto transactions at first, but later responded to a petition of 1.000 signatures, and their policy is now to allow the transactions. The bank is also working with the Ripple network to reduce costs and improve efficiency.

It's easy for those with power to overlook how the tides are turning; it's easy to believe the media when they say Bitcoin is a tool of criminals, but when we stand up, placing our reputations on the line in declaring our support, it can remind those sleeping beasts of their purpose - to provide a service to us, their customers, in the way we want it.

Conclusion - the major trends

People with imagination enough to see into the future are rare, and it's the same among banks. If you've ever publicly advocated Bitcoin or similar tech, you know how people can respond by saying that it's just play money, that it's a fad, that it has no future. But you also know the satisfaction and excitement of talking to someone who really gets it, who sees a brighter tomorrow for themselves, and perhaps even for humanity. That is something rare and precious, so the outliers like Santander Bank and Shanhin Bank should be saluted, for having the courage to act on what others are even afraid to wonder.

An important tool for disenfranchised crypto fanatics

If you are having trouble depositing to or withdrawing from crypto exchanges in your own country, Transferwise can help you facilitate an international bank transfer, sending money faster, with lower fees, and with better currency conversion rates than transfers using your bank.

About me

My name is Kurt Robinson. I grew up in Australia, and for now, the world is my home. I write interesting things about voluntaryism, futurism, science fiction, travelling Latin America, and psychedelics. Remember to press follow so you can stay up to date with all the cool shit I post, and follow our podcast where we talk about crazy ideas for open-minded people, here: @paradise-paradox, like The Paradise Paradox on Facebook here, and subscribe to The Paradise Paradox on YouTube, and on iTunes.

What I do now:

I just keep accumulating my investments into Cryptos. I let the time go, and banks, governments and other barriers sooner or later will be challenged, and some consensus will be found, or some solution. I am a believer in cryptos, in a long run. I noticed most people, make money and they are rushing to cash it out or something?

Same as internet / e-mail / amazon / e-bay/ or any other progressive and disruptive technological change - it will have many issues in the way. But problems, create solutions, and humans are creative (thanks God), so all will be sorted.

So my advice is: as long as you have money to eat, drink, have normal life, and function without any issues, just keep your crypotos, shuffle them from one investment to another. And time will come when we will be able to pay for daily consumption products in cryptos.

...just patience.... :)

Yes. There are already some solutions available for people who can't use banks with crypto exchanges. I mentioned using Transferwise to get money to exchanges in other countries. There's also Bisq, the decentralised exchange that lets people go between crypto and fiat.

Thanks for the tips dude!

Good write up and summary of banking problems. I'm from Australia and been meaning to try and identify a crypto friendly bank here, but it looks like you're ahead of me and hitting a brick wall. I use BTCMarkets, with a deposit limit and a delay for processing it is painful even moving moderate amounts, but the gate is still open at least! Resteemed.

Thanks for the comment and the resteem. For what it's worth, I've never had any problems with Citibank Australia or the building society from my hometown, but I've never had cause to be concerned with the speed of BPay or bank transfers when withdrawing. Aussie banks are set to implement near instant bank to bank transfers, I think this quarter.

Ok, thanks for the info. The goalposts are shifting quickly so it'll be wise for me to stay on my toes.

Check out coindirect.com. I haven't tried them yet. Both coinspot and btcmarkets now limited to BPAY.

In India also, Banks had froze all accounts of Major crypto exchanges.

Thanks. I'll do some research and add an addendum.

Bloody banks!

Been ripping us all off for years and now running scared.

Their days are numbered.

The people will triumph and through blockchain and crypto the corrupt elite will be ruined.

Great post ~ thanks.

xox

If it's truly a medium of the people than those wizards of oz behind the curtain shouldnt matter...but if it's an instrument of greed than they can kill it because they are the kings of greed and want.

Bitcoin will survive all attacks against it by governments and banks... the governments and banks that attack Bitcoin may not. We knew that all powers threatened by blockchain technology and currency would attack it.

Banks and governments will continue to crack down on cryptocurrency but I believe with tenacity we will prevail and revolt against the centralization control of banks and govnerments!

yes this is true, sadly.

This is the main source how Governments make money.... taxes = extortion (modern slavery).

Crypto Exchange In Australia?

This is a good article on the crypto exchanges in Australia!?Without on and off ramps to fiat, I still see a big hurdle of going straight to crypto to crypto. Fiat first has to get really bad. Zimbabwe and Venezuela style bad. And no fiat left standing all going down together

First of all i thanks for this helpfull article, as i have many issues that in my mind about banks and crypto. As whole world think crypto is the key of future. its true for new and modren era but all old and traditional owners have issues. @churdtzu thanks a lot dear.....