Trading Steem with Fractals and Multi-Timeframe Strategies

Hello everyone! I hope you will be good. Today I am here to participate in the contest of Steemit Crypto Academy about the Trading Steem with Fractals and Multi-Timeframe Strategies. It is really an interesting and knowledgeable contest. There is a lot to explore. If you want to join then:

.png)

Question 1: Explain Market Fractals

Market fractals are the repetition of the price patterns. These patterns occur in specific time frames. These patterns indicate the price areas from where reversal in the market can occur. These patterns are defined on the base of the fractal geometry. The fractal geometry suggests that the market movements can be self similar at different scales.In the crypto trading fractals represent the turning points in the price movements.

A fractal in trading is a specific price pattern. It consists of at least five bars or candlesticks:

Bullish Fractal

A bullish fractal forms when there is a local minimum in the market. It indicates a potential upward reversal. The middle candlestick or bar in this pattern has the lowest low. And this bar is crossed by two higher lows. Actually it is the combination of consecutive 5 candles. In these candles the the first 2 candles go lower side. And the very next 3rd candle goes more lower than the previous. After that 2 new candles cross the lower candles and ended at the higher price than the first candle. It represents a bullish upward trend.

Bullish Fractal

Here we can see the bullish fractal in which 5 candles are consecutive and the first 2 candles are forming the lower and the next candles is again going lower to $0.1736. The next 2 candles are forming up side and they have crossed the previous ones and reached at the level of $0.1959. And it causes a bullish trend and the price rose about 12.80%.

Bearish Fractal

A bearish fractal forms when there is a local maximum. It indicates a potential downward reversal. In the bearish trend there is the need of the 5 consecutive candles or bars. In those 5 candles the first 2 candles form a local high. Then the next candle forms more higher than the previous. And the next 2 candles go downward crossing the low of the middle candle. It is where the bearish fractal is spotted.

Bearish Fractal

Here you can see that the first 2 candles form a local high and then the next 3rd candles forms more higher than the previous and the next 2 candles went downward more than the previous candles. It is the indication for the bearish trend. And this fractal is a bearish fractal.

You can see after the bearish fractal the price moved downward while decreasing up to 4.40%. It has been highlighted with the price range chart.

How Market Fractals Can Identify Trend Reversals

We use fractals to identify the reversals in the market trend. We use the following factors to identify the market reversals. Our main motive is to use market fractals for the identification.

Spot market turning points: Fractals help the traders to identify the turning points in the market. They tell us when a trend is loosing its momentum and a new one is starting.

Determine entry and exit points: We can easily determine the entry and exit points with the help of the fractals. We can enter and exit the trades by following the fractal strategies. When the fractals indicate that the market is reversing its trend then we can exit our trades.

Combine with other indicators: We can combine fractals with other indicators for the accuracy and good results. Fractals are often used with other technical analysis tools. We use Alligator indicator or moving averages with the fractals. They assist us to confirm the trend direction.

Example of Bullish and Bearish Fractals Using STEEM/USDT

Bullish Fractal Example - STEEM/USDT

In the STEEM/USDT pair we see that before September 20, 2024 there was a downtrend. And after 20 September we can see a bullish fractal which drove the market of the STEEM to go upward.

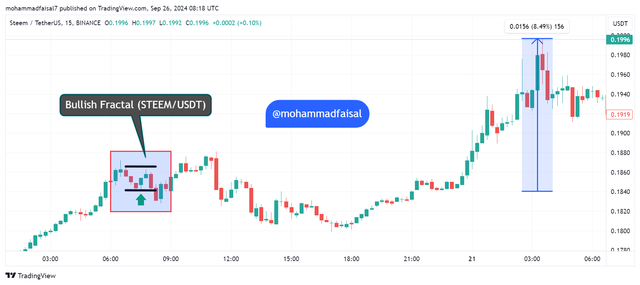

Bullish Fractal

In the above STEEM/USDT chart we can see the formation of the bullish fractal which started with 5 consecutive candles. The first 2 candles are forming lower low and the next candle is going more low than these. After the 3 candles the next candles are crossing the previous 2 candles. And it was how the bullish fractal was formed in the STEEM/USDT pair. And this bullish fractal drove the price to move upward. The price rose by 8.49% from the start of the bullish fractal as I have shown it with the help of the price range.

Bearish Fractal Example - STEEM/USDT

I have spotted an example of the bearish fractal of STEM/USDT pair from September 24, 2024. Before this the market rose up and it was in an uptrend. But at 24 September a bearish fractal was formed and it drove the price movement towards a downtrend.

In the above STEEM/USDT chart we can see a bearish fractal. AS the fractal consisits of 5 candles and the middle candle with the higher level than the previous ones. So look at the chart where I have highlighted the green candles with the black trend lines. The first 2 green candles made an upward move and the 3rd candle crossed the previous candles. And this 3rd one made a higher high. And right after this candle 2 consecutive candles were formed which retraced the price of the previous candles. And it was the turning point from where the trend was reversed as a bearish fractal was formed.

This bearish fractal affected the market greatly and it droves the price to go downward (-6.68%). So it was how a bearish fractal was formed in the STEEM/USDT pair.

Question 2: Combine Fractals with Other Indicators

Fractals play an important role in the determination of the trend reversals. We can analyze the market bullish as well as bearish trends. They tell us about the market turning points. But sometimes when we use only fractals then they may fail to determine the exact turning point of the market. So we can use other indicators with the fractals like **relative strength index (RSI), moving average (MA) or alligator indicator. So by using them we can improve the trend predictions and it will help us to avoid false breakouts or the reversals.

Fractals and Relative Strength Index (RSI)

Here I will use fractals along with the relative strength index. But before diving deep in it I will explain relative strength index indicator.

RSI: This indicator measures the momentum of the price movements. And this indicator is used to spot the overbought as well as oversold conditions in the market. The RSI indicator has values between 0 and 100.

Value above 70 indicates overbought signal or we can say it is an opportunity to sell the holdings.

Value below 30 suggests an oversold signal or we can say it is a buying signal and we can avail this opportunity.

Practical Example with STEEM/USDT

Oversold Signal

In an oversold signal and bearish fractal the market reverses its uptrend and start its downtrend. In the oversold signal the value of the RSI indicator is 70. It indicates high selling pressure. Here is the example of the STEEM/USDT chart which shows the bearish fractal along with the confirmation by the RSI indicator.

In the above picture the bearish fractal has formed where the first 3 candles are touching a high and then 4 candle has started downward and then the last one retraced the first 3 candles completely and more. SO here we say that it is a bearish fractal.

But in order to confirm this signal as bearish I have used RSI indicator. The value of the RSI indicator is 70+ which is also indicating that it is a oversold place from where the bearish trend will start because of the high selling pressure. And the price became down by 3.53% because of the bearish trend.

Here in the above STEEM/USDT chart a bullish fractal has formed by the 5 candles consecutively. The first 2 candles formed a low on the downside and then the next candle formed another lower low than the previous. But after those the next candles moved against the previous candles. The 4th and 5th candle crossed the 3 candle and here it indicated a bullish trend according to fractals.

Here again I have used RSI indicator to confirm the bullish trend. At that specific point if we analyze the value of the RSI indicator then we get value approximately equal to 30. And according to the rules this indicates an overbought signal from where bullish trend starts.

And this bullish trend confirmed by the fractals and RSI indicator moved the price upward by 4.59%.

Question 3: Using Fractals Across Multiple Time Frames

Show how fractals can be used on different time frames (daily, weekly, or even hourly charts). Identify fractals on a daily and weekly Steem chart and explain how they interact to provide a comprehensive market outlook.

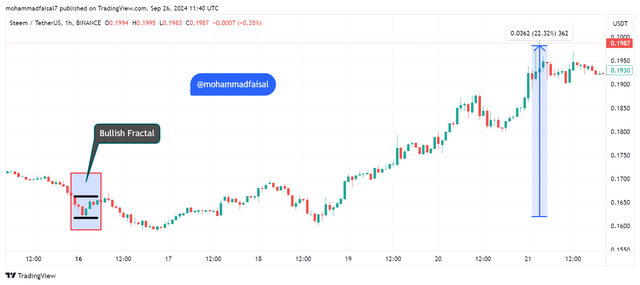

Hourly Fractal Chart

Here in the above chart fractal has been implemented in hourly time frame. This is a bullish fractal which was a perfect signal and it drove the price to really a bullish pattern. You can see an increase of 22.32% in the price of the STEEM/USDT pair. It was a good buying signal for the traders who do intraday trading.

In the above hourly time frame chart of STEEM/USDT we can observe a bearish fractal. It was the indication for the daily traders to exit their trades at the high except to face the bearish trend because the bearish fractal was formed. And if we see this bearish fractal it caused a downtrend by decreasing the price by -15.22%. In this way the daily traders can take entry and exit their entries

Daily Fractal Chart

Here we can see that we can apply fractals on the daily frame as well. In the above daily STEEM/USDT chart I have implemented fractals and I have found a bullish fractal. It was a wonderful opportunity for the buyers to take entry at this bullish fractal as it drove the price significant upward movement. The price rose around 80% from the start pf the fractal level.

Similarly we can implement fractal levels to find the bearish fractal on the daily STEEM/USDT chart. In the above chart the bearish fractal was formed. It was the indication for the traders to book their profits. After this bearish fractal the price moved downward by 45.69%.

Weekly Fractal Chart

This is the weekly time frame bearish fractal chart of SREEM/USDT. We can easily implement fractal levels on the weekly time frame as well to check the trends in the market. We can check the reversals in the trends as well as the start in the trends. In the above chart the detection of the bearish fractal was exact as after this bearish fractal the price dropped to 9.88%.

Similarly here I have a detected a very successful bullish fractal on the weekly time frame of STEEM/USDT pair. This bullish fractal caused the movement in the price insanely upward causing almost 100% upward. Th e price of STEEM/USDT rose from $0.16 to $0.32 which was the biggest achievement.

So in the weekly time frame we can also determine the fractal levels and we can behave accordingly to take entry and exit the entry from the market.

Identify fractals on a daily and weekly Steem chart and explain how they interact to provide a comprehensive market outlook.

Daily Steem Chart

|  |

|---|---|

| Daily Time Frame - Bullish Fractal | Daily Time Frame - Bearish Fractal |

In the daily time frame of STEEM/USDT chart we can see a bullish fractal. In this bullish fractal a lower low was formed as compared to the other surrounding candles. This indicates a potential upward movement in the short term. It shows the reversal from the downtrend.

This bullish fractal forms a minor pullback and then the market follows the bullish uptrend. And it is the good entry zone for the traders to take an entry and to ride the potential upward movement.

Similarly in the right side image of daily time frame a bearish fractal was formed. It produced a higher high candle which indicated the bearish trend. It was an exit zone for the traders. And they can close their long trades here and then they can take short entries.

The daily time frame fractals strategies are for the short term trading. The traders who want to take entry and exit the trade in a single day then they follow the daily time frame to determine the movement of the market.

Weekly Steem Chart

|  |

|---|---|

| Weekly Time Frame - Bullish Fractal | Weekly Time Frame - Bearish Fractal |

In the above weekly STEEM/USDT chart we can see that the market is forming a bullish fractal after the downtrend. And this upward fractals suggests a reversal of the trend from the current trend. And weekly time frame trends are longer than the daily time frame charts.

They suggests a start of the accumulation and then an upward move. As we can see in the above bullish fractal chart of STEEM/USDT that the market moved upward for long term. And it formed a 100% upward movement in the price.

This bullish fractal shows an end of the downtrend and it suggests an entry point for the buyers. Traders gets this as a serious buying signal and they can hold the assets for the lon term as well as for the short term.

Similarly we can spot the bearish fractals on the weekly time frame chart. The formation of the bearish fractal is actually the preparation of the long term downtrend. And it is the signal for traders to exit their long positions and prepare themselves for the short positions.

Question 4: Develop a Trading Strategy Based on Fractals

Create a complete trading strategy using fractals for the Steem token. Specify entry and exit points, stop-loss levels, and use recent fractals on a chart to support your strategy.

I have analyzed the STEEM/USDT chart in the 45 minutes time frame in the recent fractal formation. In the above chart you can see a bullish fractal. This fractal was formed September 22, 2024. And it gave an opportunity to the traders to take some profit. It was actually a setup for the short term.

Those traders who do scalping and intraday trading they can get benefit from this and indeed others as well but the long term investors should analyze the weekly time frame charts.

Take Entry: As soon as the bullish fractal was formed when the 5th candle crossed the lower low. It was the time to take an entry in the STEEM/USDT at the current price of .

TP 1: As it is a short term trading setup according to the current fractal. So you can book your first profit near the local resistance from where the price can move downward. So TP 1 will become $0.1956 with a profit of 2.25%.

TP 2 and Exit: If you are ready to hold it for some more time then you can wait to reach the price level to the next resistance zone. You should not become panic and wait for more time to get some better profit. So according to the above chart we can book TP 2 at the price level of $0.20 which will give us 4.47% profit. And here at this range the bearish fractal is forming and price is like to go down in the form of a correction.

Stop Loss: If the market does not go in our determined sentiment by the fractal level then we have to exit our entry. We can exit our entry from the deepest low of fractal itself. Because if the price approached it then it is expected that price will go down and in order to remain safe we can exit our entry at that point.

In the above STEEM/USDT chart we can see a bearish fractal where 5 candles are formed. First 2 candles are in the upward direction and the middle one is more higher than those. But after those new candles are forming which are retracing the price of the previous candles and suggesting a bearish fractal.

Take Entry: As the bearish fractal has formed so it is the time to take a short entry to make some profit in the short term. We can take entry at $0.1965 and the entry zone is mentioned in the chart as well.

Stop Loss: After taking the entry if the market does not follow the sentiments of bearish fractal and rise upward then we can cut our short trade at the high of the middle candle of the bearish fractal as mentioned in the chart.

Exit: After the successful entry it was also necessary to exit the entry at time without loosing the profit. So we can exit our short trade at the support level. The exit point is mentioned in the chart.

So in this way we can setup a complete trading strategy with the help of the fractals geometry. These are helpful to find out the turning points of the market.

Question 5: Analyze Steem’s Current Market Trend with Fractals

Analyze Steem’s current market position using fractals. Where do you think the Steem token is in its fractal cycle (bullish or bearish)? What are the next possible moves? Support your analysis with other indicators such as RSI or moving averages.

Analyzing the behaviour of the market is not an easy job but there is a great risk of trading all the time. So one should be very careful while analyzing the market behaviour of the tokens. Similarly in order to analyze the current situation of the STEEM price is not an easy job because at the same time there may be different options in the market indicating different trends.

If we look the above chart which is a 4 hour time frame chart of STEEM/USDT trading pair. We can see 2 big bearish and bullish fractals on the chart. The first bearish fractal was formed after the uptrend and it caused the price to move downward up to $0.15. It was s significant decline. RSI indicator was also in the favour of the correction by giving an oversold signal. I have highlighted the RSI value with the help of the circle.

After this the market behaviour changed and the price moved sideways under the local support and resistance level. After this consolidation period the price of the STEEM/USDT formed another swing.

After the sideways the price of the STEEM/USDT pair started moving upward. Actually a bullish fractal formed which drove the price of the STEEM/USDT upward to $0.20+ and currently STEEM is moving in this price. The value of the RSI indicator also gave signal in the upward trend. Because the RSI value was near 40 and it was a buying opportunity for the traders.

Next Possible Moves

It is a difficult task to determine the next possible moves of any token. But with the help of some straegies such as fractals and indicators like moving average and RSI indicator we can determine the next possible moves of the tokens.

In the above STEEM/USDT chart we can see that the price of the STEEM is is moving beyond $0.20 and the price is stuck in this range.

If we see the RSI indicator it is giving the RSI value of 61+. And if the value if 70 or near then it indicates a oversold signal and suggests that the market will go down.

So here seeing the RSI indicator and the fractals we can say that currently steem is facing a resistance and it can take a little correction. So we can say that the bearish fractal cycle of the STEEM/USDT is forming soon which will cause the correction.

But on the other hand if STEEM breaks its resistance level then the price can move upward. And it will form a bullish fractal and the price will follow the uptrend.

Conclusion

Fractals are important elements in trading cryptocurrencies. They help us to determine the turning points and the next possible movements in the market. We can predict the trend reversals with the help of the fractals. A fractal is formed by the 5 candles. In the bullish fractal the first 3 candles are downward but the middle one is more lower than others and the next 2 candles crosses the previous ones and they cause to drive the price in upward direction. Similarly a bearish fractal works the same but in the opposite direction. Sometimes we may fail to find the correct reversal with fractals. So in order to confirm the accuracy of the trend we can use other indicators as well with the fractals such RSI, Moving Average and Alligator. They play a key role in the confirmation of the trend reversal along with the fractals.

Disclaimer: All the screenshots have been taken from TradingView and edited by me other used assets are stated.

X Promotion: https://x.com/stylishtiger3/status/1839483626133606687

@mohammadfaisal I especially appreciate how you broke down the patterns and their role in identifying trend reversals. The examples of bullish and bearish fractals in the STEEM/USDT pair really helped me understand how to spot turning points in the market. Combining fractals with other indicators like the RSI is a great strategy for improving accuracy. Thanks for sharing this valuable information and good luck with the contest

Thank you it was a technical analysis post about fractals and implementing fractals while trading STEEM/USDT

My dear friend as always you have analyzed very nicely and presented the cycle of Bolis faculty and Bearis faculty very nicely. Of course we need to understand the market trend before changing the market trend. We can save our funs through these times. I can take exit from the market. Anyway thank you very much for participating in the contest and best of luck.

Thank you so much for stopping by here. Indeed bullish as well as bearish fractals help us to trade carefully.

You have given a good description in your post of how fractals along with relative strength indicator RSI can strengthen trend prediction and eliminate false signals. . Real examples of Steem/USDT, in particular, clearly show how all the indicators mentioned above interact to give bullish and bearish signals. I found this very useful as you emphasized the need to use multiple indicators to increase the validity of an assessment. This can go a long way in improving the quality of decision-making as well as helping traders deal with risk. Combining great analysis with understandable instructions, this post can be useful for anyone interested in technical analysis. Good Job Brother..!

Thank you so much for stopping by here and leaving your valuable feedback.

You are right we can validate the turning points highlighted by fractals with the help of the rsi indicator.

Your strategy explanation is very clear and informative.

It can open new horizons in terms of trading.

Thanks and good luck for the contest.

Thank you for stopping by here and leaving your valuable feedback.