Steemit Crypto Academy Contest / S8W2 - What are Stablecoins?

Hello everyone, how are you doing, I wish everyone a Happy new season and I hope everyone is doing great, I welcome you to week 2 season 8 of the engagement challenge, and here I shall be participating in the contest discussion of "What are Stablecoins?".

We are all familiar with what a stablecoin is despite that we might not have a deep knowledge of it, Still, we understand that we do have a stablecoin of our own on the platform known as SBD, here I shall explain the details of stablecoins to you in this article, why they were created, and their usefulness, Happy Reading!!!

Stablecoins are the type of cryptocurrency that is designed to maintain a stable price, as the name implies "Stable" which they are unlike the other cryptocurrencies we are all familiar with like Steem, Tron, and others which are volatile in terms of their price, what makes stablecoins reliable is because they have stable value.

How did they manage to ensure a stable price?

There are a couple of ways in which stablecoins maintain their price stability which are ;

Peggings: Some stablecoins maintain stability through pegging, which means they are pegged to the value of a specific asset, such as the case of Terra LUNA and Terra UST.

Algorithm: Other Stablecoin uses algorithms to maintain their stability, in a way by which they adjust the supply of the coin to keep the price within a certain range.

Stablecoins are created for a lot of reasons;

To create an asset that has a stable value and maintain its stability.

Give users the ability to hold a currency without having to worry about its extreme volatility and leave users at calm

Give room for everyday purchases, in the case of business transitioning, instead of making payments in a cryptocurrency that is unstable which might deem to leave the owners at risk of volatility, with stablecoins, users can easily make purchases and sales without having too much worry of the price drop rather than making a loss in the transaction.

- How are they useful?

Transactions: One of the major uses of stablecoins is that they provide a way for businesses to make transactions using cryptocurrency without customers and clients worrying about price fluctuations. This makes them a more reliable option for purchases like buying groceries, paying bills, or making other small purchases.

Trading: Another usefulness of Stablecoins is that they can be useful for trading, as we are familiar with Tether USDT which is the largest Stablecoin, this gives users the ability to trade different assets and convert to the stablecoin at the end of the day to recoup your earning.

Stability: Just like I had said earlier, stablecoins are cryptocurrencies that are designed to be stable, they are a more reliable option for crypto users who are basically interested in holding a cryptocurrency for the long term. This can serve as a safe investment for them since they are in for a long, and they get not have to worry too much about value drop.

The most popular stablecoins of all time are Tether (USDT) and USDC, these two coins have been around for a while and they are both pegged to the US dollar but they use different technology and both have their own uniqueness.

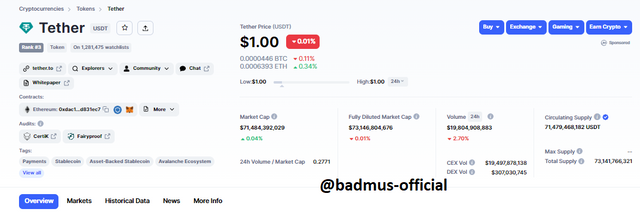

Tether(USDT)

Tether USDT is currently ranked 3rd in the list of coins with a Market Cap of $71,484,254,812, this is majorly used for its stability in trading assets in the most centralized exchanges.

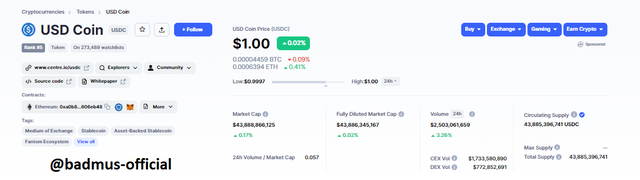

USD Coin(USDC)

USDC is also another popular stablecoin ranked 5th with a Market capitalization of $43,888,866,125, unlike Tether, USDC is mostly used in De-FI programs such as Yield Farming, Lending, and Swapping, it has proven to be the second best stable cryptocurrency.

Which do you use more and why?

I do make use of Tetheer USDT more because most of my trades are based on the centralized exchange as I don't often patronize Defi's platform, and I find it easier to convert as well.

YES!! , Stability coins are likely to lose their stable value which might be due to several reasons.

An example is the case of Terra UST, which happens because LUNA starts losing its value and the LUNA coin serves as the stability backdoor for UST, as the stability is no longer in the form to patch the supply of UST, then Terra UST began to lose it stability as well causing downtrend, this was a case that happened 2022 and it was one of the greatest loss in the crypto realm.

- Advantages Of Stablecoins:

Stability: One of the biggest advantages of stablecoins is their stability, they provide a way for users to hold cryptocurrency without having to worry about market fluctuations.

Recoup Investment: Stablecoins are advantageous in a way that they give users peace of mind to recoup investments, which after traders had successful carry on several trades for the day, gives them more chance to safeguard their investment in stable assets without having to worry about losing.

Liquidity: Stablecoins provide more liquidity than traditional cryptocurrencies, simply because they can be easily exchanged for other assets or fiat to cash without users having to worry about price volatility.

- Disavdantages Of Stablecoins:

Risky - One of the major disadvantages of stablecoin is that they are risky and there is a probability that it could lose its stability, which could result in a huge amount of losses for users.

Security Conscious: Stablecoins are just like any other cryptocurrency, which means they are not prone to hacking which could mean a massive loss to the user.

In summary, stablecoins and traditional cryptocurrencies both have their own advantages and disadvantages and are both related in a couple of ways as they are both decentralized assets and carry the same weight as any cryptocurrency.

The major difference between them is that stablecoins are cryptocurrencies that are stable in value while Traditional cryptocurrencies are less reliable, volatile, and can't serve as a method of payment.

Stablecoins is one of the interesting development in the cryptocurrency realm, giving users assets that offer reliability and also serve as a safe investment option for users who are interested in holding digital assets for a long time without having to worry about their price volatility.

Thank you everyone for coming, I hereby invite @solexybaba, @josepha, and @Sahmie to participate in the contest as well.

Hi @badmus-official, how are you?

Just came across your post and found it interesting to read and get some knowledge out of it.

You have explained what you think about stablecoins and how they are managed to stay stable in the market.

Then you discuss about why it was needed to design stablecoins. The reason is right that you mention is an asset that must have stable price, giving users the ability to hold a cryptocurrency without any fear of lossing it's value.

After that you mentioned about famous stablecoins that are USDT and USDC. Your personal favorite is USDT and also was mine but now my favorite is BUSD.

Stablecoins can lose their stability if issuer makes problem and if he hides backed asset to lose confidence of investors.

You have also mentioned the advantages and disadvantages of stablecoins.

Overall, you have shared with us quality content that is full of knowledge for people like me. I wish you best of luck for the contest. Thank you :)

TEAM 1

Congratulations! Your Comment has been upvoted through steemcurator04. We support good comments anywhere..Thank you 💕

Thanks for the input my friend, you seem to have got your own interest in BUSD, well Binance Stablecoin is in fact one of the best as it offers you free service on the exchange, nice input bro, good luck to you.

My Pleasure :)

Greetings.

No doubt that the stablescoin are a very useful tool in the world of cryptocurrencies because with them we can somehow protect our money in the face of high market volatility.

Stablecoins provide a safeguard for us in protecting our assets, it's a genius innovation!!

Hey buddy @badmus-official,

While scrolling through steemit and reading interesting post, I couldn't pass by yours without appreciating the hardwork you have put into place to ensure that you delivered this interesting and informative posts.

I particularly appreciate your approach to the first question, you made us to understand why a stable coin is called a stable coin.

It was gotten from the word stable which distinguishes it from other coins like steem and TRX.

I also agree with the answer you gave to the fourth question, yes, a stable coin can loose its stability.

The example you gave to yours is similar to the example i gave, the fall if Terra Luna.

I actually feel pity for those that suffered great loses.

Overall, you have given your best to this contest and I wish you all the best 😊😊

I'm stunned by those words bro, you got me all smiling in a funny way, well, you've been a top content creator as well on the platform, well respect you for that.

The Fall of Luna kind of exposed people to the thought that stablecoins are not totally safe, anything can happen, algorithms might fail or supply could lose value, it's indeed a terrific year, but I hope everyone moved on to a new phase of the market.

Yeah, I agree with you, algorithm can fail, we are to expect anything in the crypto space.

Thank you again 😊

Great job, @badmus-official! Your post on stablecoins is well-written and informative. Your explanation of what stablecoins are, their benefits, and their various types is very helpful for those who are new to the world of cryptocurrencies.

I appreciate that you provided real-life examples of stablecoins like Tether, USD Coin, and Dai, which helps readers understand how they work and their practical applications. Your discussion on the risks and challenges associated with stablecoins is also valuable, as it helps readers make informed decisions when it comes to investing in stablecoins.

Yes sir!! I'm glad you agreed with the knowledge shared, stablecoins both have their good sides and their bad sides, despite that it is a safe option for investment, that doesn't mean it's a total saint, anything is bound to happen.

TEAM 1

Congratulations! This post has been upvoted through steemcurator04. We support quality posts, good comments anywhere and any tags.Thanks for the support my friend, have a nice day ahead.

Las monedas estables, a diferencia de las criptomonedas tradicionales, pueden mantener su precio estable como su nombre lo indica ante lo voluble del mercado; sin embargo, el caso de Terra Luna por ejemplo, es solo una muestra que tal estabilidad puede perderse. Exito en tu gran entrada. Saludos cordiales!

Thanks mary , and more goodluck to you too, yes stable coin also has it bad side despite that they are good investment , anything can happen, thats why its always safe to advice people in crypto to DYOR and invest what they could afford to lose.

This is actually one of the best experience with the stable coins. One can recoup or gather their assets after they’ve successfully completed a trade. Also traders can convert their assets into stable coins and wait for the right time to then use them to trade.

You have actually explained what stable coins are in details. Good luck buddy

Really appreciate your post on Stablecoins for a fact you have written a well presented article.

I especially agree on the fact you mentioned concerning one of the merits of stablecoin in that it helps secure or protect our investment against market fluctuations, yes indeed Stablecoins are a good way to hedge our profit in cryptocurrency.

I have learned a lot reading your post on stable coins. I am adding knowledge to what I know already about it.