SEC S16-W5 || Navigating the STEEM Token

|

|---|

INTRODUCTION |

When we talk about the word "Sentiment", we are talking about emotions and feelings. Hence, we can say sentiment is like the overall vibe or mood that someone or something gives off. That is, if you are feeling happy and excited about something or someone, we can say that is a positive sentiment and if you are feeling down, sad or angry about something or someone, we can say that is a negative sentiment.

Sentiment can also be said to be the feelings or opinions of a person or a group of people towards something or someone and it is used to describe whether the overall perspective towards a particular thing is positive or negative, and it can also be used to describe the intensity of that attitude.

|

|---|

For example, the sentiment towards a new movie could be positive if people are excitedly discussing it and recommending it, or negative if people are expressing disappointment and criticising it.

Hence, Sentiment is a way for us to describe how we feel about something or someone and this can be influenced by different factors and can vary from person to person. This week's topic is centred around how people's feelings towards the STEEM token can affect or influence the Steem community perspective and the token price movement. Like always, I hope you get to learn something new this week.

How can analyzing sentiment around the STEEM token on social media provide clues about the community’s overall perception and influence price movements? |

|---|

Knowing what sentiment is all about, as the feeling of someone towards something or someone, then what is sentiment analysis?

Sentiment analysis is the process of analyzing large amounts of data, such as social media posts, news articles, and customer reviews, to determine the general feelings or attitudes expressed in the text.

So, sentiment analysis is like having a special tool that can us understand and analyze the vibes and feelings towards something. It is a way to help us figure out the overall mood, opinion or perspective of something, like a social media post or a customer review.

|

|---|

This is such a cool tool because it can tell us if something is positive, negative, or even neutral. Hence, it is like having a magical tool that can help us read between the lines and understand the emotions behind what people are saying. Sentiment analysis is super helpful to know how people feel about something and understand public opinions about something. Therefore, I can say Sentiment analysis is like having an emotion detector or emotion detective working for you.

The general aim of sentiment analysis is to provide insights into how people feel about a particular topic, product, or brand to help businesses and organizations understand public perception and sentiment towards their brand and products and make better decisions accordingly.

For example, a company that produces cars may use sentiment analysis to analyze customer reviews of their latest automobile model. They can then identify common themes and sentiments expressed in these reviews, such as praise for a feature or criticism of a design flaw. This information can be used to make improvements and changes to future models, as well as positively impact the brand's reputation.

Sentiment analysis can also be used in social media marketing to identify popular topics and trends and tailor advertising campaigns accordingly. By analyzing sentiment, businesses can gain insights into what their customers want and need, and create more effective marketing strategies.

Therefore, analyzing the sentiment around the STEEM token on social media is like eavesdropping on conversations online to get a sense of how people feel about the STEEM token. That is, by looking at what people are saying on platforms like Twitter or Reddit, we can get clues about the overall perception of the STEEM community.

If people are talking positively and excitedly about the STEEM token, this indicates that the community has a positive outlook on the token, whereas if there is a lot of negativity or scepticism, it could suggest a less favourable perception.

These sentiments can therefore influence the price of the token because if there is a positive buzz around it, more people might want to invest in the STEEM token, driving the price up, and if there is a negative sentiment, it could discourage people from investing, potentially affecting the STEEM token price negatively.

Therefore, analyzing sentiment around the STEEM token on social media can provide clues about the community’s overall perception and influence price movements in the following ways;

Market sentiment:

Social media platforms like Twitter and Reddit are popular channels for cryptocurrency investors and traders to share their opinions, views, and analysis on the market. By analyzing social media sentiment, we can gauge the overall market sentiment towards STEEM. Positive sentiment could mean that demand for STEEM may increase, which could drive prices up.

Community engagement:

The level of community engagement on social media regarding the STEEM token can be a good indicator of its popularity and adoption level. Positive sentiment and high engagement could suggest that there is growing interest in STEEM, indicating a potential bullish trend.

News and announcements:

We are all very much aware of how news outlets can affect the price of any goods, even cryptocurrencies and social media is often the first channel through which investors and traders find out about news and announcements related to a cryptocurrency.

Hence, analyzing the sentiment around such news can provide insights into how the market will react. For example, if a major STEEM protocol update or partnership is announced, and the sentiment around the news is overwhelmingly positive, this could lead to increased demand and higher prices.

Influencer impact:

Social media influencers, such as analysts, traders, and personalities, can greatly influence the sentiment and price of STEEM, therefore by keeping track of their posts and analyzing the sentiment around them, we can get an idea of how their opinions may affect the market.

How can emerging trends on social media platforms, such as Twitter and Reddit, be used to anticipate potential STEEM market implications? |

|---|

As I have earlier stated, social media platforms like Twitter and Reddit can be very useful for following up on emerging trends related to a cryptocurrency like STEEM. Therefore, by keeping an eye on discussions, opinions, and reactions to events related to STEEM on these platforms, one can anticipate potential market implications.

Therefore, I can say that emerging trends on social media platforms like Twitter and Reddit can give us hints about how they might impact the STEEM market.

Think of it like this, when lots of people start talking about something related to STEEM maybe a new DApp or project on STEEM blockchain, it can create a buzz and catch people's attention.

For example, if there's a sudden surge of positive posts about STEEM, it might indicate that more people are getting interested in it and this increased interest could potentially lead to more demand for STEEM, which could influence its market value.

On the other hand, if there's a negative trend or a lot of scepticism being expressed about STEEM, it might make people hesitant to invest in STEEM, which could have an impact on its market implications.

How can sentiment analysis be combined with other technical indicators to enhance the importance of STEEM-related trading signals? Provide a graphical analysis that illustrates this point of view. |

|---|

I have explained sentiment analysis to be a special tool that helps us understand the overall mood and emotions behind people's opinions on any cryptocurrency to tell us if the sentiment is positive, negative, or neutral. Therefore, when we combine sentiment analysis with other technical indicators in trading, it's like putting together puzzle pieces to get a clearer picture.

Technical indicators on the other hand are tools that help us analyze the price and volume movements of a cryptocurrency, therefore, by combining sentiment analysis with these indicators, we can get a more comprehensive understanding of the market.

For example, if sentiment analysis shows positive sentiment towards STEEM, and technical indicators like moving averages or volume analysis also indicate positive trends, it could be a strong signal that STEEM might be a good investment.

On the other hand, if sentiment analysis shows negative sentiment and technical indicators confirm a downward trend, it might suggest that it's not the best time to invest in STEEM. Therefore, by considering both sentiment analysis and technical indicators, we can make more informed decisions in trading.

Thanks to this topic and this particular question a graphical analysis was needed and due to my search for graphical analysis, I have come to learn something new through my research, you might be wondering what it is, do not worry, I will share it with you all.

I have come to learn some common Sentimental analysis tools, tools such as;

- Volume Profile

- Commitment Of Traders (COT)

- Fear and Greed Index

- Relative Strength Index (RSI)

You might be wondering how these tools measure market sentiment, right? I will explain and share my findings with you.

Volume Profile

Volume Profile serves as a means for us to understand how much trading activity is happening at different price levels. This means that it helps users see where there is a lot of buying or selling happening.

Therefore, when there is high volume at a certain price level, this indicates that many traders are interested in buying or selling at that level, hence this can give users clues about market sentiment because it shows where traders are placing their bets.

For example, if there is high volume at a specific price level, it suggests that traders have a strong opinion about that price and believe it is a good entry or exit point and on the other hand, if there is low volume, it may indicate that there is less interest or conviction in that price level. Therefore, the Volume Profile can be used to analyze market sentiment by identifying key levels where traders are active and making decisions.

However, I am sorry to say I can't provide a graphical analysis for this tool, as it is way above my subscription level on Tradeview right now.

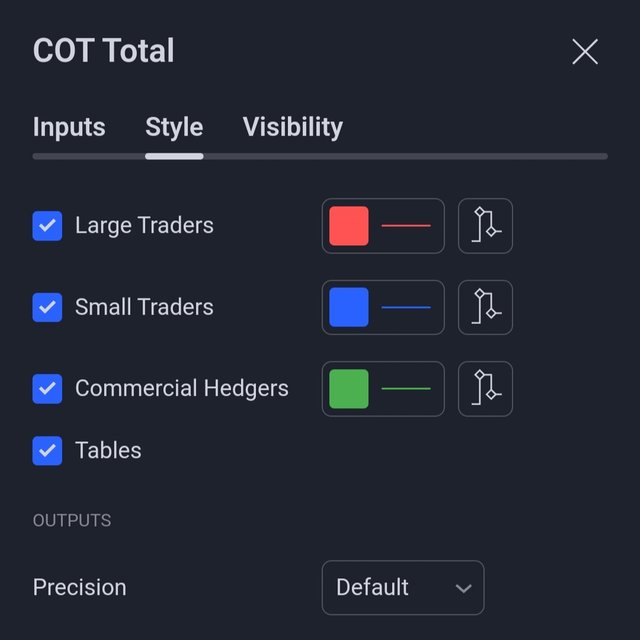

Commitment Of Traders (COT)

The Commitment of Traders (COT) report for a cryptocurrency or any financial market provides insights into the positions of different types of traders in the market and this helps us understand whether traders are bullish or bearish about the future price movements of a cryptocurrency.

This report categorizes traders into different groups, such as commercial or large traders, non-commercial traders, and small traders. Therefore, by analyzing the positions of these various groups, we can get a sense of the market sentiment.

For example, if the non-commercial traders (speculators) are holding a large number of long positions, it suggests they are optimistic about the price going up. Conversely, if they hold more short positions, it indicates a bearish sentiment. Therefore making the COT report a helpful tool to gauge market sentiment and make more informed trading decisions.

|

|---|

The above screenshot shows the COT of BTC, under the 1 Day timeframe showing the various traders and their interactions with the price moments showing in green (🟩) arrows (bullish movements) and the red (🟥) arrow (bearish movement). Where;

- Red (🟥) represents the large traders.

- Blue (🟦) represents the small traders.

- Green (🟩) represents the commercial hedger

|

|---|

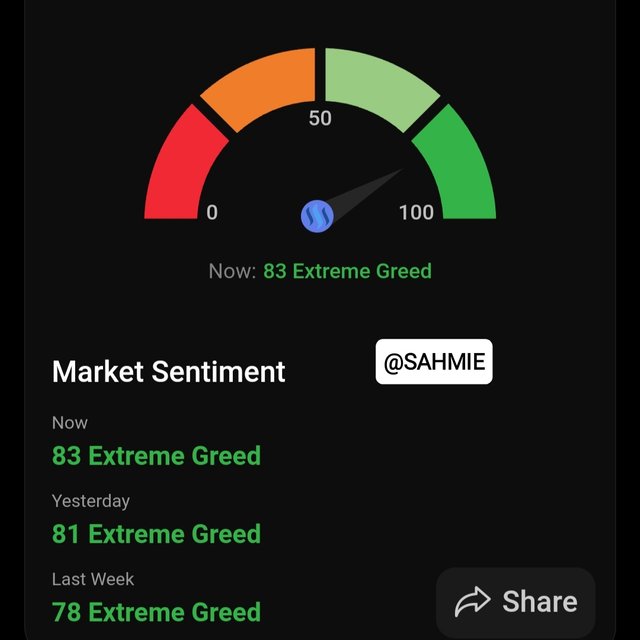

Fear and Greed Index

The Fear and Greed Index of a cryptocurrency is a way to measure market sentiment or the overall feeling of investors in the market and it is based on various factors like price movements, trading volume, social media buzz, and more, making it a more complete tool for sentiment analysis.

Therefore, when the index value (which is usually from 0-100) is high usually above 70, it suggests that investors are driven by extreme greed and may be more willing to buy, potentially indicating an overbought market, while when the index is low usually below 30, it suggests extreme fear and caution among investors, possibly indicating an oversold market.

|  |

|---|

The above screenshot shows the Fear and Greed Index of the Steem token, with an index value of 83% which gives an indication of extreme Greed, meaning users are holding onto their tokens and is more willing to more also. Therefore, the Fear and Greed Index is one tool that analysts and traders use to get a sense of how people are feeling about a cryptocurrency.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a mood indicator as it measures the strength and speed of the price movements to help determine if a cryptocurrency is overbought or oversold. It is usually measured on a scale from 0 to 100 which tells you if people are getting too excited or too worried about a cryptocurrency.

However, when is above 70, it is considered to be high and means that the cryptocurrency might be overbought. This signifies when everyone is super excited and buying a lot, which could indicate that the price might drop soon. while, when the RSI is low, usually below the 30 mark, it means the cryptocurrency might be oversold and likened to when everyone is feeling down and selling a lot, which could indicate that the price might go up soon.

|

|---|

The above screenshot shows the RSI of STEEM, under the 1 Day timeframe showing the oversold positions circled in Green (🟩) and the over bought position circled in Red (🟥). However, on the current market index, Steem is on a neutral ground.

Therefore, the RSI indicator is a way to gauge market sentiment and see if people are getting too greedy or too fearful about a cryptocurrency, which can help traders make decisions based on the current mood of the market.

What are important considerations when using sentiment analysis in a volatile market environment, and how can it help investors make more informed decisions about STEEM? |

|---|

When using sentiment analysis in a volatile market like STEEM, there are a few important factors we should consider, such factors include;

The Context:

Sentiment analysis looks at the overall sentiment or feelings of people towards a particular cryptocurrency, like STEEM. However, it's crucial to consider the context in which the sentiment is expressed. Factors like news events, market trends, and social media buzz can heavily influence sentiment. Therefore, it is important to look at the bigger picture and not solely rely on sentiment analysis.

Accuracy and reliability:

Sentiment analysis tools are not perfect and can sometimes misinterpret or misclassify sentiments. Therefore, it is important to use reliable and accurate sentiment analysis tools or services to ensure more accurate results.

Time sensitivity:

Sentiment can change rapidly in a volatile market, i.e., what may be positive sentiment today could turn negative tomorrow. Hence, it is important to consider the time-sensitivity of sentiment analysis and regularly monitor the sentiment of STEEM to stay up to date with the latest market trends.

Source Quality:

The quality and relevance of the sources from which sentiment analysis is conducted are crucial. Social media platforms can be a valuable source of sentiment data, but it's important to verify the authenticity and trustworthiness of these sources.

Data Volume:

The amount of data being analyzed should be sufficient for accurate results. In a volatile market environment, high-frequency data can be more useful than less-frequent sources of information.

Unpredictability:

In a volatile market environment, there can be unpredictable events or news that can cause sudden changes in sentiment and market conditions. It's important to keep this in mind when analyzing sentiment and making investment decisions based on this analysis.

How can constant monitoring of trends and sentiment analysis on social media provide traders with a strategic advantage in the dynamic STEEM market environment? |

|---|

By constantly monitoring trends and sentiment analysis on social media, traders can gain certain strategic advantages in this dynamic STEEM market environment and such advantages include;

Early identification of market trends:

By constantly monitoring social media platforms, traders can identify emerging market trends and sentiments related to STEEM. This enables them to take early action to buy or sell STEEM tokens, thereby capitalizing on potential price movements before others do.

Real-time insights into community sentiment:

Social media platforms provide real-time insights into community sentiment towards STEEM, enabling traders to stay updated on the latest developments and market updates. This helps them assess the potential impact of these developments on the STEEM market and adjust their trading strategies accordingly.

Predictive analysis:

Social media sentiment analysis can be used to predict future market trends based on historical data and trading patterns. This allows traders to forecast price movements and make trading decisions accordingly, giving them a strategic advantage in the market.

Risk management:

Social media monitoring enables traders to identify potential risks associated with STEEM tokens at an early stage. This makes it easier to take appropriate risk management measures and minimize potential losses.

Competitive analysis:

Social media analysis can also provide insights into competitor strategies and market trends, enabling traders to assess where they stand in the competitive landscape. This can help them develop better trading strategies and make more informed investment decisions.

CONCLUSION |

In conclusion, Navigating around the Steem token and social media analysis can be a bit complex, but then, the bottom line is that the Steem token allows users like us to earn rewards for the content we create on the Steem blockchain, while social media analysis helps us understand the various trends and user behaviours around the Steem environment. Therefore, by digging through Steem and analyzing social media outlets, we can gain an understanding of how these various components such as social media and user behaviours can impact the Steem token, its price and the environment.

I wish to invite @starrchris, @ngoenyi, @chants and @hamzayousafzai.

Thank You for your Time

NOTE: Always have a smile on your face, as you are never fully dressed without one.

That's really great to know your perspective about sentimental analysis and that's great that before moving on questions asked you have given all view of the topic by explaining sentiment in your own word sentiment is basically attitude of people which could be general users or investors towards the particular thing and if people are attracting towards a particular thing then it means that there is a positive sentiment and if people attention is distracting from a particular thing then it means that it is an negative sentiment that is going to create so here we are particularly talking about sentiment world which is used in cryptocurrency and that's why it is very significant to talk about sentiment analysis.

I extremely agree with you that example you have explained that suppose if there is a new app which is introduced at steem blockchain and where there are exceptional features that are beneficial for its uses it is providing then it would be a source of attracting new and new people with a passage of time and it will make the blockchain more stronger.

Your analysis was really very helpful to know the understanding of the topic were providing and you have successfully implement relative strength index which is the tool for making technical analysis and you have truly elaborated that in green colour there is over buying and in red colour there is over selling so these are basically positive and negative sentiment and buying and selling opportunities for investors and by keeping in mind they can make the investment decisions.

I really enjoyed your content you have truly elaborated I wish you good luck in this challenge...

I'm glad you found my perspective on sentiment analysis helpful. Sentiment analysis is all about understanding people's attitudes towards something, whether it's positive or negative. And you're right, it's super important in the world of cryptocurrency, where people's sentiments can have a big impact.

For example, let's say there's a new app introduced on the Steem blockchain with awesome features that users find beneficial. This positive sentiment will attract more and more people over time, making the blockchain stronger and more vibrant.

And yeah, I also talked about the Relative Strength Index (RSI) in my analysis. It's a tool used for technical analysis, and it helps determine if something is being overbought (green) or oversold (red). These colors represent positive and negative sentiment, respectively.

Understanding sentiment is key in the crypto world, as it can give us insights into market trends and help us make informed decisions. So, it's definitely worth talking about sentiment analysis. Thank you so much for your support and good wishes, I very much appreciate.

I want to say that I am very thankful to you that in such an active way you respond on my comment with such kind of detail and extensiveness.

I am happy that again you have elaborated sentiment analysis in your words that it's positivity and negativity is depends upon attitude of the people what they are showing about the particular currency so if you are observing positive sentiment then it means that it is a good strategy to invest and if you are observing a negative sentiment then you should also take help from other technical analysis tools so that you may make more informed decisions.

You are also talking about relative strength index and in my last participation I have also thought about this tool that it is one of the most necessary and most widely used while making the technical analysis as well as you have clearly elaborate with the pictorial demonstration and now it is clear to everyone that which colour is showing which type of trend.

I agree with you that sentiment is one of the most important thing for making decisions related to investment in Crypto world and without it no one can investor think to move on and to make different decisions.

It was great pleasure to be at your post and to support your perspective because everything was very clear and understandable. Thank you so much for appreciating my comment too

TEAM 5

Congratulations! Your post has been upvoted through steemcurator08.The Steam Network has been doing very well since its inception. There are many reasons behind doing well. However, one of them is the trend of price increase through discussion on social media and the price trend of Steem due to some currencies being more discussed. Since many people trade. Those who are traders or investors can easily analyze the previous data and trend news and they will benefit themselves.

Community users, including traders and newbies, all need to analyze the top investor information and discussions on everything. By doing this, the new Bina will be able to make decisions very easily. Social media has a lot of fake big news, but if you watch the right news, it is definitely good for you. But a false comment or discussion is definitely a big loss for this platform. Because one bad negative discussion will make this platform appear not very trustworthy to people. That's why I will share the correct information about Steam.

Thank you so much for sharing your beautiful contest with us. Competition you succeed.

Regards @shohel44

Greetings friend,

I very much agree with you. I must say that the Steem Network has been doing really well since it started. There are a bunch of reasons for its success, and one of them is how discussions on social media can influence the price of Steem. It's interesting how traders and investors can analyze previous data and news to benefit themselves. It's also important for the community, including traders and newbies, to analyze information and discussions from top investors. That way, they can make better decisions. Social media can have a lot of fake news, so it's crucial to follow the right sources. One wrong comment or discussion can really hurt the platform's trustworthiness. That's why it's great that we are sharing correct information about Steem.

Thank you for your time and wonderful feedback, I really appreciate your support and good luck to you too.

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

@sahmie I appreciate how you have broken down sentiment analysis and its application to the STEEM token market. Your explanation of tools like volume profile and COT report really clarifies how sentiment can influence trading decisions. Best of luck in the contest

Thanks a lot for your kind words. I'm glad my breakdown of sentiment analysis and its connection to the STEEM token market was helpful. Explaining tools like volume profile and COT report can really shed light on how sentiment affects trading choices. I appreciate your support and good luck wishes for the contest.

Platforms like Twitter and Reddit are good ways of promoting STEEM so investors can be aware of STEEM which will make the steemit platform more profitable as the price of STEEM will rise in price. It is nice to read your post, I wish you the best of luck.

Absolutely. Platforms like Twitter and Reddit are awesome for promoting STEEM. They help spread the word and attract investors, which can make the steemit platform even more profitable. As more people become aware of STEEM, its price has the potential to rise. I'm glad you enjoyed reading my post, and thank you for the well wishes. Best of luck to you too.

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

Wow, very detailed and informative post! Your analysis is very important. Thanks for analyzing the sentiments shared. Checking sentiments on social media with Steem tokens

I'm glad you found the post detailed and informative. Analyzing sentiments shared on social media with Steem tokens is indeed crucial. It gives us a valuable insight into how people feel about Steem and helps us understand the potential demand for the tokens. Thanks for appreciating the analysis.

Your most welcome 🤗 brother it my pleasure to come on your post

Hello friend greetings to you, hope you are doing well and good there.

Steem is a project that is too much linked to the social media websites, because Steem in itself is a decentralized Media Blockchain. Yes ofcourse sentiment analysis play a very vital role in describing the insight data of any crypto project. You said that Sentiment analysis is the process of analyzing large amounts of data, such as social media posts, news articles, and customer reviews, to determine the general feelings or attitudes expressed in the text. This is a very valid and true definition of it. Sentiments in real words are the opinion and feelings of the users toward a project.

Now coming ocial media platforms like Twitter and Reddit, they are the most popular social media websites having huge followers. Yes you are true that these two are good sources for cryptocurrency investors and traders to share their opinions, views, and analysis on the market. Now many people take decision based on watching these two places, if it's positive they get entry, if negative take exist. You have mentioned some beautiful and very authentic indicators. I really love reading your post. This is too much superb one.

I wish you very best of luck in this contest.

Greetings friend. Thank you for the warm greetings. I'm doing well, and I hope you are too.

You're absolutely right about Steem being closely connected to social media websites. It's like a decentralized Media Blockchain. And sentiment analysis is therefore super important. It helps us understand the overall feelings and opinions people have about the Steem project by analyzing things like social media posts, news articles, and customer reviews.

Twitter and Reddit are definitely popular platforms where investors and traders share their thoughts on the market. It's true that many people make decisions based on what they see there. If it's positive, they might jump in, but if it's negative, they might consider exiting. It's like these platforms have become important indicators for many.

I'm really glad you enjoyed reading the post. Thanks for the kind words, and I appreciate the good luck wishes for the contest.