SEC S17-W4 || Crypto Assets Diversification

Assalamualaikum everyone!

Welcome back to my blog. Hopefully, all of you will be doing well and enjoying the time with the grace and blessings of Almighty Allah. Today, I'm back here to be a part of the week 4 contest in our beloved SteemitCryptoAcademy. The topic for this week is quite interesting, Crypto Assets Diversification. So, let's start the fun without any waste of time.

What are the main reasons why crypto asset diversification is important in an investment portfolio?

Well, while moving towards the importance and main reasons behind diversification of the crypto assets, let's discuss what is actually 'diversification', do you have any guess? Alright, Lemme explain it a bit more in simpler words. We are all familiar with the a very popular saying 'Do not gather all your eggs in only one basket'. This line is very concise and perfect to explain the word diversification.

Diversification is actually a very important concept in investing, especially when it comes to crypto assets. Diversifying your portfolio means spreading and distributing our crypto assets in different markets, in different exchanges, and in different blockchains. The most important advantage of this thing is that it spreads risk across multiple assets, minimizing our exposure to any single asset's volatility or possible losses (as we know very well that crypto markets are highly volatile and unpredictable).

CAD (Crypto Assets Diversification) actually reduces the impact of one asset's bad performance on your entire portfolio. We all know that excess of everything is very bad, we can also apply this thing in our trading experience as well. Overconcentration or excess of investment in a single asset can be very dangerous, and diversification helps to escape this trap.

By investing in a variety of assets, you reduce your dependency on any single asset's performance. CAD, in addition to lowering risks in the market and improving potential profits, can also serve as a buffer against market downturns or unexpected events in the market. For example, if one crypto asset in your portfolio loses value, gains in another can help balance the loss. Isn't it cool?

Another important thing to consider here is that CAD provides you with a more stable and less risky investment experience. Diversification is totally important for long-term investors who want to ride over the market changes and maintain a perfect portfolio. We are better positioned to meet our financial goals and handle the market's ups and downs if we spread risk through diversification and get exposure to different crypto assets and markets.

Can you explain how you diversified your crypto assets in your portfolio? What strategies have you used to maximize diversification while minimizing risk?

I'm into the cryptocurrency world for more than 3 years and it has been a very profitable and great journey for me so far and I wish that this amazing journey will continue for many more years. Well, moving towards the point, 'Yes' I always apply the technique of CAD to minimize the risks in my crypto portfolio and maximize the chances to get the best from the volatility of the crypto market.

I have diversified my total funds in the crypto space in such a way that I have to face minimum loss if the market moves against my predicted direction. I have distributed my funds in different wallets, in different exchanges, and most importantly, in different coins.

Some of the crypto assets in my crypto portfolio are those which I have claimed from different Airdrops or Mining projects. So, I try my best to give the best of my best to any project on which I work. I make the choice of the mining projects and airdrops in a very careful manner. I always try my best to study all the fundamentals, all market aspects, the back hands, the future, the supply, the tokenonmics, the allocation of the assets and many more things before working on any project.

Besides the airdropped and mined crypto tokens, whenever I have to trade or invest in any crypto asset then I always try my best to have a complete (or at least, enough) study of all the aspects related to the token and it's blockchain. I always study the historical aspects, the supply and demand, the utility (use cases), the market influencers, the historical performance of the projects and so many things before investing in any token.

Another important technique to do diversification in the best way is to invest low amount in the highly volatile tokens, and invest more in the less volatile (but having good use cases) assets so that we have the maximum chances to get good profits whenever the market moves in our favorable direction and have to face low loss when the market is behaving in the opposite direction.

Moreover, it is totally important to consider the other things like the genre of the projects in which we are investing. We should divide our funds in projects of different genres like gaming, finance, artificial intelligence, science, fintech, and so on. Besides that, the diversification of assets in different chains (i.e, BSC, Ethereum, Solana, Avalanche, etc.) and exchanges (i.e, Binance, OKX, Bitget, Gate.io, etc.) is also very much important technique that I usually follow.

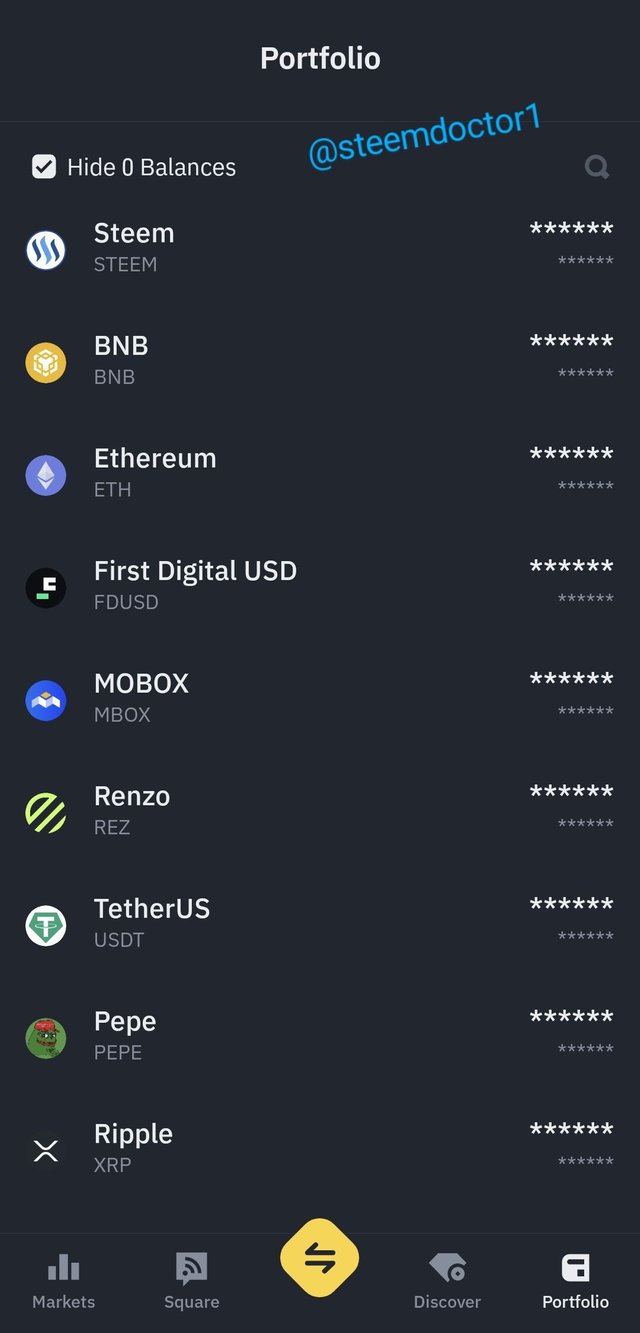

Have a look at my diversified crypto portfolio in different exchanges, tokens, projects of different genres.

|  |

|---|---|

How can diversifying crypto assets help mitigate market volatility? Can you give concrete examples of situations where diversification has had a positive impact on your portfolio?

As we have already discussed what is diversification of the crypto portfolio and what are the major reasons behind the diversification of our crypto portfolios. CAD helps us a lot to minimize our risks and maximize our gains on the market moves, at the same time. Let's consider some scenarios to understand it's importance more perfectly.

Bitcoin (BTC) and Altcoin Diversification is the first and the most important thing which helped the traders a lot during the 2018 bear market. As BTC's price fell by more than 70%, some other altcoins such as Binance Coin (BNB) and Huobi Token (HT), have grown significantly as a result of their connections to successful exchanges. A diversified portfolio that included both Bitcoin and several altcoins would have lowered overall losses.

Besides that, the stablecoins diversification is another perfect scenario. Including stablecoins such as USDT or USDC in a portfolio can help us to mitigate market volatility. During the times of excessive volatility in the market, stablecoins might serve as a safe haven, lowering total portfolio risks in overall.

Another important kind of the diversification is in the projects of different genres. Investing in several areas or genres such as DeFi (Decentralized Finance), Gaming, Artificial Intelligence (AI) and Social Media can help to reduce market volatility. If one industry suffers a downturn, then probable gains in another can offset losses and thus thing can reduce the overall negative impact on the portfolio.

- My Personal Experience...

Well, I still remember the time of the last days of the February and starting days of the March of this year. At that time, most of my funds were distributed in two tokens, STEEM and ICE. Actually, I was already holding STEEM tokens for so long and then I received a good amount of ICE tokens as the mining of ICE Blockchain ended in February 2024.

Well, when I claimed my mining rewards I was thinking that the market will pump even more and for that, I will hold these ICE tokens for a long term. Well, I also deposited some funds in my OKX exchange to buy more ICE tokens (besides the mined ones). But unfortunately, the market started dropping little by little, as you can see in the below screenshot.

In the above screenshot, you can see that the price of the ICE token was continuously dropping which was badly effecting my portfolio. But, wait wait wait! As I have already said, I was also holding an awesome amount of STEEM tokens on the other hand. So, those STEEM tokens proved to be the buffers for my portfolio at that condition and maintained my portfolio. Have a look at the below screenshot in this regard.

In the above screenshot, I have highlighted the pumping market of the STEEM token. Here, the STEEM tokens were providing good profits and this profit helped me a lot to cover the overall loss that I faced from the ICE token. So, in this way Crypto Assets Diversification helped me a lot to balance my portfolio. This is exactly what we expect when we have a good strategy of CAD.

How does the STEEM token fit into your crypto asset diversification strategy? What is its role in your portfolio and how did you select it among other assets?

The STEEM token plays a very important part in the diversification of my crypto portfolio. The first thing is that I am gathering good amount of Steem tokens in the form of SP (Steem Power) in my on-chain wallet and this thing helps in the diversification of my portfolio. Moreover, many times the STEEM token helped me a lot to balance the overall crypto portfolio (one of such cases is also discussed above).

The STEEM token has always been a very important part of my cryptocurrency portfolio. I have been working on the Steemit platform for more than two and a half years and this is the very reason that STEEM token has always been a very major part of my cryptocurrency portfolio. There are so many reasons behind this so let's discuss the most important ones,

The first and the most important reason is that I am very much optimistic about the future of the Steem Blockchain as it is one of the best performing blockchain projects in the crypto world. The historical events that had occured in the STEEM market are also another important reason behind my trust on this crypto token.

As I am active user of the platform for so long, and I have a good knowledge about the utility of the STEEM token on the blockchain, so I always prefer allocating a huge amount from my funds to the Steem market. Another thing that encourage me to invest in the STEEM token is that, even if the STEEM price goes down, I can still deposit my tokens on the Steemit platform and earn good passive rewards through curation and staking.

Moreover, being active user of the platform I got the awareness about most of the events occuring on the platform and which can effect the market and this thing helps me a lot to make timely and effective decisions regarding the STEEM token. So, all of the above reasons are very valid to make the STEEM token stand at the top of my list, have a look at the below screenshot in this regard.

Can you share a detailed analysis of your crypto assets, including their distribution, historical performance and the criteria used to select these assets? How do these choices reflect your overall crypto asset diversification strategy?

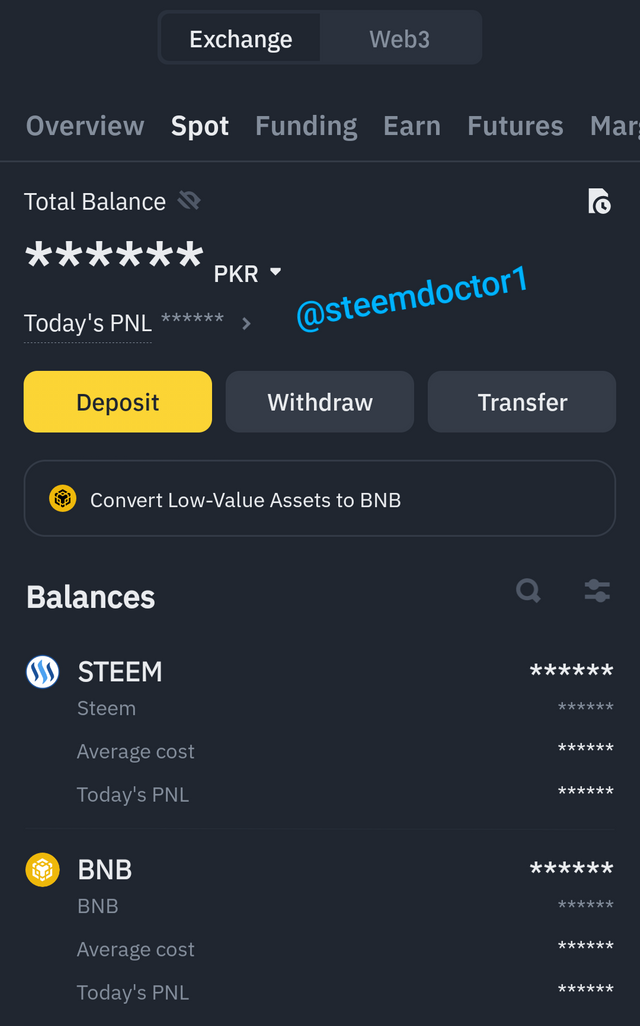

At this time, I am holding most of my crypto assets in the two major exchanges, Binance and the OKX Exchange. So, let's discuss the major tokens that I am holding in these two exchanges at the present time.

In Binance Exchange...

First of all, have a look at my portfolio on the Binance Exchange.

There are three major coins that I am holding at this time in the Binance Exchange. Let's discuss the other two besides STEEM (as we have already discussed the it in the previous section). I have allocated 46.5% of my funds in the STEEM coin due to the previously discussed reasons.

- BNB:

Almost all of the crypto traders and even the ones who have the basic knowledge of crypto are well aware about the BNB token which is actually ranking at #4 at the CoinMarketCap. It is the native token of the most successful and the largest crypto exchange, Binance.

There are several occasions when the BNB token has helped me a lot while the other tokens are not performing well. I have allocated 29.4% of my total funds to the BNB token. The general stats of the BNB coin are shown below.

- ETH:

I don't think there is anyone who is linked to to the crypto space and not aware about the Ethereum (ETH) token. Ethereum blockchain is probably the largest blockchain of the crypto space and ETH token is obviously ranking below BTC, at #2 in the CoinMarketCap.

Ethereum token provide me a lot of benefits in different market conditions. Most importantly, it helps me a lot to make my participation sure in many of the airdrops and crypto projects as it the largest chain of the crypto space and many projects, DApps, SCs integrate with ETH chain on daily basis. I have allocated 23% of my funds to ETH. Have a look at the current stats of ETH.

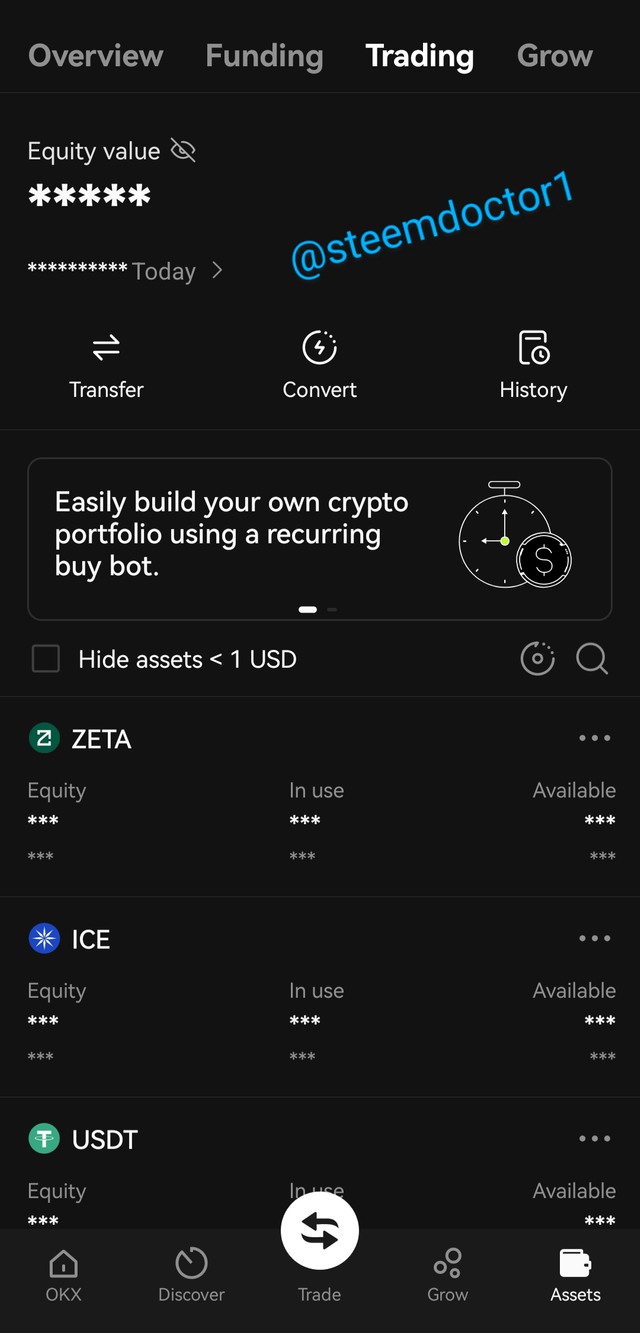

In OKX Exchange...

Let's move towards the OKX wallet. Currently, I'm holding only two tokens on OKX exchange, ZETA and ICE. So, let's discuss them.

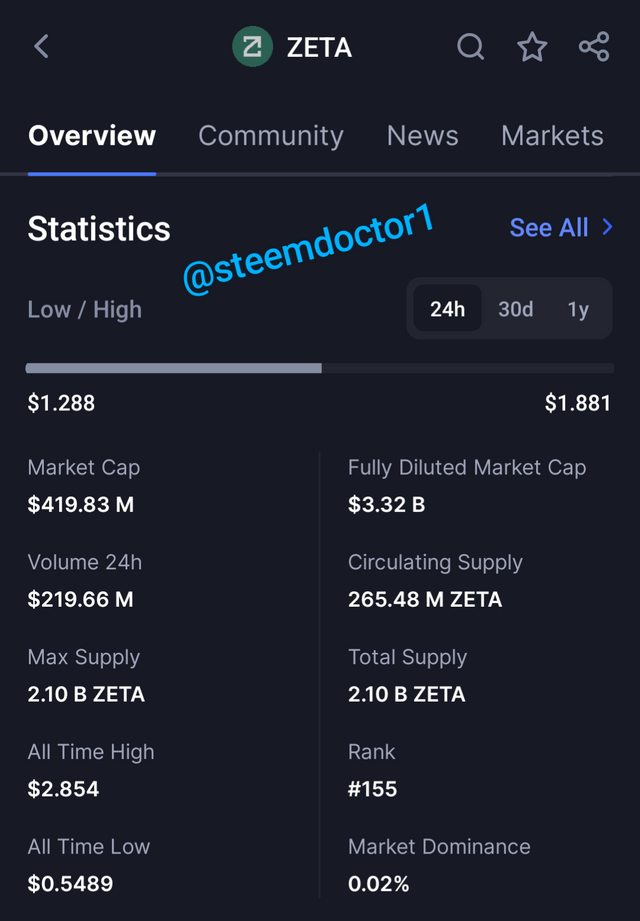

- ZETA:

ZETA token is the native token of the ZetaChain which is one of the growing blockchain platforms of the digital world. It is one the complete Blockchains of the crypto world and there are so many activities that are being operated on this Blockchain.

The integration of the ZetaChain with many other chains is a great thing which helps the users for the transfer of the cross-chain assets very easily. The utility of this token is also good. They are also currently hosting an Airdrop Season 2 event which is going to end very soon and I am also a part of it. I have allocated a good amount to the ZETA token. Have a look at its overall stats.

- ICE:

One of the newest and good performing crypto assets of the crypto space is the ICE token which is actually the native token of the ICE Decentralized Blockchain. They have recently completed their mining event and they are currently working to launch the mainnet of the platform in the October 2024.

I have been holding the ICE network tokens for the past few months as I got these tokens as a reward of my mining activities. I'm optimistic that this token will make good performance in the future after the launch of the mainnet. Have a look at the current overall stats of the ICE token.

Conclusions

The diversification of the portfolio is the process of distributing our total funds in different projects, different exchanges, different tokens or so. The most important advantage of the diversification is that we can minimize the risk and maximize the profits by this technique. It is a very helpful technique which can help the traders to groom their trading experience steadily.

I would like to invite my friends @waqarahmadshah, @solaymann, @khursheedanwar, @suboohi, aaliarubab and @ashkhan to be a part of this amazing contest.

|  |  |  |

|---|

Assalamu Alaikum, doctor brother, how are you? I hope you will be fine. I have given my participation before you, but despite that I got very good knowledge from your post.

Crypto asset diversification means investing your money in different cryptocurrencies, exchanges and blockchain networks. This way you can reduce the risk if something goes wrong.

Diversification is very important in Crypto, I agree with you 100% on this as the market is very volatile and unpredictable. If you invest in just one cryptocurrency and it falls, you could lose everything. But if you divide your investments into different cryptocurrencies, and one cryptocurrency falls, the other can rise and the balance remains maintained. This is a good learning from your post.

For example, imagine you have some Bitcoin and some Ethereum. If the price of Bitcoin falls, but the price of Ethereum increases, then you don't lose everything. This works like a safety net.

Diversification helps keep you stable through market ups and downs. By investing in different cryptocurrencies and projects, you will feel less impact if a market sector crashes.

Thanks a lot for such a nice comment

Your most welcome brother

Congratulations! This comment has been upvoted through steemcurator04. We support quality posts, good comments anywhere, and any tags.

Thanks Alot @mvchacin for curation thanks again

I really appreciate how you written a very clear and self explanatory entry. It's awesome that you also gave real-life examples to show how diversification can help protect against the ups and downs of the market. Your strategies for choosing and handling different tokens clearly demonstrate that you've put a lot of thought and research into it. Your insights are super valuable for both experienced traders and newbies who want to navigate the world of cryptocurrencies safely. Good luck 👍

Thank you bro

X Share Link:

https://twitter.com/mrsheraz7588/status/1786427575322980711?t=Ao7-TcouKGmVwLZ00mCJsA&s=19

Crypto assets diversification interesting and significant topic to share

Brother I have learnt some points about this post topic and soon I would try my best to share my quality entry also and thank you so much for giving me invitation I wish you much success

Thank you so much brother

I admire how you shared your personal experience, showing real-life examples of how diversification can protect against market volatility. Your strategies for selecting and managing different tokens reflect careful consideration and research. Good luck in the contest! Your insights are valuable for both seasoned traders and beginners looking to navigate the crypto world safely. Keep up the excellent work!

Thank you brother

Bht hi behtreen post. Aap ny bilkul theek kaha k saary andy aik hi tokri m nai daalny chahiy aur crypto industry m tu ye baat bht fit baithti hy. Jitna ziada aapka portfolio diverse huga utna hi risk factor b kam huga. M trading m koi itna expert tu nai hu laikn kabhi kabhi trading kar leta hu. Recently, m ny spot grid bot trading thori study ki hy Binance p. M is p kuch experiment kar raha hu small amount k saath. Let'see and best of luck for the contest! 😊

Me dua krta hun k apki ye strategy kamyab ho or apko acha trading experience hasil ho. Aik acha comment krny ka shukria Waqar bhai

What you say is very true, by diversifying our investment portfolio we can better manage the ups and downs that occur in the market; that's what we call "calculated risk"; because we never know exactly what will happen in the market, nor what factors or actors will enter or leave it at any given time. So diversifying our crypto asset portfolio is a preventive and wise measure to take care of our investment capital.

Right, thanks for comment

Greetings dear friend, you have written so well on the topic crypto asset diversification and you have clearly explain to a lay man understanding what diversification is all about. Indeed it is important we spread our asset across different exchanges, different blockchain and many more most importantly across different assets.

With this, the exposure to risk will be minimal as we all know that the crypto market ideally is a highly volatile market. I wish you success in this contest my friend.

Thanks a lot brother

Hello friend hello you won't professionally as usual I must say I learned a lot after going through your article I must say this one of a kind and such high quality content should be seen more frequently on our beloved platform.

It amaze me to see you also participate fully in a diversification of asset in the portfolio this shows that you are smart and you follow necessary risk management technique.

Thank you for going through please engage on my entry through the link below https://steemit.com/hive-108451/@starrchris/sec-s17-w4-or-or-crypto-assets-diversification

Thank you so much brother