SEC S17-W4 || Crypto Assets Diversification

I sincerely hope that everyone enjoys the educational themes of the Steemit Engagement Challenge S17-W4 . subsequently, the competitors' epic entries under the designated subject. I was eager to learn more about this new topic, so I did some research and shared my own opinions with you all. I hope that my contribution will also be valuable.

What are the main reasons why crypto asset diversification is important in an investment portfolio?

The importance of diversification in a bitcoin investing portfolio stems mostly from the market's extreme volatility and unpredictability. Investors can lessen the danger of any one cryptocurrency failing by distributing their money among a range of digital assets, including altcoins, stablecoins, Ethereum, and Bitcoin. Every kind of cryptocurrency asset responds differently to different market circumstances.

For example, because of their market capitalization and liquidity, big cryptocurrencies like Bitcoin may be a safer investment than altcoins, which may have higher upside potential but higher risk. Stablecoins also provide as a cushion against volatility because they are usually linked to more reliable assets, such as the US dollar. Diversification can possibly increase returns while lowering overall portfolio risk because different assets may perform better in various market cycles or economic conditions.This strategy lessens the impact of big losses from any one investment by helping investors manage their portfolios more effectively and possibly smoothing returns over time.

Can you explain how you diversified your crypto assets in your personal portfolio? What strategies have you used to maximize diversification while minimizing risk?

Well , It is possible to lower risk and maybe increase profits by distributing investments among a variety of cryptocurrency kinds in a personal portfolio by diversifying crypto assets. To do this, one might employ a number of techniques are going to agree with you here.

Invest in a variety of cryptocurrency assets, such as NFTs (Non-Fungible Tokens) and DeFi (Decentralized Finance), for prospective growth, as well as a variety of altcoins and tokens from up-and-coming industries. Examples of these assets include Bitcoin and Ethereum.

Yes, Think about expanding our investments into other areas of the blockchain ecosystem, including as gaming, finance, and technology, in addition to simply distributing our money across a variety of cryptocurrencies. This lessens the chance that any one industry may experience downturns.

Accordingly to the research , I have came to know that one way to protect against regional volatility and regulatory concerns is to invest in projects headquartered in multiple nations or areas. In contrast to markets in Europe or North America, some Asian markets might have distinct growth trajectories or regulatory frameworks.

To reduce volatility in the portfolio, include stablecoins, which are cryptocurrencies linked to a reliable asset like the US dollar. In times of extreme market volatility, stablecoins can serve as a safe haven.

Maintaining the appropriate degree of risk and exposure can be facilitated by routinely modifying the composition of the portfolio in light of performance and market analysis. In order to maintain the portfolio in line with one's risk tolerance and investing objectives, this entails purchasing or selling assets.

I have acknowledged that these techniques can be combined by investors to build a diversified cryptocurrency portfolio that is more likely to produce a balanced return over time and less vulnerable to the volatility of any one asset.

How can diversifying crypto assets help mitigate market volatility? Can you give concrete examples of situations where diversification has had a positive impact on your portfolio?

Diversifying investment risk across various cryptocurrencies and blockchain projects can reduce market volatility by incorporating different market dynamics, technological advancements, regulatory news, and community support. Building a diverse portfolio can mitigate the impact of a single asset's price shift, ensuring a balanced return on investments. For instance, Bitcoin may respond to market fluctuations differently from altcoins such as Ethereum, Solana, or project-specific utility tokens.

A portfolio's overall impact can be mitigated by other assets that may maintain steady or even increase in value in the event that one asset declines as a result of unfavorable circumstances. Thus, diversification aids in balancing the returns.

Can you give concrete examples of situations where diversification has had a positive impact on your portfolio?

Accordingly to the in deep research I have came to know that Emerging economies, like China and India, have shown robust growth during the early 2010s, benefiting investors with global diversification. Diversification helps manage risk and achieve steady returns, stabilizes portfolios during economic downturns, and takes advantage of growth in various sectors, acting as a buffer against volatility. In addition to helping to stabilize the portfolio during economic downturns and take advantage of growth in a variety of sectors and regions, this strategy acts as a buffer against the volatility and unpredictability of any one investment or market sector.

How does the STEEM token fit into your crypto asset diversification strategy? What is its role in your portfolio and how did you select it among other assets?

The distinct underlying platform of the STEEM token, Steemit, which blends social media and blockchain technology, allows it to have a particular place in a crypto asset diversification plan. Unlike just transactional cryptocurrencies, it can be included in a portfolio due to its ability to generate returns through content creation and curation.

STEEM's specialized appeal and ability to diversify the risk associated with more popular cryptocurrencies like Bitcoin or Ethereum may be the factors influencing investors to choose it over other assets. Inclusion of STEEM may also be motivated by the platform's development history, community involvement, and performance history, all of which point to future development and greater utility within the larger blockchain ecosystem.

Can you share a detailed analysis of your crypto assets, including their distribution, historical performance and the criteria used to select these assets? How do these choices reflect your overall crypto asset diversification strategy?

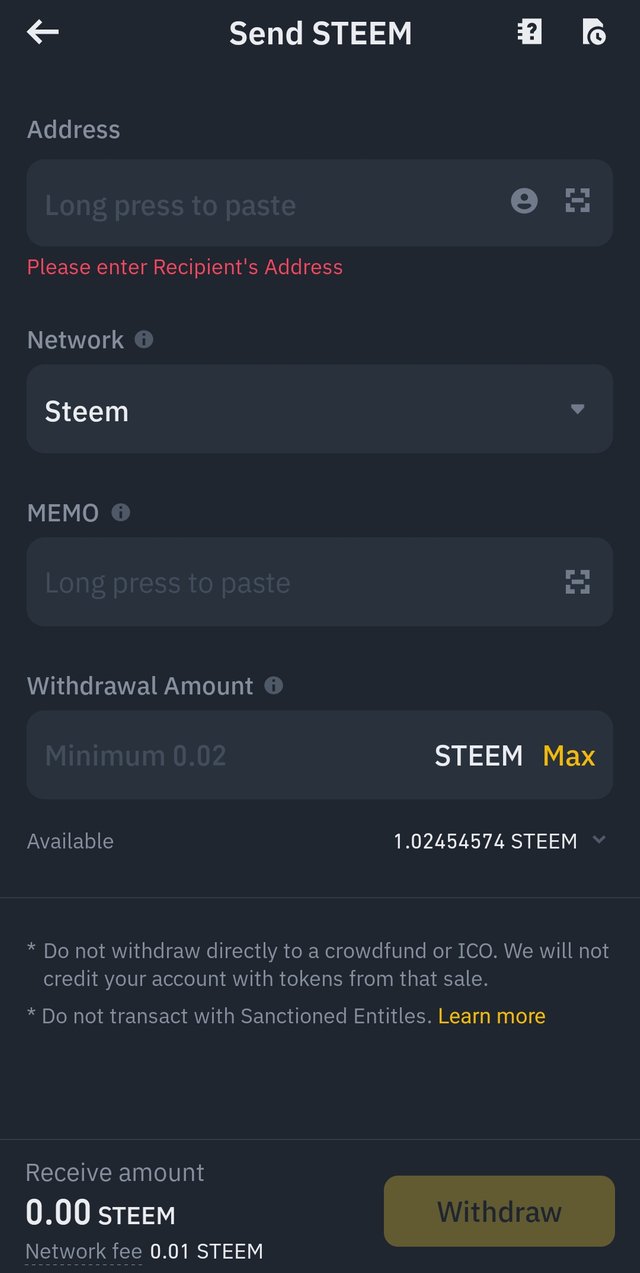

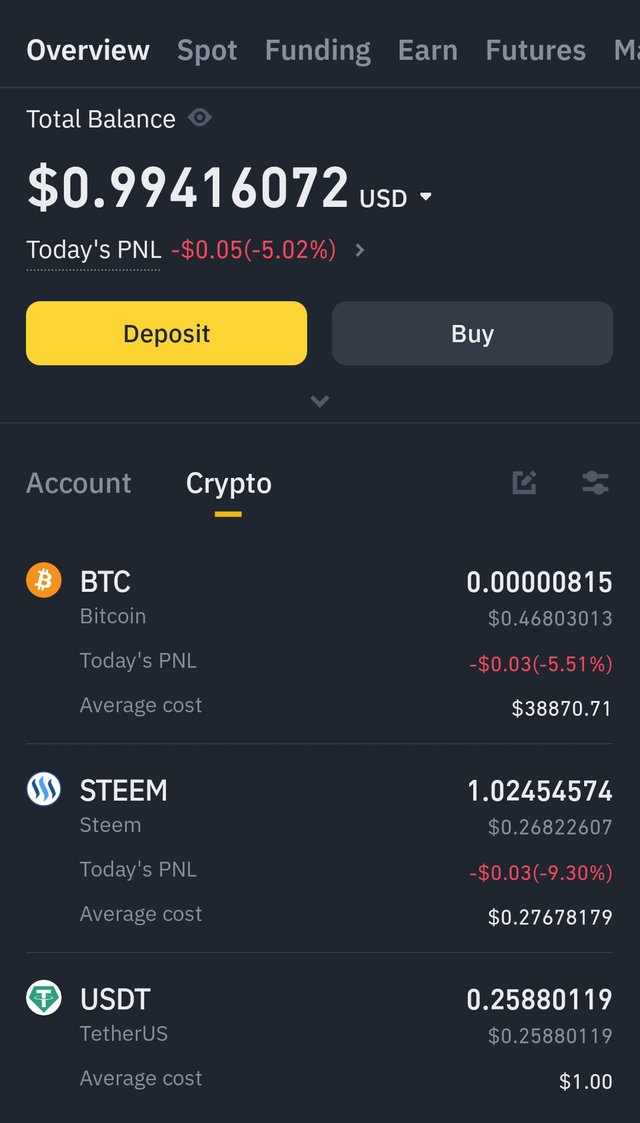

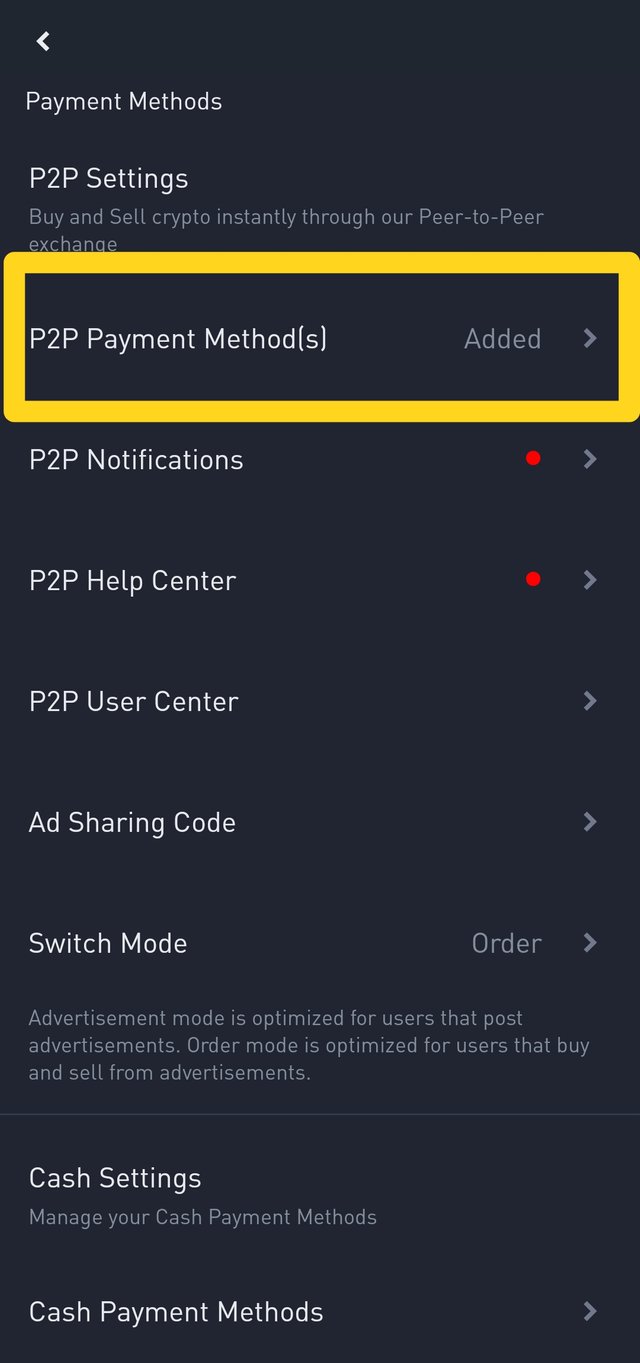

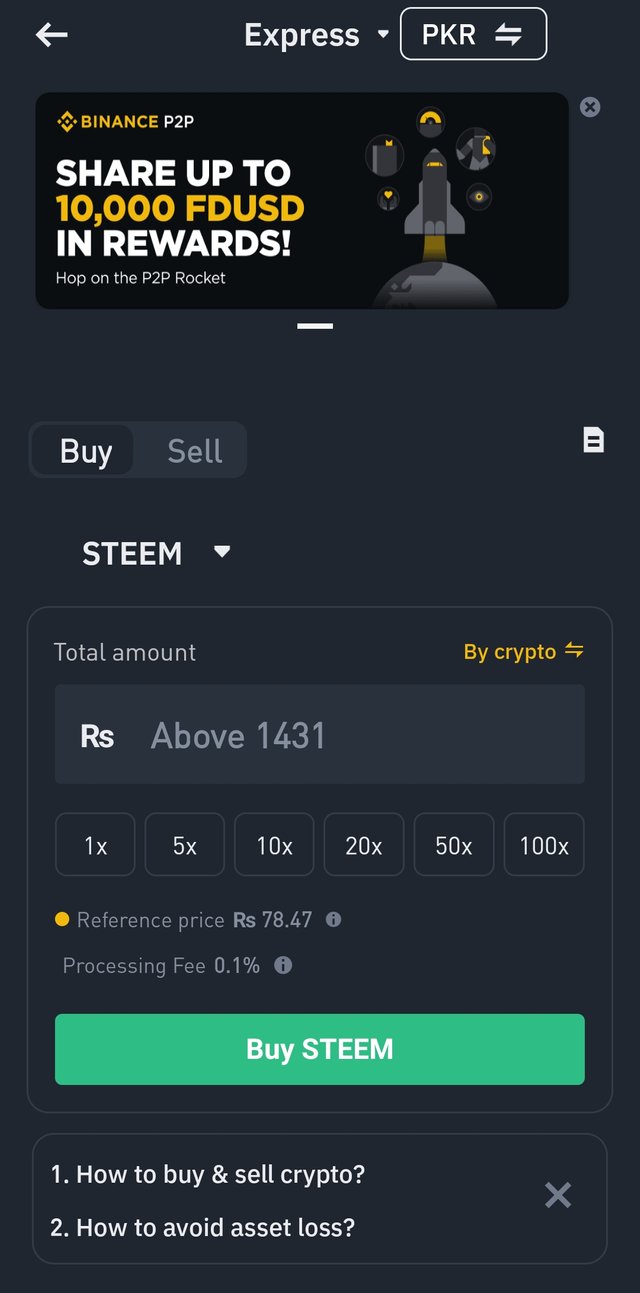

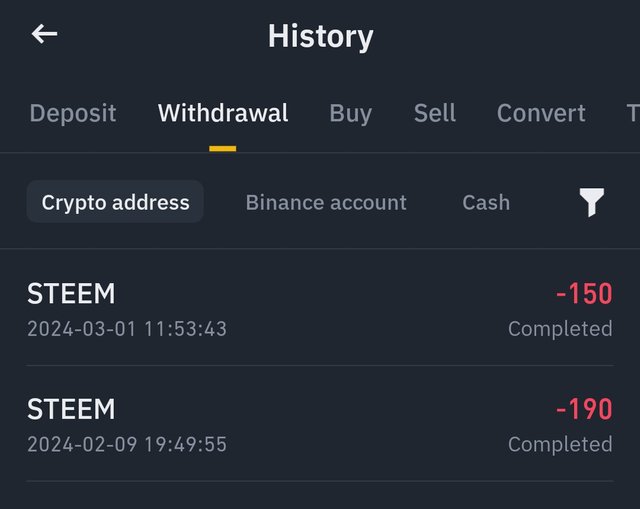

Yes, I have created a Binance account and through a Binance account I have been depositing and withdrawal my Steemit Assets. I have used two different methods or criteria used to select, buy ,sale , deposit or withdrawal my crypto assets. Here's with going to share screenshots of each scenarios which are justifying the required answer.

Well, I can concluded that Binance allows for the rebalancing of portfolios by withdrawing specific crypto assets based on performance, growth potential, and risk level, ensuring a balanced distribution across different asset types and markets.

| Kind Regards 💐 @uzma4882 |

|---|

https://twitter.com/UShaharyaar/status/1785683642431213949?t=NaSptfaL_OZFlmD3xr_9hw&s=19

Upvoted! Thank you for supporting witness @jswit.

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

@uzma4882 Your insightful analysis on crypto asset diversification is spot on! It's crucial to spread investments across different types of cryptocurrencies to manage risk effectively. Your strategy of including NFTs DeFi tokens and stablecoins alongside major cryptos like Bitcoin and Ethereum shows a smart approach. I appreciate your emphasis on considering factors like regional volatility and regulatory concerns. Including STEEM in your portfolio for its unique platform is a wise move. Good luck

Thanks for you review and shared your own perspective. Good luck too you.

Hello uzma how're you

I couldn't quite understand your answer to this question as it was needed to show any evidences where CAD helped us in our portfolios. If you can, please explain what you meant in your answer It'd be really helpful. Best of luck the engagement challenge

I am fine thank you !! It's good to see you once again.

Well , I have not experienced practically to stay my assets and then gain profit from availing the CAD strategies help me out in my portfolios. I couldn't take any risk to lose my assets that I have got from my dedication and hard work.

That's why to acknowledge about significance of diversification for the positive impact of portfolios , I have researched theoretically.

In short, I figured out that diversification acts as a buffer against market volatility and leverages industry growth to protect portfolios. This strategy protects against volatility and unpredictability in addition to assisting with portfolio stabilization during economic downturns and leveraging expansion across many industries and geographical regions especially in China and India.Thats'all , Hopefully you will understand now. Good to see your engagement. Stay Blessed.

TEAM 1

Congratulations! This post has been upvoted through steemcurator04. We support quality posts, good comments anywhere, and any tags.Thanks for supporting 💐

I love your content because it is so brief and straight to point which gave me data and knowledge that would help me apply more diversification to my portfolio to help me increase my risk management technique I reduce any sort of weeks that could cause me you lot of money.

Thank you for sharing please engage on my entry through the link below https://steemit.com/hive-108451/@starrchris/sec-s17-w4-or-or-crypto-assets-diversification