The Consumer Financial Protection Bureau: Safeguarding Consumer Rights

In an age where financial transactions are increasingly complex and ubiquitous, protecting consumer rights is more crucial than ever. The Consumer Financial Protection Bureau (CFPB), established in the aftermath of the 2008 financial crisis, stands as a pivotal institution in the United States' efforts to ensure fair, transparent, and competitive markets for financial products and services.

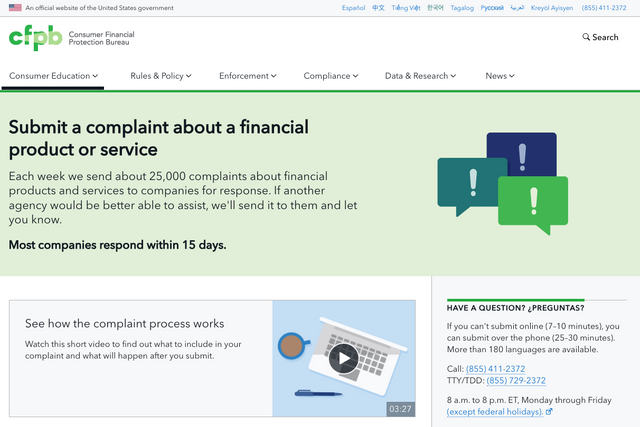

cfpb "Submit A Complaint"

What is the CFPB?

The CFPB is a regulatory agency charged with overseeing financial products and services offered to consumers. Since its inception in 2011, the CFPB has had a clear mandate: to prevent predatory financial practices and to uphold the rights of consumers by ensuring they have access to information to make informed financial decisions.

Key Functions of the CFPB:

- Regulation and Enforcement: The CFPB enforces laws that outlaw discriminatory, unfair, or abusive acts or practices in the consumer finance sector. It supervises banks, lenders, and large non-bank entities, such as credit reporting agencies and debt collection companies.

- Consumer Complaints: A core function of the CFPB is to handle complaints about financial services and products. Consumers can submit complaints online, by phone, or by mail, regarding issues ranging from problems with mortgage companies, banks, credit card issuers, to debt collectors.

- Education and Research: The bureau also works to educate consumers about their rights and financial options in an easy-to-understand format. It conducts research to understand consumers, financial services providers, and consumer financial markets.

How to Submit a Complaint to the CFPB:

Consumers who face issues with financial products or services can file a complaint by:

- Visiting the CFPB Website: The fastest way is to submit a complaint online at www.consumerfinance.gov/complaint.

- Calling Directly: Individuals can call the CFPB at (855) 411-2372 for assistance with filing complaints.

- Mailing a Complaint: For those who prefer traditional mail, complaints can be sent to the CFPB’s postal address.

The Impact of Your Complaint:

Once a complaint is filed, the CFPB reviews the information, forwards the issue to the company, and works to get a response. The transparency of the process allows consumers to track the status of their complaints and ensures that their concerns are addressed.

The CFPB's role in consumer protection is integral to maintaining the integrity of the financial marketplace. By empowering consumers to report unethical practices and by enforcing laws designed to protect the public from financial harm, the CFPB helps ensure that the financial playing field is fair for everyone. As consumers, knowing how to engage with the CFPB and understanding the resources available can significantly enhance our ability to navigate financial decisions confidently and securely.

Congratulations, your post has been upvoted by @upex with a 0.62% upvote. We invite you to continue producing quality content and join our Discord community here. Keep up the good work! #upex