Crypto Currency Wrapping: Minting, Good sides and Bad sides by @swaylee

Greetings Everyone,

I am Rasheed and welcome to my blog. I decided to venture into the crypto world once more. Today would be a blockbuster post where we would be looking at tokens that have undergone rapping. A layman would see and assume but we are literally wrapping these tokens but we are not, atleast not physically. Have you ever seen wBTC, wETH and wondered what they are? We would be looking at that in this post so get ready to learn guys.

Cryptocurrency Wrapping

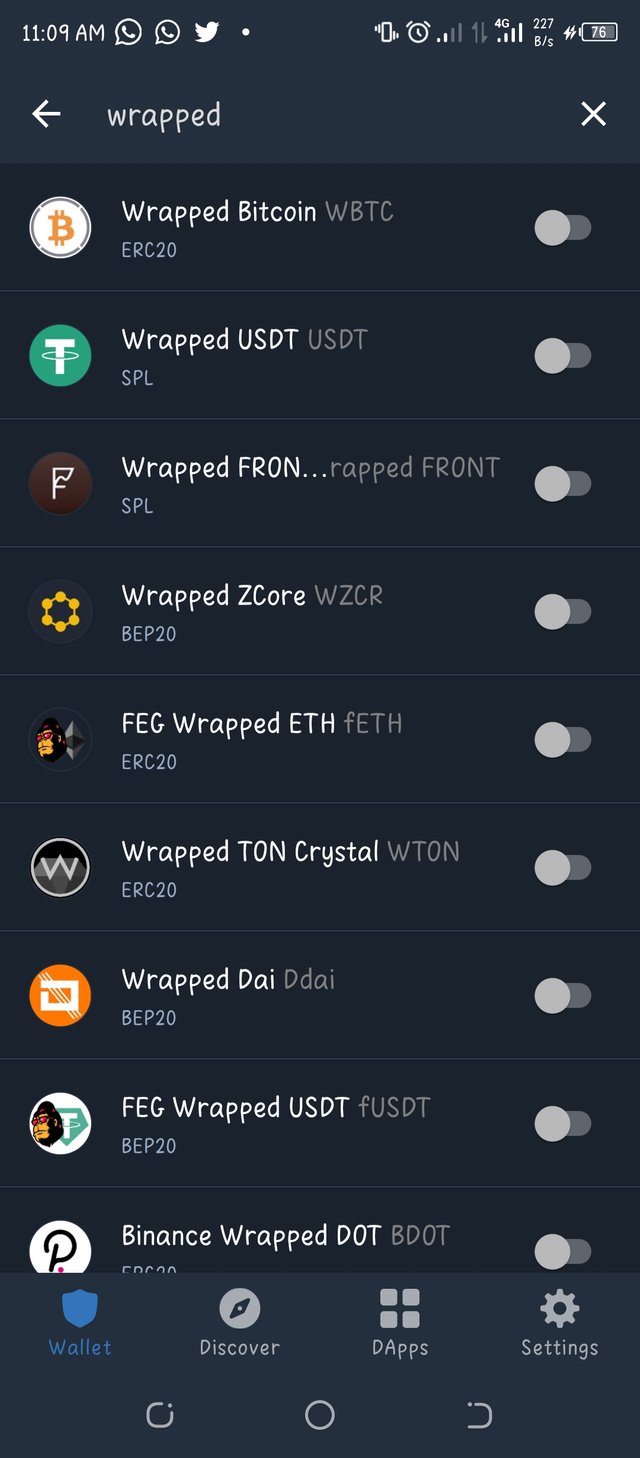

screenshot taken from trust wallet

screenshot taken from trust wallet

Wrapping in cryptocurrency is simply the creation of a token in another blockchain other than their native blockchain. These wrapped tokens can be unwrapped and wrapped again. These tokens are usually pegged in value 1 : 1 with their main token i.e The price of BTC would be pegged with the price of wBTC so if BTC is $22,900 then wBTC should be $22,900 too.

This wrapping is important because it makes a coin's feature available to another blockchain. For example, wBTC is an ERC-20 token meaning it was wrapped on the Ethereum Blockchain now the wBTC would enjoy the features of the Ethereum Blockchain.

If I want to mint a wrapped token let's say 10 Bitcoin now, I would give a Decentralized Autonomous Organization, a merchant or even a smart contract which acts as a custodian that amount (10 BTC) to hold on to so I would be able to mint 10 wBTC tokens which is practically of the same value due to the peg. This custodian acts as the wrapper and the unwrapper as they are needed when wrapping and they are needed when unwrapping the cryptocurrency

Stable Coins like USDT are believed to be the first version of wrapped tokens are they are pegged to the dollar and are tokenized versions of the US dollar but in terms of actual wrapping wBTC is said to be the first as it was wrapped on the Ethereum Blockchain using smart contracts. This wrapping isn't necessarily limited to one Blockchain as one coin can be wrapped on more than one Blockchain.

I went to my trust wallet and checked wBTC it's an ERC 20 token then I took the initiative of going to my Tronlink pro wallet and I saw wBTC as a TRC 20 token which shows that it can be wrapped on any suitable blockchain asides it's native blockchain. As the wBTC is on the Tron blockchain, it's holders enjoy faster and cheaper transactions.

Advantage of Cryptocurrency Wrapping

It enables the linking of various blockchains together by making the currencies of those blockchains available on other blockchains. For example, there are alot of defi products on the Ethereum Blockchain but Bitcoin users can't utilize them so wrapping Bitcoin as an ERC-20 token makes them usable.

It enables users to perform transactions at far cheaper rates and with far less transaction fees. On blockchains like Bitcoin or Ethereum where the transaction costs are outrageous. For example ETH in the Binance Smart Chain is pegged as Binance Pegged ETH which is a Bep20 token and makes Ether available on the BSC with far lower fees.

On the Ethereum Blockchain, there are some defi protocols which ETH isn't compatible with so wETH was made to be compatible with these protocols and this boosts the amount of transactions would be carried out on the blockchain as a suitable alternative has been made available.

Disadvantages of Cryptocurrency Wrapping

Minting of these wrapped cryptocurrencies isn't as easy and cheap as I made it seem in this post as they are huge transaction costs required in wrapping and unwrapping. Blockchains like ether would cost one a lot to wrapped a large amount of tokens and a large amount of unwrap these tokens.

The minting, wrapping and unwrapping process is done by a custodian as I mentioned earlier this makes it vulnerable to centralization and over reliance on third party. If there is an issue on the part of the custodian then this issue can have it's adverse effects on the wrapping process.

Closing Thoughts

Wrapping has alot of positive impact in the cryptocurrency world as it has provided with more advantages and use cases than disadvantages. The linking of blockchains through wrapping cryptocurrency is becoming more and more prominent and a way to do this without the use of custodians would make the process even better in the future if such a way is found. Thank you for reading ⭐

All unsourced images used in this post were made using Canva

10% to @tron-fan-club

https://twitter.com/St0k3ley/status/1537416412251181056?t=bqvgffJ7MYIPl3R7qsq-WA&s=19

In fact, I didn't have an idea about Crypto Currency Wrapping before. I was confused once a time after seeing this wBTC in the Coin list. However, now I have an idea about it. Thank you very much for this important article.

one of the interesting packaging and of course it is a good thing to read and of course I have read what you wrote

Wrapped token is a Concept am new to.thanks for bringing this teaching. I will do a further study on it soon.

Nice concept...

I would really love your thoughts explained intricately. Steem on

Now I get the proper understanding of wrapped tokens

Thank you for sharing

Very good. Thank you for your insight