Understanding Crypto Volatility || A concept all crypto enthusiast should know.

Volatility can be define as a measure of how much a particular asset price has moved up and down over a given period of time. Generally knowledge is that the more volatile an asset is, the more risky it is when considering an investment.

In business, is has been proven that the riskier an investment is the more its potential in term of what it has to offer which is usually either high returns or high losses within a short period of time but this is not the case in a lesser volatile investment. What the above statement simply means is that a more risky investment brings in more return (profit) or more lose.

Crypto is consider among a newer asset class and a wildly volatile market with the potential for a significant downward and upward movement over a short period of time. Although, there are some coin which are created to be stable so the issue of volatility is at minimum. These coins are mostly used when buying or selling crypto asset, examples of stable coin are Tether (USDT), Binance USD (BUSD), USD coin (USDC) and many more.

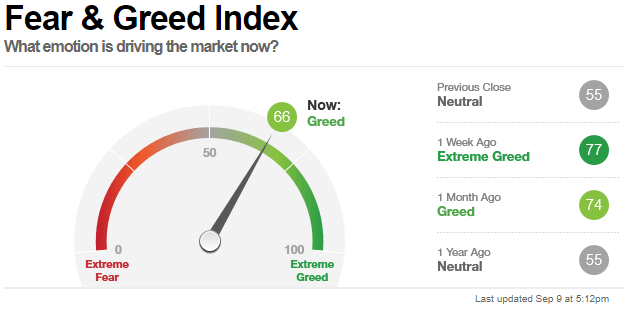

When most people talk about how to measure volatility, they usually refer to historical volatility, which is a number derived from the study of prices over a given time period (usually 30 days or a year). This volatility measurement can help predict the price movement in the future and this is called implied volatility. Because no one can predict the future, sometimes this prediction are not correct and the accuracy is hugely dependent on some widely used financial tools such as the Cboe Volatility Index which is nicknamed the fear index. What the Cboe volatility index does is that, it predicts the next 30 days of crypto or stock market volatility.

They are many ways of quantifying volatility but I am going to mansion just two and there are:

-The first method is called beta and it measure volatility by compering an asset to the relative broader market.

-The second method is by computing an asset standard deviation, which calculate how widely it prices has been diverged from it historical average.

Volatility is one of the main factor use in assessing an investment risk. Normally, investors usually consider a higher level of risk investment if they believe the potential return is worth the possibility of losing part of their investment. We see few cases where all the investment are lose in a highly volatile market (LUNA).

Traditionally, it is advised to diversify your investment as an investor within an asset class, this process reduce risk. So instead of investing in few coins it is risk wise to invest that same amount of resource in many rather than few. This helps reduce the potential of downslide and instead of investing randomly, you can pair your investment with top coin which are less volatile and other which are highly volatile.

Crypto is an asset class which is few years old, we have seen series of steep rises as well as subsequent falls. It has been notices that higher trading volumes on Bitcoin (the biggest cryptocurrency by market cap) and also the increasing institutional participation has been helping reducing Bitcoin volatility over time. In the other hand, cryptocurrency with lower trading volumes or raising cryptoassets such as DeFi tokens have higher tendency of been highly volatile when experimenting with such assets so it best when investing in such asset, to risk a reasonable amounts you can afford to lose.

Many factors can affect volatility of an asset but an important factor which has a high influence is either positive or negative news coverage and earning reports which can be better or worse than expected. Unexpected high spikes in the volume trading usually correspond to volatility. Very low trade volume usually equivalent with high volatility.

One of the major reason some investor invest in cryptocurrencies is because of possibility for high returns and this is due to the high volatility of the market which is appeal. Most investors believe the best time to buy cryptocurrency is when the market has been on a downtrend for some time so that makes the possibility of an uptrend very high this is usually called “buying the dip”.

A chat showing a downtrend and immediately followed by a quick raise.

Image source

For investor who are less risk-tolerant, there are strategies that can help limit the downside effect of volatility such as dollar-cost averaging. Investor who is interested in investing in an asset for long-term and have a good reason to believe his investment will rise over time should not worry about short term volatility. As said early there are now stablecoin which price are pegged to a reserve asset such as U.S dollar, so your asset can be in form of stablecoin and you do not need to worry about the volatile nature of the market.

Cryptocurrencies are highly volatile in nature that is why it is advisable to do your research before investing in any token. Volatility can be either good or bad for any investor but for those planning on holding a specific coin for long term should not be bother with short term dip.

Thank you all for reading.

NOTE: 10% Author's reward goes to the community account.

Thank you all for reading.

Twitter shared link;

https://twitter.com/AbdulganiyuAh17/status/1533068720007946242.

Upvoted! Thank you for supporting witness @jswit.

Please check my new project, STEEM.NFT. Thank you!

Note: You must enter the tag #fintech among the first 4 tags for your post to be reviewed.

What a great explanation you've done here, good work friend ⭐

Thank you for stopping by really appreciate.

The cryptocurrency market is volatile meaning that it's prices fluctuates in a rapid manner and therefore it requires one to be careful while dealing with it.

Yea thank you for reading I really appreciate your time.

You're welcome.

I encourage you to keep up with the good work

The crypto market is known for it volatility and fluctuation.

Yes and that is why we need to be careful when investing or trading. Thank you for reading I really appreciate your time.

You have done so well by explaining to us in regard to the volatility in crypto market. Thank you for sharing

Thank you for reading.

Volatility can be beneficial or detrimental to any investor, but those who intend to retain a coin for the long term should avoid short-term dips.

Exectly no need to be worried over short time dip when planning on hold a coin for the future.